- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Central Banks

- Post Fed Rate Hike

News & AnalysisPost Fed Rate Hike

March 15th 2017 – The United States Federal Reserve (Fed) raised borrowing costs for the third time since the end of the financial crisis. An event so widely predicted that Bloomberg’s World Interest Rate Probability was pegged at close to 100%. The Federal Open Market Committee (FOMC) decided to increase the federal funds rate by 25 basis points to a target range of 0.75-1.00%.

During the announcement, FOMC cited continued progress towards achieving maximum employment and inflation of 2% for raising rates. Jobs gains have been “solid” and household spending continues to grow “moderately.” They are predicting increasing rates a total of three times this year. President Trump has been vehemently against a strong dollar; we may see more of him pressing for a weaker dollar as he believes this will increase exports.

Below are the dates of the remaining FOMC meetings this year.

May 3nd — June 14th — July 26th — September 20th — November 1st — December 13th

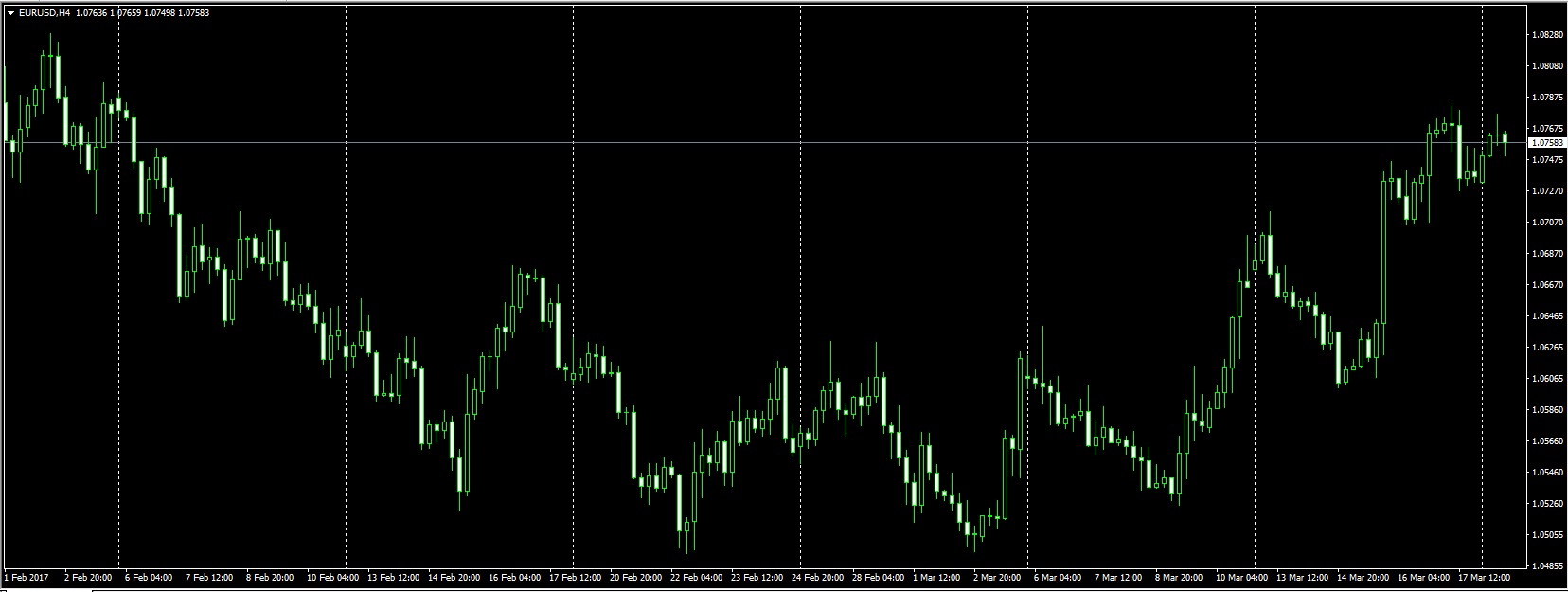

EURUSD

We have seen a steady decline in the value of the Euro over the last several years, culminating in a 10 year low the first days of 2017. The weeks leading up to the official announcement experienced a small slump. Once the announcement was made and the outcome was as expected we didn’t see much of an impact. Rather, the Euro strengthened on the results of the closely watched Dutch elections. The Populist Anti-EU Party of Freedom fared less well than polls had predicted. All eyes are on the French Elections starting next month.

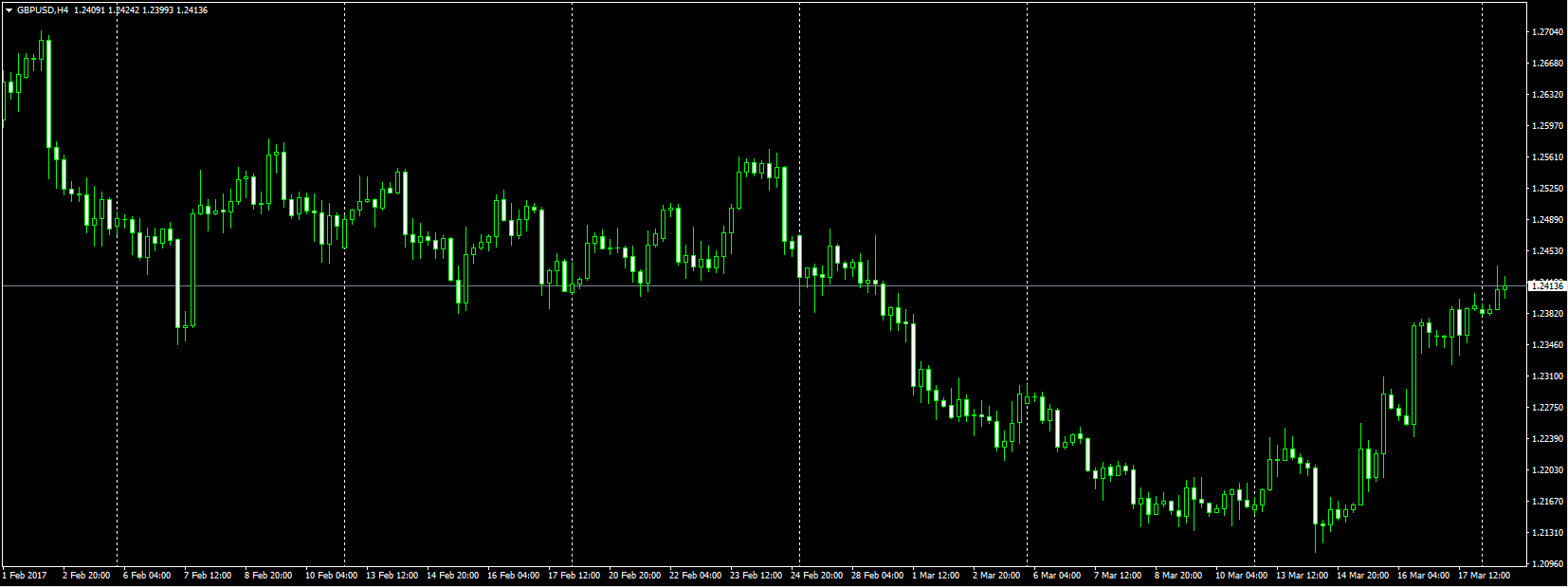

GBPUSD

In the weeks leading to the announcement we saw the dollar pricing in the expected outcome of the Fed. Since the announcement increased bets that the Bank of England will start tightening policy as early as next year has seen Sterling slowly rising. In the coming months, lingering Brexit and political uncertainty across Europe will keep Sterling saved on our Watchlists.USDJPY

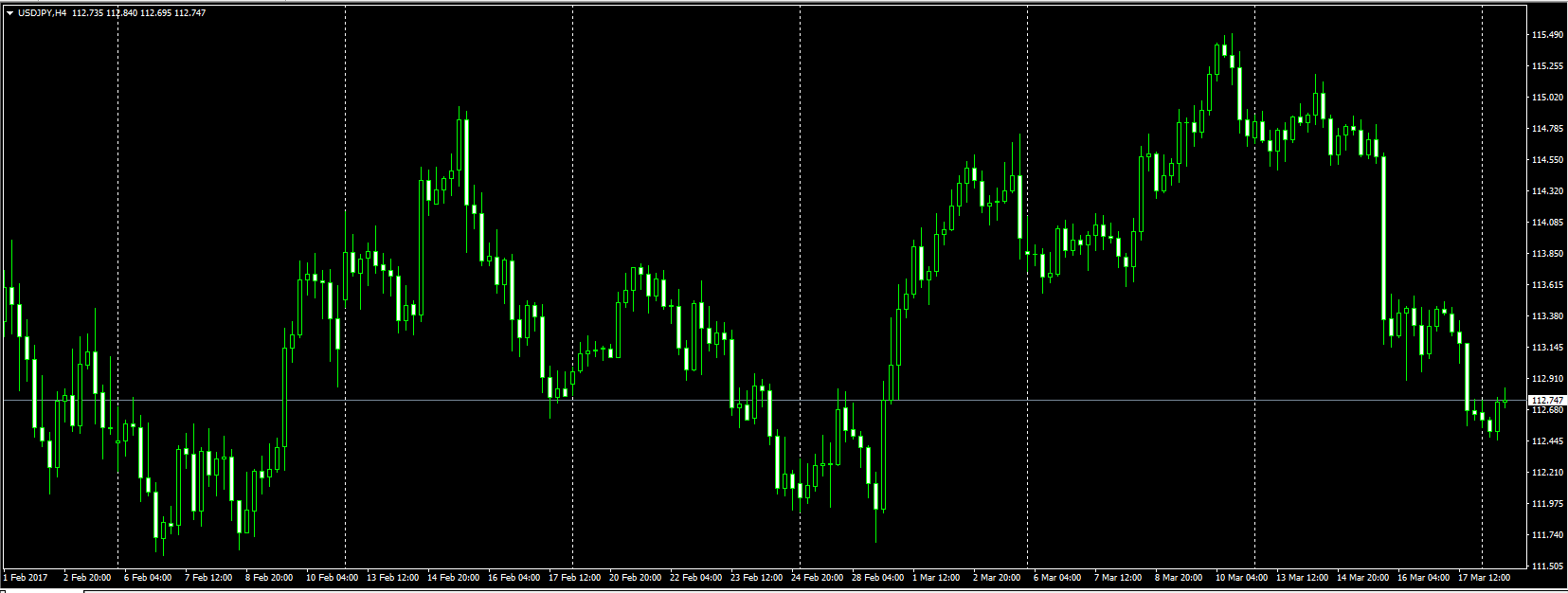

The Yen has recovered substantially from the Summer 2016 lows. The weeks leading to the March 15th announcement we saw the Japanese Yen stumbling to the lowest level since January 20th. There has been a gradual recovery since. It will be interesting to see the if the BOJ’s bonds (JGBs) purchase plan will have a lasting impact on the Yen.USDCAD

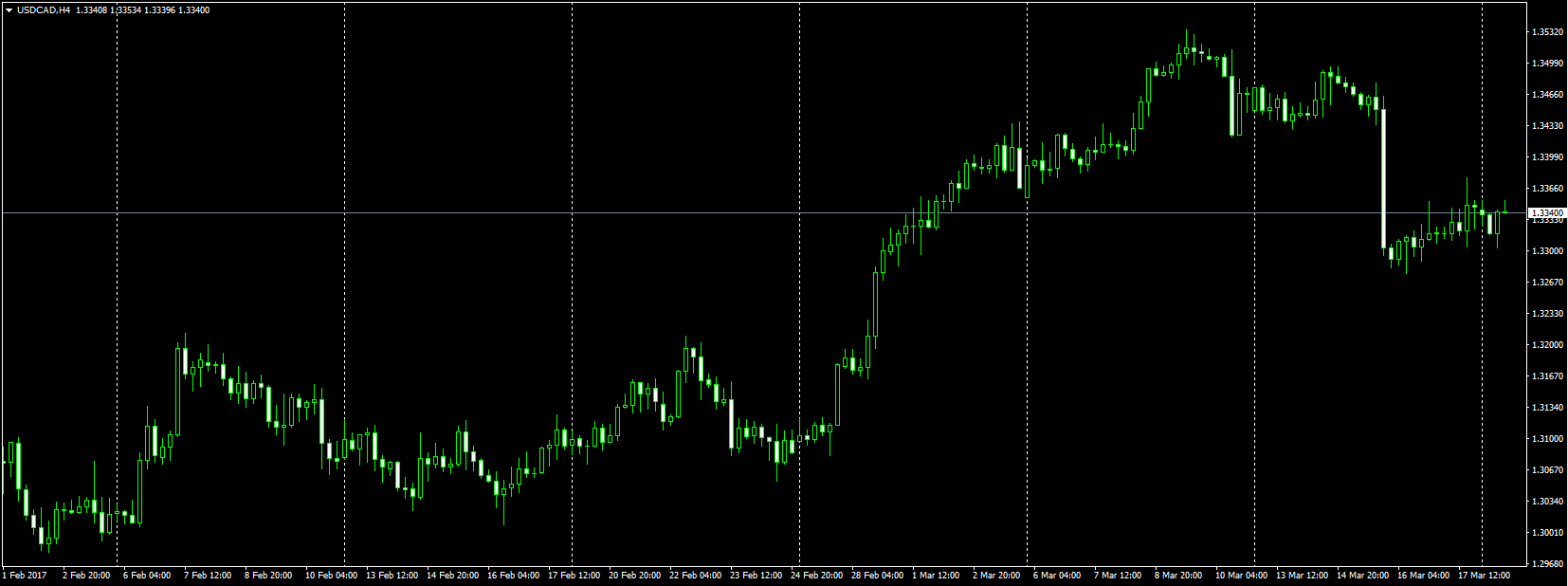

The Canadian dollar has recovered significantly since the USD/CAD reaching a 13 year high in January 2016. Pre-announcement we saw a three-month low in Canadian dollar value. The Loonie has experienced a small bounce back since. Looking further, the price action in Oil is expected to play a considerable part for the sixth largest oil exporter.S&P500

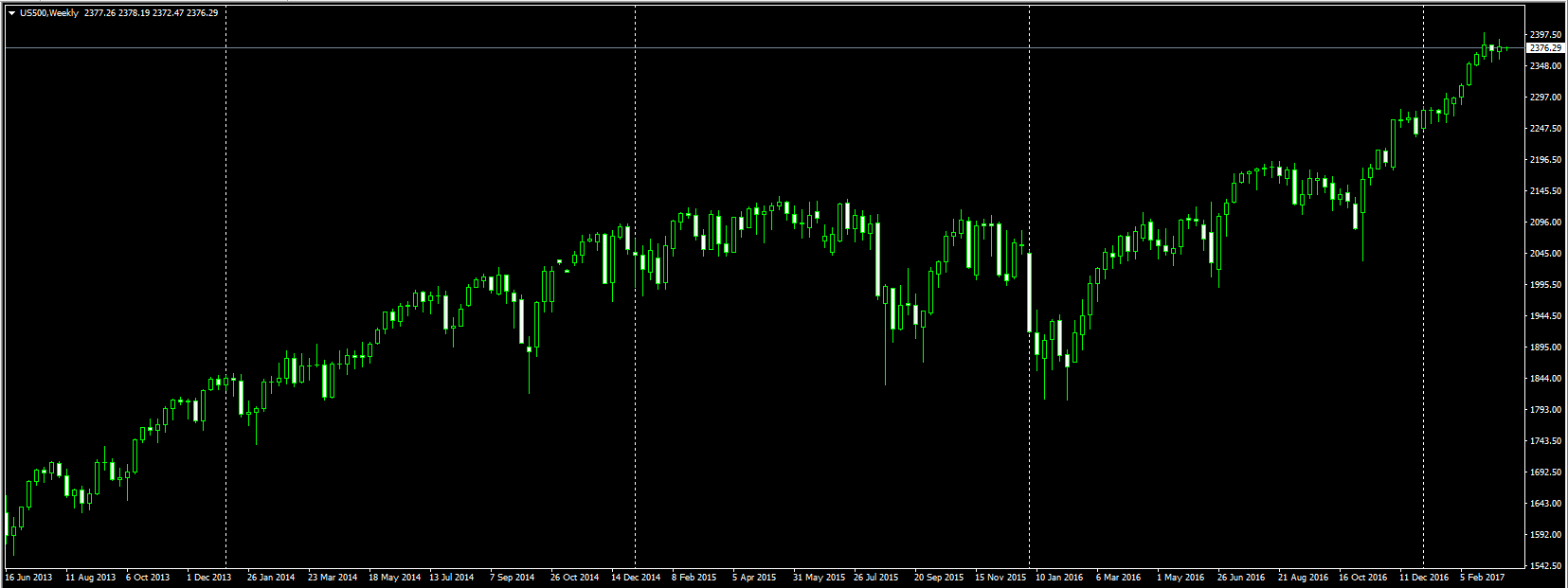

The S&P500 continues it’s astronomic rise. The buildup to the FOMC meeting saw the index grow to records heights. For how long will the bulls last with continued whispers of an imminent correction or will we see 2500 this year?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Post Inauguration – approaching 100 days

Post Inauguration – approaching 100 days Back in November 2016, the people of America went to cast their vote for their 45th President. There were two main candidates – Donald Trump and Hilary Clinton, the polls indicated a win for Clinton but the result proved the opposite. Even though Clinton won the Popular vote, Trump won the vote that coun...

April 19, 2017Read More >Previous Article

Trading Forex – USD/CNH

Trading Forex - USD/CNH The Chinese Yuan (RMB) has doubled its share of global currency trading from 2013 to 2016, advancing from the ninth place to t...

March 27, 2017Read More >Please share your location to continue.

Check our help guide for more info.

- Trading