- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Central Banks

- What to expect from the European Central Bank this Thursday?

- Home

- News & Analysis

- Central Banks

- What to expect from the European Central Bank this Thursday?

- Threat of protectionism

- Vulnerabilities in the emerging markets

- Financial Market Volatility

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

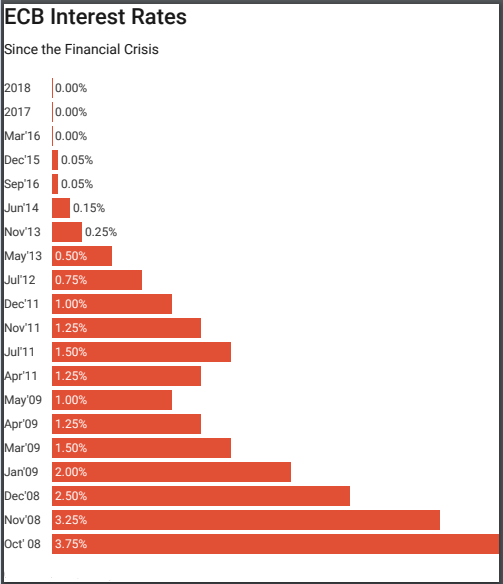

The European Central Bank (ECB) is set to announce its interest rate policy this Thursday. Market participants are widely expecting the rate to remain on hold, but most importantly, the “language” and the “tone” of the statement will be closely watched.

It is unlikely that there will be any surprises from the ECB policy meeting and they are expected to maintain the current guidance about ending bond purchases and keeping rates on hold.

Despite being mostly uneventful, it should stay on the Euro traders radar as policymakers have been slightly more hawkish on the underlying inflation pressures recently and some have even highlighted the possibility of bringing forward the timing of the first rate hike.

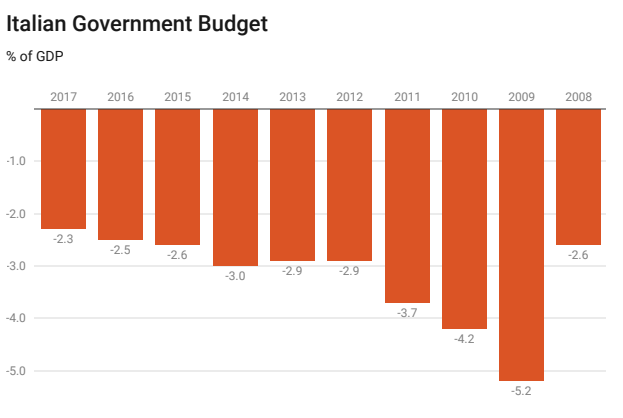

The growing uncertainty around the Italian budget and fiscal position will be the main significant issue that investors will be keen to watch. This week, the European Commission officially rejected Italy’s budget proposal. The proposal of the deficit is definitely below the 3% EU deficit ceiling, but the EU was hoping that Italy will curb its massive debt given that they are the second largest public government debt pile in Europe after the Greeks. The debt to equity ratio in Italy currently stands at 131.81% of its GDP, and market participants are concerned on the country’s ability to repay its debt. European leaders have ramped up pressure on Italy over its public spending plans and gave unprecedented warnings.

Source: National Institute of StatisticsAll eyes will, therefore, be on the President Draghi’s comments on Italy’s budget woes to gauge the thoughts on the developments in Italy and the possible effects it may have on the Eurozone economy.

Investors will also closely watch how the ECB is balancing the “external” risks that have become more prominent over the coming months:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Gold Making Waves – Where Will Price Settle?

Creating New Monthly Highs Yesterday gold reached a three-month high of $1,239.68 which, as we head into the final quarter of 2018, is once again stirring up price speculation and talk of a change in directional bias. While the fundamental aspects appear to be related to hiccups in global stock markets, we'll focus on the technicals for clues as t...

October 24, 2018Read More >Previous Article

October Stock Market Volatility – The Myth

The Psychological effect behind the Stock Markets’ Most Volatile Month. Generally, the volatility in October has been well-above average, and ...

October 22, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading