- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Central Banks

- Jackson Hole Symposium set to get underway today

- Home

- News & Analysis

- Articles

- Central Banks

- Jackson Hole Symposium set to get underway today

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Kansas City Federal Reserve is set to host the 45th Annual Symposium at Jackson Hole Lodge in Wyoming’s Grand Teton National Park. Some of the countries and world’s most important central bankers, economists, and academics will be meeting to discuss the biggest issues facing the global economy. The key issue on the agenda is of “Reassessing Constraints on the Economy and Policy.”

All eyes will be on Jerome Powell, with the chairman of the Federal Reserve expected to speak on Thursday and provide an update on the proceedings of the conference. At last year’s event Powell was caught out after stating that inflation was transitory, only to see it become a huge long-lasting issue. Therefore, he may try and correct this perception and portray a much more conservative attitude. There is also a view from some analysts that the Fed came across too dovish in the July meeting which led to the market rally. At this stage the market has priced in a 75-bps increase at the September meeting, however this may change. With key inflation measures slowing somewhat, the question will be whether the fed continue its aggressive interest rate hikes or eases their policy to avoid a potential recession.

The market will be hoping that Powell provides some clues for what the Fed plans to do after rates peak. They will be hoping for clarity over whether the bank will hold the rates at the high levels for some time or lower them straight away to avoid a recession.

Market participants should be weary that although Jackson Hole may provide some important context to the future rates, no official policies will be set. The conference will most likely have a relatively small impact on the market, it still has the potential to provide some volatility for both equities and currency if significant attitude shifts are expressed.

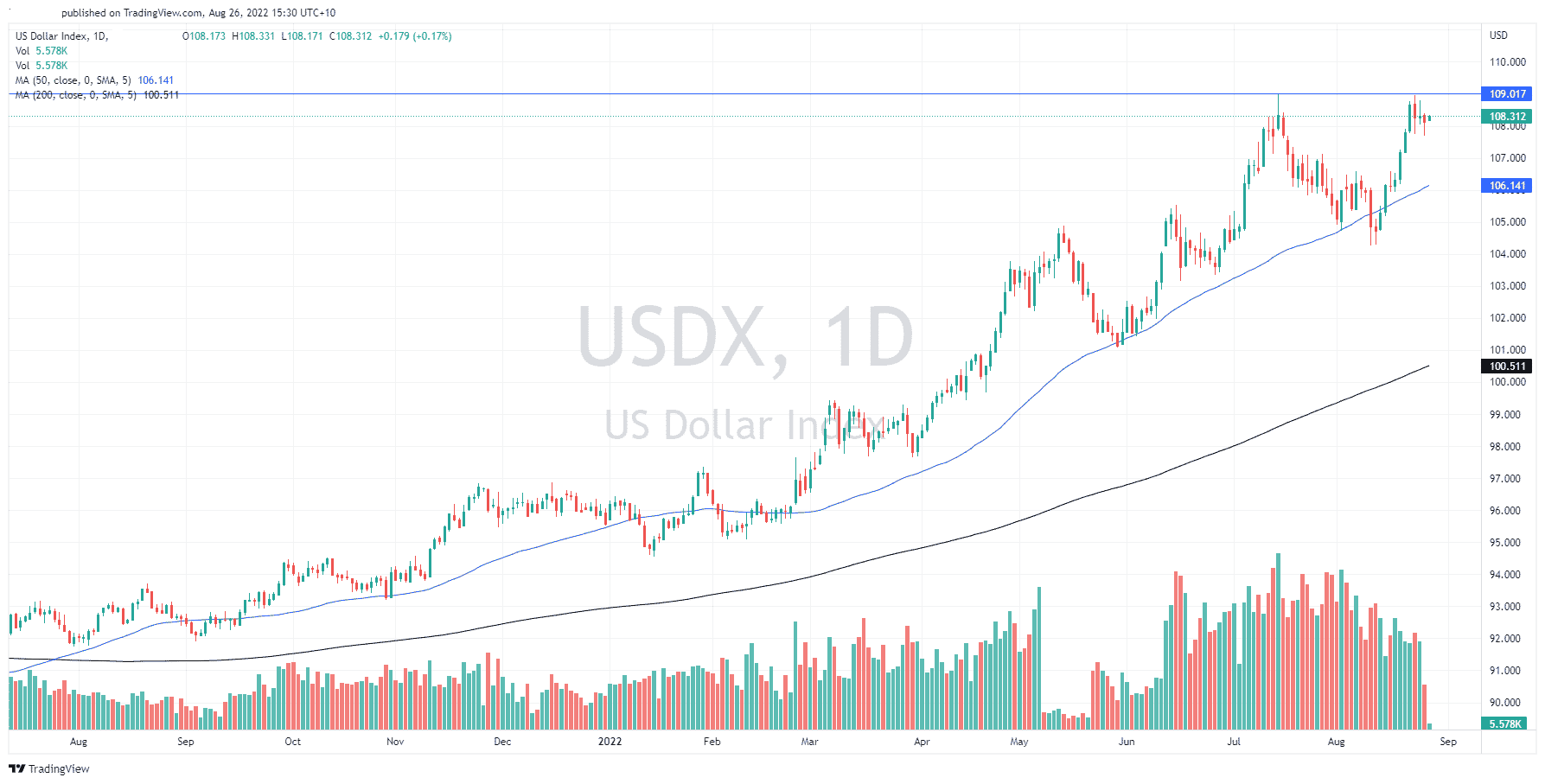

The USD is currently at 5 year highs and with some positive catalysts for the currency, it may continue to rise further if the Fed continues to be aggressive in its rate hikes.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

The week ahead – NFP and European inflation figures in the spotlight.

Global equities took a battering last week, most of it in Fridays session after Fed Chair Jerome Powell re-iterated the Feds number one priority is taming inflation in a hawkish speech at the Jackson Hole symposium. This saw the Feds rate hike trajectory reprice sharply higher and seeing risk assets take a significant leg lower, the Nasdaq was hamm...

August 29, 2022Read More >Previous Article

How to develop a good training plan?

Trading FOREX, equities, commodities, and any other asset can be an emotional rollercoaster. With so many different emotions and external factors diff...

August 25, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading