- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Central Banks

- The Bank of England Rate Decision

News & AnalysisThe Bank of England on the 3rd August, will announce whether they will increase, decrease or maintain the key interest for the United Kingdom. In this article we will look ahead with some industry experts and see how the UK economy performed last quarter.

Who decides the rates?

Interest rates are set by the Bank of England’s Monetary Policy Committee which is made of nine members – The Governor, the three Deputy Governors for Monetary Policy, Financial Stability and Markets & Banking, the Banks’s Chief Economist and four external members appointed directly by the Chancellor.

Expectations

According to Bank of England’s Deputy governor Ben Broadbent it is unlikely that the current interest rate of 0.25% will be raised on 3rd August as the directions of the UK economy remains unclear. Mr Broadbent is a close ally to the Bank of England governor Mark Carney, who in a recent interview said he was not ready to raise interest rates.

“In my opinion, it is a bit tricky at the moment to make a decision (to raise the interest rates). I am not ready to do it yet”.

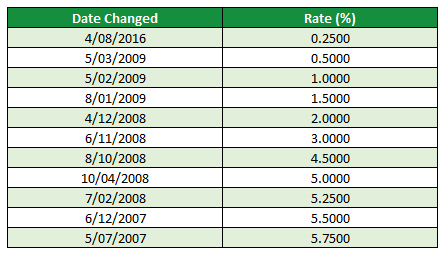

Bank of England rate history in the last 10 years

Source Bank of England Economy

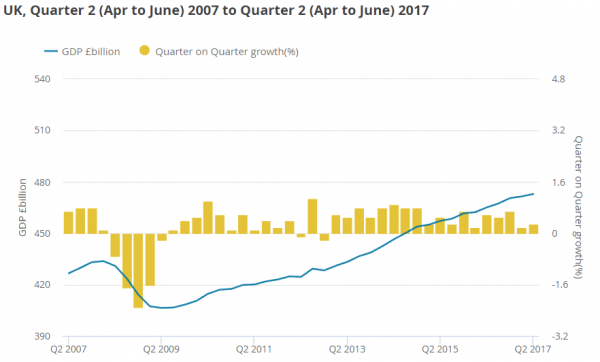

The UK GDP (Gross Domestic Product) was estimated to have increased by 0.3% in Quarter 2 (April to June) 2017. The growth in Quarter 2 was driven mainly by services, which grew by 0.5% compared to 0.1% growth in Quarter 1 (January to March) 2017.

The largest contributors to growth in services were retail trade and film production and distribution. Construction and manufacturing were the biggest downward pulls on quarterly GDP growth after two consecutive quarters of growth.

GDP per head was estimated to have increased by 0.1% during Quarter 2 2017.

Source: Office for National Statistics Financial Markets

The Pound

The Pound has been at a steady level for the past few weeks, on 16th July reaching its highest level against the US Dollar since September 2016. Most experts predict the rates to remain at the same level in the upcoming Bank of England meeting. The markets would have priced in the outcome already.

GBP/USD Source: Go markets MT4 Since reaching record highs back in May, the FTSE100 has remained around the same level with no major movement in the Index in the recent weeks.

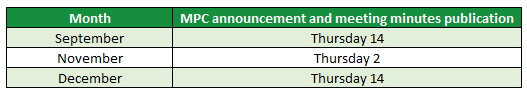

FTSE 100 Source Go Markets MT$ Remaining Monetary Policy Committee meeting dates in 2017

The New Note

On 18th July 2017, the Bank of England unveiled the new £10 note which will be issued on 14th September 2017. The £10 note which features author Jane Austen, will be larger than the new £5 note but smaller than the current £10 note and will is made of plastic and has traces of animal fat.

Speaking at Winchester Cathedral, the resting place of Jane Austen, the Governor Mark Carney said“Our banknotes serve as repositories of the country’s collective memory, promoting awareness of the United Kingdom’s glorious history and highlighting the contributions of its greatest citizens”.

The New Ten Source Bank Of England The new £10 note celebrates Jane Austen’s work. Austen’s novels have a universal appeal and speak as powerfully today as they did when they were first published. The new £10 will be printed on polymer, making it safer, stronger and cleaner. The note will also include a new tactile feature on the £10 to help the visually impaired, ensuring the nation’s money is as inclusive as possible.

By: Klavs Valters

GO MarketsThe information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

US Indices at Record Highs

US Indices at Record Highs US Indices have hit record highs in 2017 and are continuing to rally since the Trump presidency began back in January. The recent rally in the US Indices is mainly due to big number of companies reporting stronger performance results than the experts were predicting and a weaker dollar. Now let’s look at how the main US...

August 3, 2017Read More >Previous Article

How Brexit will effect the finance industry

An update on Brexit: How it will effect the finance industry With Brexit talks in full swing, financial services companies based in the United Kingdom...

July 25, 2017Read More >Please share your location to continue.

Check our help guide for more info.

- Trading