- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Central Banks

- Up Next: The Bank of Canada Rate Decision

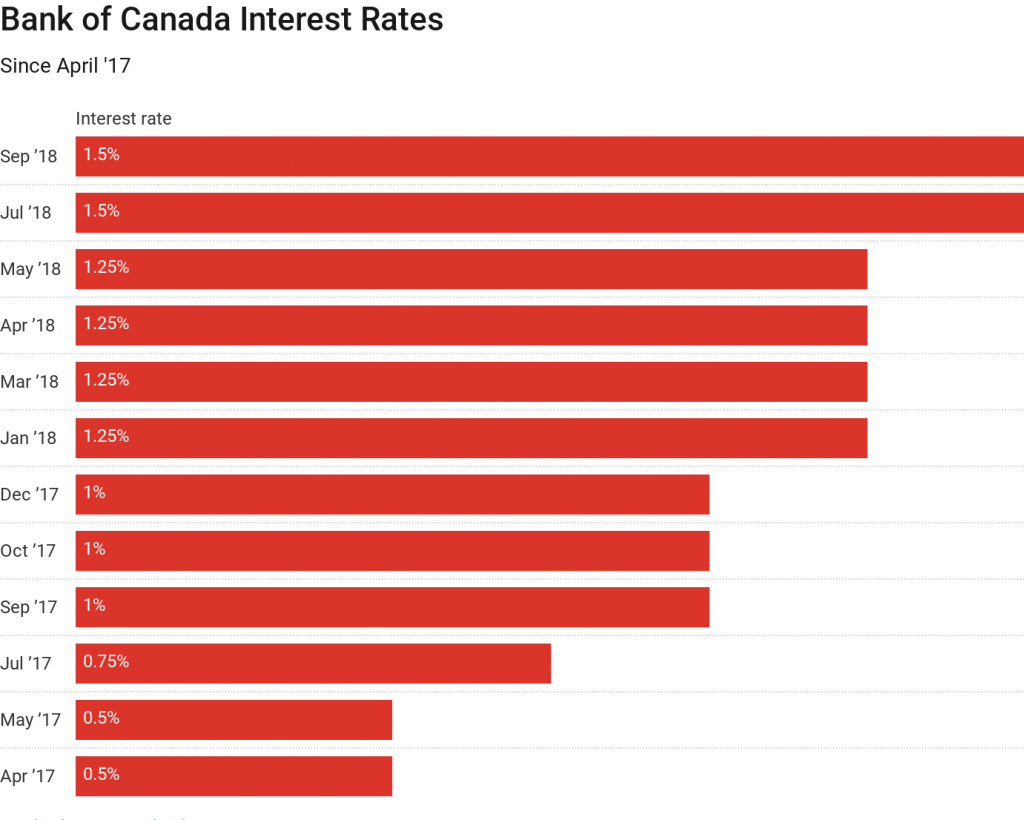

News & Analysis One of the must-watch economic events this week will be the Bank of Canada interest rate decision. The decision is scheduled to be announced on Wednesday at 14:00 PM London time. It will be the first meeting since the new United States–Mexico–Canada Agreement (USMCA). The bank has increased its interest rates four times since July of last year, so will there be another hike?

One of the must-watch economic events this week will be the Bank of Canada interest rate decision. The decision is scheduled to be announced on Wednesday at 14:00 PM London time. It will be the first meeting since the new United States–Mexico–Canada Agreement (USMCA). The bank has increased its interest rates four times since July of last year, so will there be another hike?Why Is The Announcement Important?

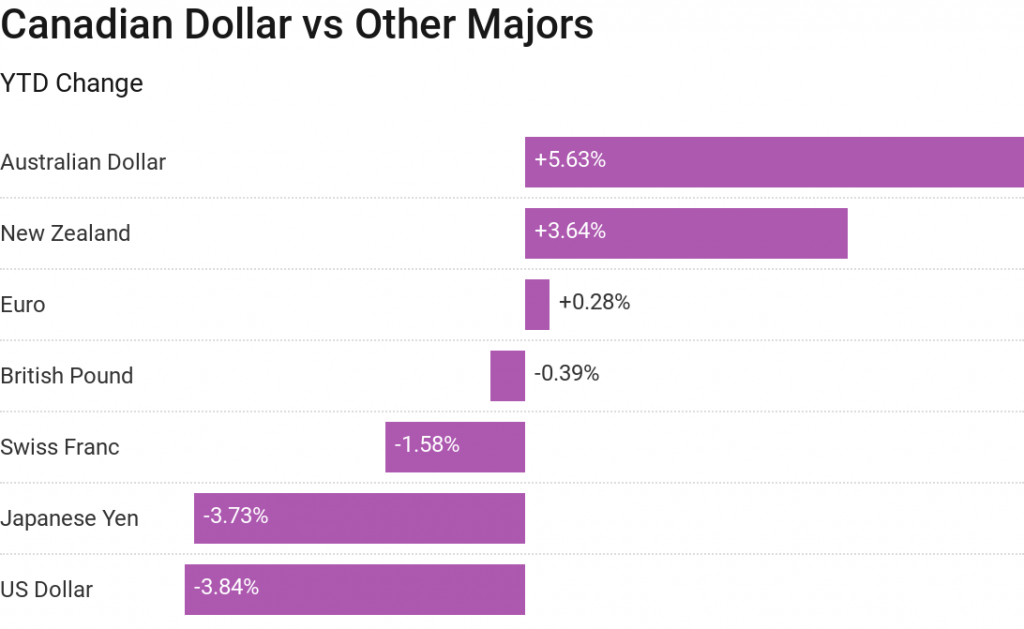

A bank interest rate is a rate at which a countries central bank lends money to local banks. The interest rate is charged by nations central or federal bank on loans advances to control the money supply in the economy and the banking sector. The Bank of Canada has an inflation target of 1% to 2% (currently 2.8%), and the interest rates are changed accordingly to meet the target. Therefore, the Bank of Canada’s and other central bank rate decisions can have a significant impact on the financial markets.

Expectations

In a recent speech, Stephen Poloz, the Governor of Bank of Canada said he continues to believe gradually increasing interest rates is the right approach.

According to the latest forecasts, it is highly anticipated that the Bank of Canada will raise its interest rates in the upcoming meeting from 1.5% to 1.75%, potentially a fifth rate hike since July 2017. “We expect the Bank to hike this month, in addition to hiking four more times in 2019, as the BoC’s measure of core inflation touched 2.0% for the first time since 2012 in August and is facing increased capacity constraints,” said Daniel Hui, an analyst at J.P. Morgan.“This [October] hike was already well anticipated by markets even before the USMCA breakthrough (80% priced before, 90%+ priced now), so it is the forward-looking rhetoric that might imply future pace and terminal rate that is more important for markets to monitor,” says Hui.

All eyes will be on the decision on Wednesday.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Go Markets MT4, Google, Datawrapper

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

October Stock Market Volatility – The Myth

The Psychological effect behind the Stock Markets’ Most Volatile Month. Generally, the volatility in October has been well-above average, and this does have a psychological effect on investors’ minds. The biggest market crashes – Black Monday/Tuesday and other turmoil had occurred in October making it the “Jinx Month”. The sharp an...

October 22, 2018Read More >Previous Article

Yield Curves: What Are They And How Can We Use Them?

Undoubtedly anybody who dabbles or takes an interest in the financial markets will have come across the term yield curves. Perhaps stumbled on durin...

October 19, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading