- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Central Banks

- Preview: The European Central Bank Rate Decision

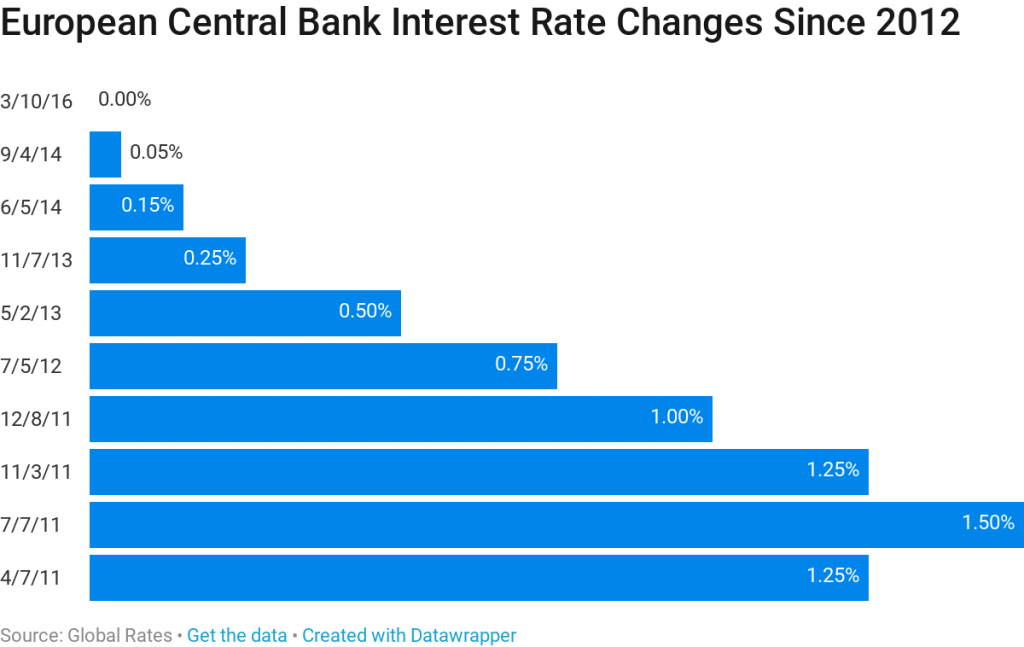

- Previous: 0.25%

- Forecast: 0.25%

- Previous: -0.40%

- Forecast: -0.40%

News & Analysis

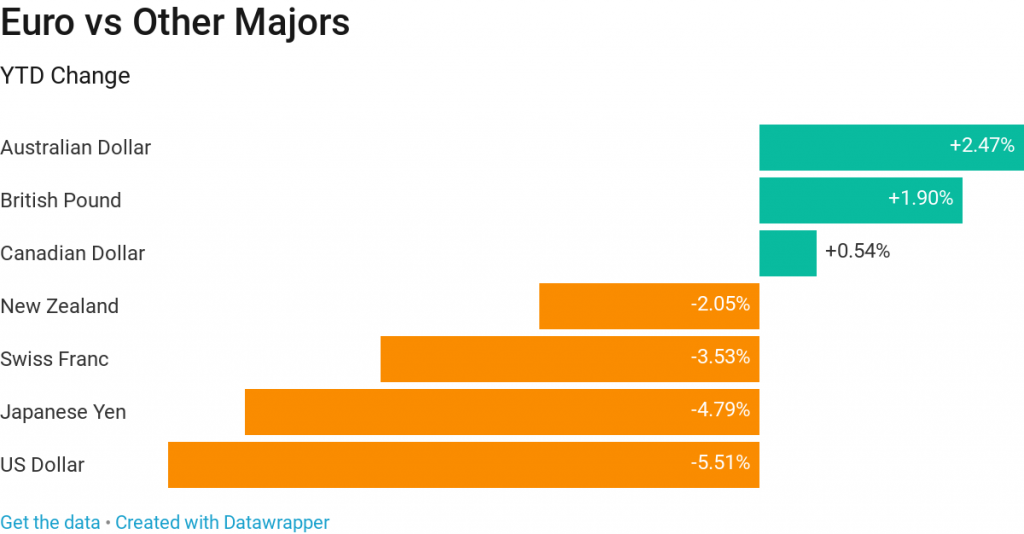

With the Brexit negations dominating the news flow over the last few weeks, you may forget there are other events taking place. On Thursday, the European Central Bank will announce its decision whether to increase, decrease or maintain the interest rates. The decision is scheduled to be announced at 12:45 PM UK time.

Why Is The Announcement Important?

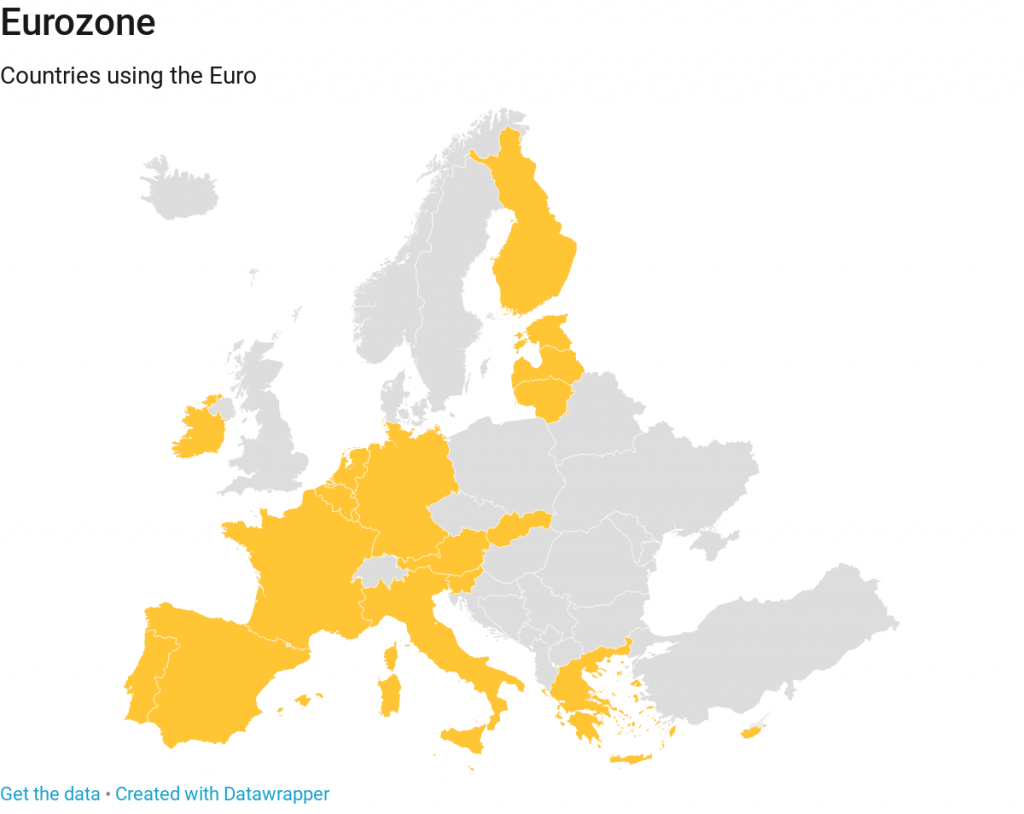

The European Central Bank is the central bank for the Eurozone, the countries which have adopted the Euro, including Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, and Spain. ECB’s decision to increase, decrease or maintain the interest rate has a significant impact on the financial markets because changes in interest rates affect the exchange rate of the Euro, so it is one of the must-watch economic events in the calendar.

Expectations

The European Central Bank has not changed its interest rates since March 2016 and analysts are forecasting that the rates will also remain unchanged in the upcoming meeting.

All eyes will be on the European Central Banks President, Mario Draghi’s speech shortly after making the announcement. Hot topics will involve the Italian and the Brexit process, which has developed into complete chaos.

The French budget is another issue to address for the ECB after the French President Emmanuel Macron gave in to the recent anti-government protests by the ”yellow vest” movement which will cause France to exceed the European Union’s budget deficit ceiling next year.

Other ECB data releases to keep an eye out:

ECB Marginal Lending Facility (12:45 PM London time)

ECB Deposit Facility Rate (12:45 PM London time)

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Go Markets MT4, Google, Datawrapper

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

The Dow Jones Industrial Average

Source: Bloomberg Terminal For the traders returning from the Christmas break, the sudden surge in the Dow Jones Industrial Average is probably the main event of significance to monitor. Major US equity benchmarks experienced the biggest daily gain in a decade. Until recently, those benchmarks were flirting with the bear market levels. What has ...

December 27, 2018Read More >Previous Article

US Jobs Numbers Are In

The Buraeu of Labor Statistics have released the latest jobs report for September. Let’s take a look at the latest numbers. The total non-farm pa...

December 7, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading