- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Central Banks

- Hawkish & Dovish Explained!

- How the economy is flaring

- How interest Rate will change or foresee

- How the monetary policy will develop over time and affect the value of a country’s currency

News & AnalysisHawkish and Dovish are two crucial words widely used in our industry whenever there are central bank speeches or talks about monetary policies.

But what does it mean?

Central banks are more transparent than ever and forex analysts or traders try to dissect the overall tone and language used when central bankers speak to see:

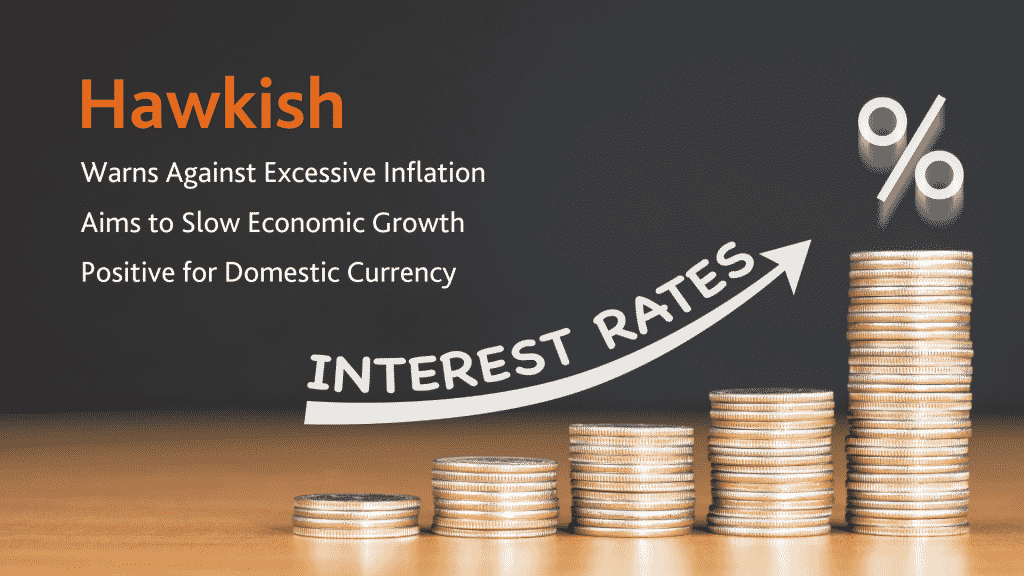

A hawkish tone means that a central bank is seeing the economy growing too fast and is warning the markets of excessive inflation.

Therefore, to curb inflation and slow economic growth, central banks might increase interest rate which will be positive for the domestic currency.

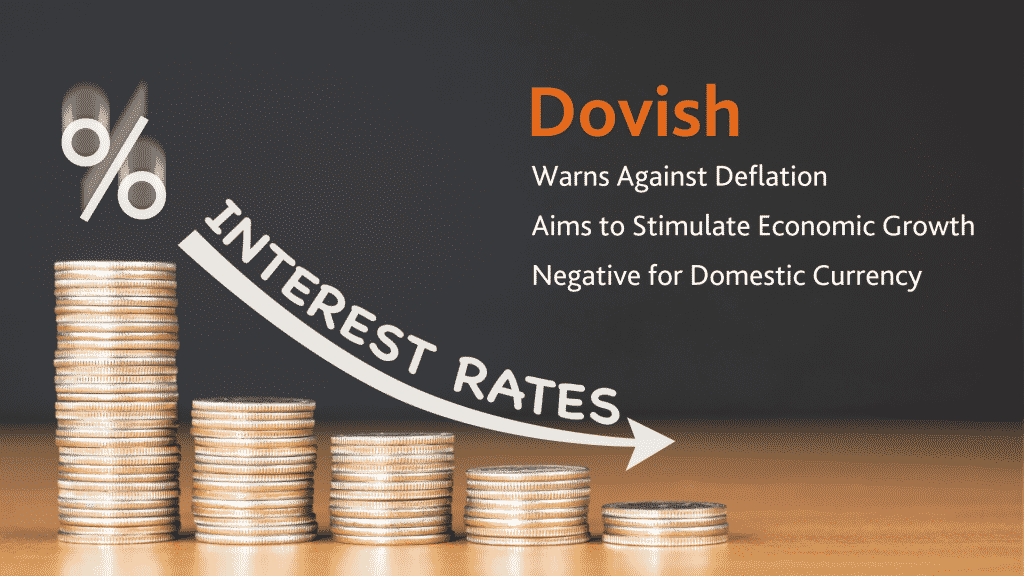

A dovish tone is a complete opposite – The economy is not growing and the central bank is warning against deflation.

In other words, there might be interest rate cuts to stimulate the economy which is negative for the domestic Currency.

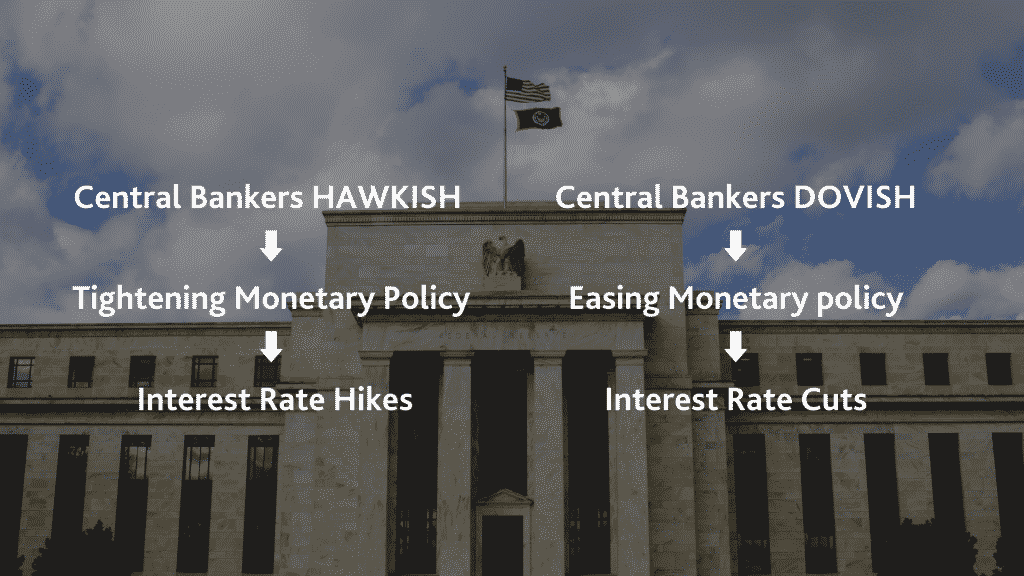

Put simply, when there is a Hawkish tone, there are talks about tightening monetary policy which will probably lead to interest rate hikes.

On the other side, a dovish central bank will use easing or accommodative monetary policy which will result in interest rate cuts.

Recently, Major Central Banks of Key economies have turned dovish due to slowing global growth and this week the Reserve Bank of New Zealand joined the dovish chorus as well.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk .

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Your Trading Journal Blueprint – Free Download

Those of you who have attended any of our LIVE Inner Circle education sessions, or participated in our courses, will know that a regular theme covered is the importance and benefits of measuring your trading. One of the key tools we often discuss is the use of a trading journal. For those of you less familiar with this as a concept, a ...

March 29, 2019Read More >Previous Article

GO Markets Launches ASX Share CFDs; Flags Release of US Shares CFDs

MELBOURNE, AUSTRALIA – 27 March 2019. GO Markets is pleased to add ASX shares to its CFD product range, increasing the number of instruments availab...

March 28, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading