- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Central Banks

- FOMC Brief – Sep 2018 Rate Hike

- About The Stock Market: Powell believes that Equity prices are at the upper band of the historical range. Although he does not comment on market corrections, he emphasized that high leverage may bring harm.

- End of Tightening: He said it depends on economic data, including inflation, unemployment rate, and salary growth rate (literally like say nothing).

- Trade tariffs: Powell is worried about the impact of inflation in the long-run. While still being observed, it has not affected the US economy in the short term. (It feels like he must say so to avoid confrontation with Trump )

- Emerging Markets: Recognizing the importance of emerging markets when the Fed to consider raising interest rates, but he believes that it is only because of the fundamental problems of individual countries that the country’s currency is under pressure.

- Fiscal policy: Worried about the sustainability of fiscal stimulus and believe that budgetary debt will be an inevitable problem in the future. (True, but it seems nobody had any solution for that)

- Inflation: He emphasized that if inflation unexpectedly rises, the Fed will raise interest rates even faster, but there is no such indication currently. The impact of the trade war on inflation has not yet emerged, and overall inflation is still mainly supported by oil prices. (that’s why Trump is giving pressure to OPEC on twitter recently)

News & AnalysisYesterday, the US Federal Reserve announced the raising of interest rates from to 2.00%~2.25%.

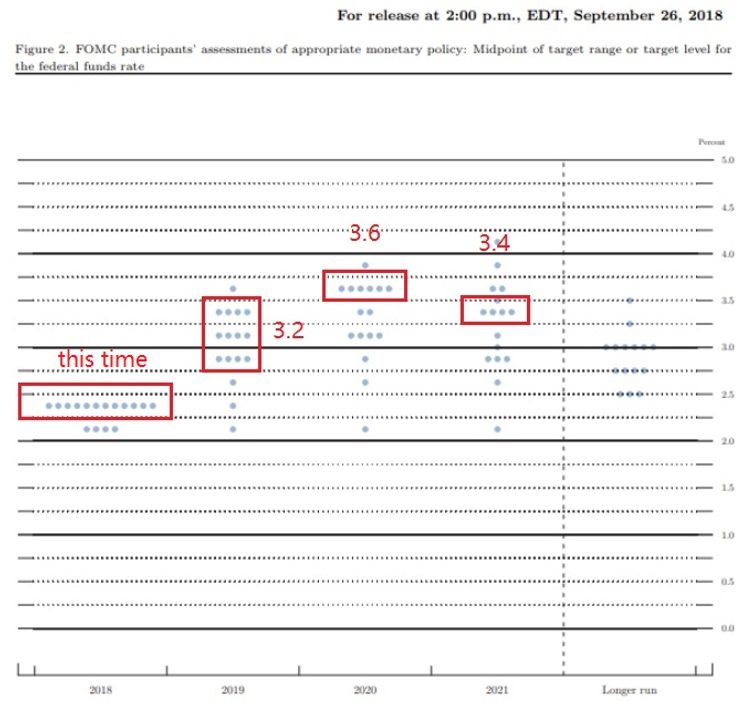

Most Fed officials agreed (12 people out of 16) in principle to raise the rate, in line with market expectations, and according to the Dot Plot, the expected interest rate in 2019 & 2020 is 3.2% and 3.6% respectively, which is still 4-5 hikes from today’s level.

Although the Dot plot provides the information for the year 2021 as a “long-term” projection, from personal experience, this data is much less important to pay attention to as it is so far away from now. We all know that the further out the predictions, the more uncertainty it has surrounding it, similar to that of weather forecasts.

In summary, if we focus on the pattern of 2018-2020, it still maintains the hawkish trend.

Powell’s Statement

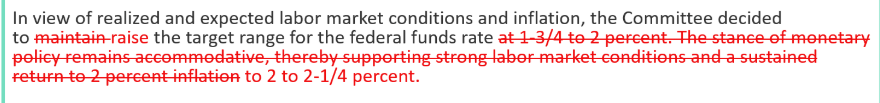

The statement of the Fed maintains optimism about the economy and removes the wording of the easing policy.

For the first time, they deleted the sentence of “The stance of monetary policy remains accommodative, occasion supporting strong labor market conditions and a sustained return to 2 percent inflation” from the original text. That’s also a sign of hawkish movement.

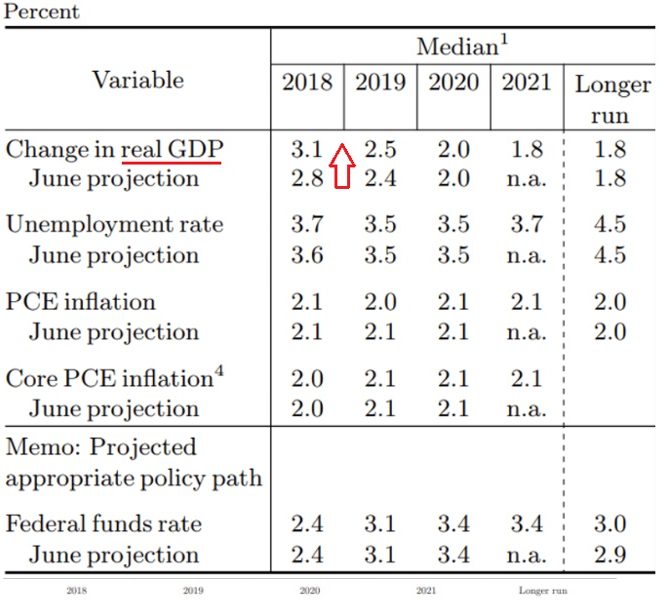

Economic Data Forecasts:

Most of the numbers remain unchanged compared with June 2018’s prediction, but notably, they adjusted the GDP forecast from 2.8% to 3.1%, which is more optimistic.We all know that the “balance sheet normalization plan” initiated by the Fed in October last year 2017. The purpose of this plan is to reduce the huge amount of debt back to its “normal” size (i.e., not too far away for the country’s GDP level)

Let’s see how it goes up till today: after one year of the reduction process, the total assets (including liabilities) of the US has dropped from nearly $4.5 trillion to $4.2 trillion.

Powell Highlights During The Conference

By Lanson Chen – Analyst

@LansonChen

@LansonChenThis article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: www.federalreserve.gov,

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

The Most Traded Currencies In The World

The Forex market is the largest in the world with around $5 trillion average daily trade volume. It dwarfs the daily trade volume of the New York (NYSE), Tokyo (TSE), and London Stock Exchange (LSE) which stands at around $22, $18 and $8 billion respectively. In this article, we will take a look at the top 5 most traded currencies in the world. ...

September 28, 2018Read More >Previous Article

Global Financial Markets: Dispersions and Catalysts

On GFC’s 10-year anniversary, one cannot help but wonder about the current dispersion in the financial markets. Developed Markets (DM) equities are ...

September 26, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading