- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Cryptocurrency

- Bitcoin and Crypto Outlook

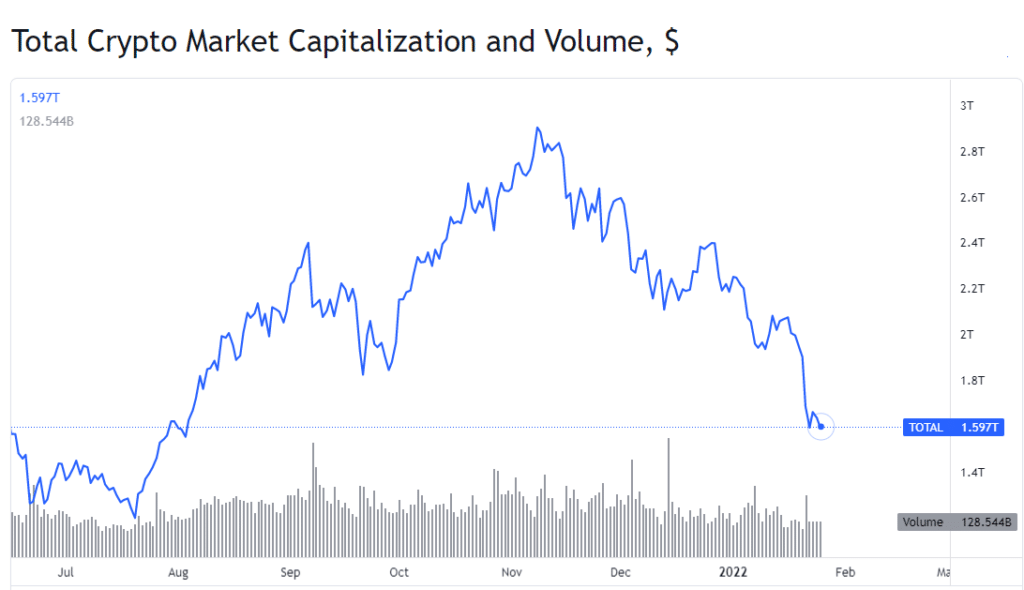

News & AnalysisNovember 2021, cryptos are regularly making all-time highs amid a mania like euphoria that increased institutional uptake and a newly launched ETF that crypto traders believed would drive prices even higher towards some of the uber bulls loftier 2021 targets. Two months is a long time in the crypto world and they have lived up to their volatile reputation with the two largest tokens (BTC and ETH) having lost almost half of their value since then. The broader crypto sector has also suffered with more than $1 trillion in losses amid an accelerating panic that the expected Federal reserve tightening cycle will lead to another deep crypto correction. The question crypto traders are asking is “where to from here?”, is this the start of a deep correction, or an opportunity to Buy the dip?

Source: Tradingview

While the selling has been relentless since November, it picked up pace after the Federal reserve released their latest minutes in early January. The hawkish tone of the Fed, where it outlined its intention to not only hike rates but to accelerate the tapering of its asset purchase program, saw a broad sell-off of the riskier “bubble” assets, with bitcoin getting hit especially hard amid the rout.

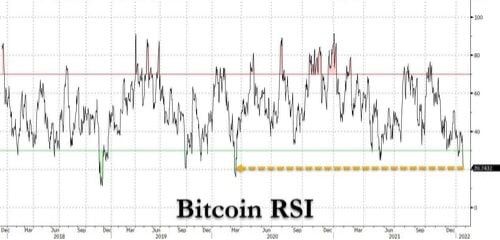

This rapid decline has pushed Bitcoin’s RSI indicator to an extreme oversold level, a level not seen since the pandemic crash of March of 2020.

Source: Tradingview

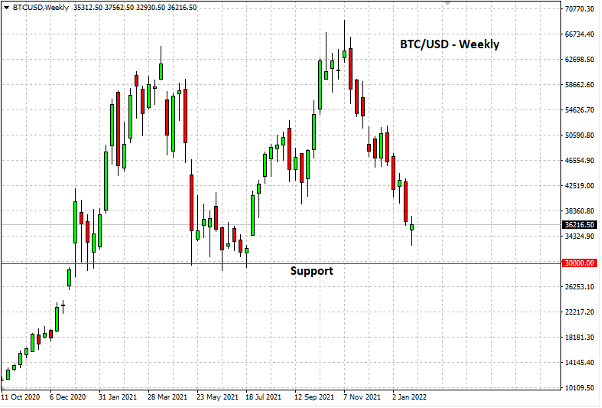

Also bringing the price down to within touching distance of the all important, major support level of around 30k USD per token, a support that held previous sell offs in 2021.

