- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Central Banks

- Eyes are on the BOE tonight for the rate decision

- Home

- News & Analysis

- Central Banks

- Eyes are on the BOE tonight for the rate decision

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUpcoming News

» 9:00pm BOE Inflation Report – GBP

» 9:00pm MPC Official Bank Rate Votes – GBP

» 9:00pm Monetary Policy Summary – GBP

» 9:00pm Official Bank Rate – GBP

» 9:30pm BOE Gov Carney Speaks – GBP

» 10:30pm Unemployment Claims – USD

» 11:30am RBA Monetary Policy Statement – AUDEye’s are on the BOE tonight for the rate decision. As with the previous meeting the market is expecting a cut from 0.50% to 0.25%. Expectations were not met in the last meeting with the BOE holding rates. Based off that I’m not leaning towards any sure thing for tonight’s meeting.

Overnight Oil snapped out of this weeks down trend with a 3% counter rally. I’m looking for this to extend further. Gold and Silver lost ground overnight with Silver continuing to lose further ground today. US Markets bounced back, the US30 put in a second failed low this could be a trend continuation forming. I ‘m looking for more upside tonight to confirm this current pattern. The EURUSD had a strong move down over night losing 72 pips. It’s sitting on a previous high which could come in as short term support.

Today’s Asian session has been mixed for the USD, the AUD has recovered retesting its .7630 high. The JPY has mainly been weaker but has seen some buyers. It’s currently weaker at this point in the session with pairs making small increases consolidating yesterday’s gains. The JPN225 has reversed a low put in earlier and is now posting a strong looking session. I’m seeing 16020 as short term support. It’s showing signs this could be a developing reversal point. The GBP has been in quiet trade as the market awaits tonight’s raft of news. Expect a sharp move up on the GBP if the BOE holds rates for the second time. Due to the upcoming multiple news events, I’m steering clear of the GBP tonight.

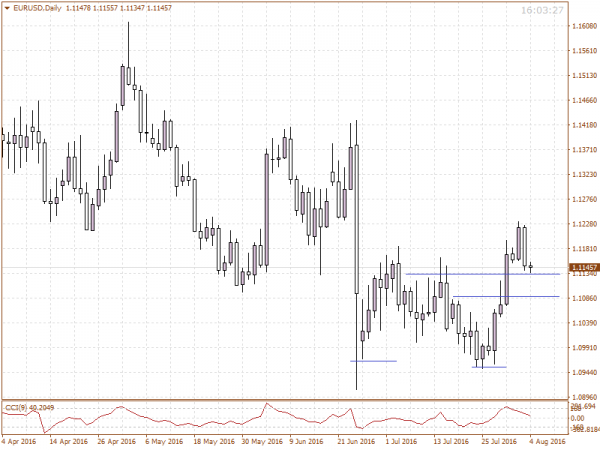

EURUSD – Two levels shown are the points I’m watching currently. We did have a strong move down overnight but 1.1134 is presenting as the first point of support. 1.10860 is the next level down. I still see the EURUSD in an uptrend at the moment. Until counter evidence develops I’m looking for support to confirm and a continuation to possibly follow.

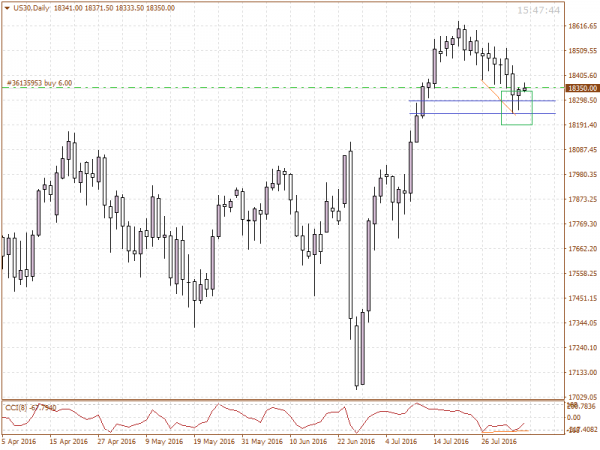

US30 – Buy idea filled today. The first sign here for me was the failed low on the 2nd of AUG. While last night’s recovery can be seen as an inside bar, it also shows a failed low off 18295. This point now has three tests and three fails at going lower. Divergence has also set up around this support area. These are all good signs we could see a continuation higher to possibly test 18460 if buyer commitment stays strong. A new move lower that breaks 18245 cancels this buy idea out. There’s one issue present that didn’t make this setup perfect for me. It’s the fact that price is still in a short-term downtrend. Seeing a break is normally best for trend continuation setups, keep that in mind when looking at future trend continuation trades.

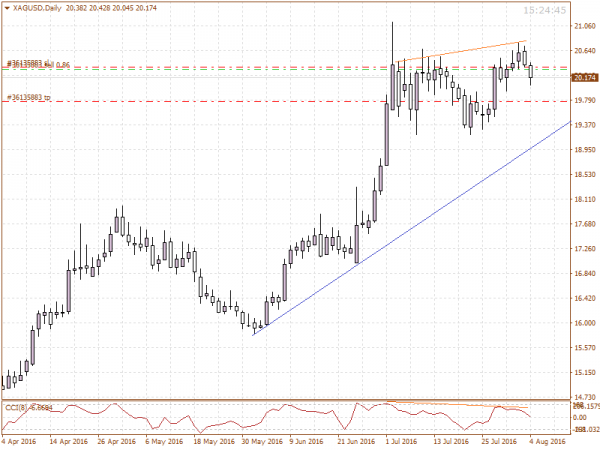

XAGUSD – This is a follow up from yesterday’s silver section. Price tried to break 20.64 again overnight. This attempt failed and sellers took control of the session. Today my sell idea was filled, price has broken its current trend in today’s Asian session. This is the hard part of being in a sell position in an established uptrend. We don’t know if this is going to be a deep or short reaction. As shown I have sharpened my stop loss and closed part of the position to limit any losses in case we have a snap back to test the new breakout. 20.00 has shown support and has seen buyer interest today. I have a target of 19.96 down to 19.83. Time will tell if that’s reached or not. Managing potential damage is important once your position is moving in the right direction. If prices get down to 19.37 I would be looking for buyers to reconfirm that support area.

Good Trading.

Please note that trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. You should only trade if you can afford to carry these risks. Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies. All times are in AEST.

Written by Joseph Jeffriess, GO Markets Market StrategistThe information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Oil continued its rise

Upcoming News » 10:30pm Employment Change - CAD » 10:30pm Trade Balance - CAD » 10:30pm Unemployment Rate - CAD » 10:30pm Average Hourly Earnings - USD » 10:30pm Non-Farm Employment Change - USD » 10:30pm Unemployment Rate - USD The BOE delivered on market expectations overnight with a rate cut to historic lows of .25%. Even though ...

August 5, 2016Read More >Previous Article

RBA cut interest rates

Upcoming News » 6:30pm Construction PMI - GBP » No release time, GDT Price Index - NZD As expected the RBA cut interest rates by 25 basis points. �...

August 2, 2016Read More >Please share your location to continue.

Check our help guide for more info.

- Trading