Source: GO MT4

While these technical may give confidence to the bulls that a bounce is due, there is one interesting fact that has become apparent in the last 12 months.

Cryptos have increasingly transformed from relatively uncorrelated assets providing diversification during market turbulence, into what is effectively a high beta stock. The increasing BTC correlation with high growth tech stocks means that not only do traders need to take Bitcoin fundamentals and technicals into account, but also the fundamentals/technicals of the high growth tech sector as well, the chart below shows this BTC correlation with the FAANG basket (Facebook, Amazon, Apple, Netflix and Google)

Source: Tradingview

One of the main reasons for this correlation is the increase in institutional adoption of cryptos, the same institutions that are now facing margin calls on their tech holdings, are also dumping cryptos to provide much needed liquidity.

Antoni Trenchev,, co-founder of Nexo, cites Bitcoin’s correlation to the tech-heavy Nasdaq 100, which right now is near the highest in a decade. “Bitcoin is being battered by a wave of risk-off sentiment. For further cues, keep an eye on traditional markets,” he said. “Fear and unease among investors is palpable.”

The evidence is growing that Bitcoin and altcoins should be classed as risk assets rather than safe havens.

Along with fears of central bank tightening and an increasing liquidation of correlated risk assets, crypto also has had to deal with a relentlessly pessimistic news cycle. Recently regulators from Spain, the U.K., Russia and Singapore all announced regulations and interventions that could undermine crypto uptake and growth in those regions. Out of the US as well, cryptos are under scrutiny with federal agencies tasked with assessing the risks and opportunities that cryptos pose in a report due as early as February.

It’s not all doom and gloom with cryptos though, crypto bulls and many analysts point out that on all previous occasions of crypto carnage, they eventually rebounded to new all time highs.

“At some point, sellers will become exhausted and the market could see some capitulation soon”, said Matt Maley, chief market strategist for Miller Tabak + Co. “When that happens, the institutions will come back in in a meaningful way,” he said. “Once the asset class becomes more washed-out, they’ll have a lot more confidence to come back in and buy them. They know that cryptos are not going away, so they’ll have to move back into them before long.”

Ironically, the real support could come from the Federal reserve as they realise that hawkish tone they have set may be to much for an economy that is slowing and could pivot to the dovish side in this week’s FOMC meeting, a pivot which would be expected to send risk assets sharply higher, cryptos with it.

“If we see a bigger selloff in equities, expect the Fed to verbally intervene to calm nerves and that’s when Bitcoin and other cryptos will bounce.” Said Nexo’s Trenchev.

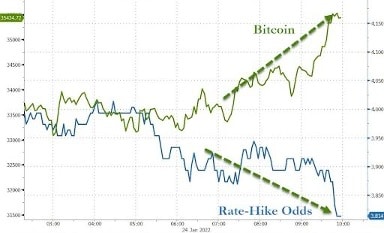

This effect could be seen in Mondays (24/01) huge turn around in equities and Bitcoin, bitcoin soared $3000 from its low to finish positive for the session, this was on the back of rate hike expectations dropping dramatically during the day as the market started to price in a backed into a corner Fed striking a more dovish tone than previously expected in Thursdays FOMC meeting as the below chart shows.

Source: Tradingview

Thursday’s Fed meeting will be pivotal for the near term direction of Bitcoin and Cryptos in general, and any serious crypto trader should be tuning in.

2022 will be an exciting year for cryptos, with strong forces on both sides of the bull / bear argument.

The bears have a seemingly endless negative news cycle, with regulatory and market risk weighing heavily on crypto prices.

The bulls have the Fed, a Fed that has shown in the past that the faster markets crash, the faster they panic and move to stabilise the stock market, this will also benefit other risk assets, Bitcoin and other cryptos among them.

Whichever side a trader picks, they will have to be nimble and be across the fundamentals and technicals of the broader market, not just the crypto chart they are looking at.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Verizon tops Wall Street expectations

Verizon Communications Inc. (VZ) released their previous quarter financial results before the market open on Tuesday. The US telecommunication giant topped Wall Street analyst expectations on both revenue and earnings per share. The company reported total revenue of $34.1 billion vs. $34.056 billion expected. Earnings per share at $1.31 a sha...

January 26, 2022Read More >Previous Article

IBM beats Wall Street expectations in Q4

It is set to be a busy week over in the US with major companies, including General Electric, Johnson & Johnson, Microsoft, Tesla, Apple and McDona...

January 25, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading