Is Bitcoin in a league of its own?

4 November 2022Bitcoin, the currency of tomorrow, a new age currency, has seen some severe ups and downs over the last few years. From reaching highs of nearly 70,000 dollars to dropping to lows of 17,000 the volatility and action around the cryptocurrency has been startling. Even compared to other traditional currencies the range and volatility of the price has been far more aggressive. In fact, when compared to other more volatile tradable assets such as indices and equities, Bitcoin still stacks up with how volatile it is. For traders this is an important aspect to consider when deciding what to trade.

Recent Chronology

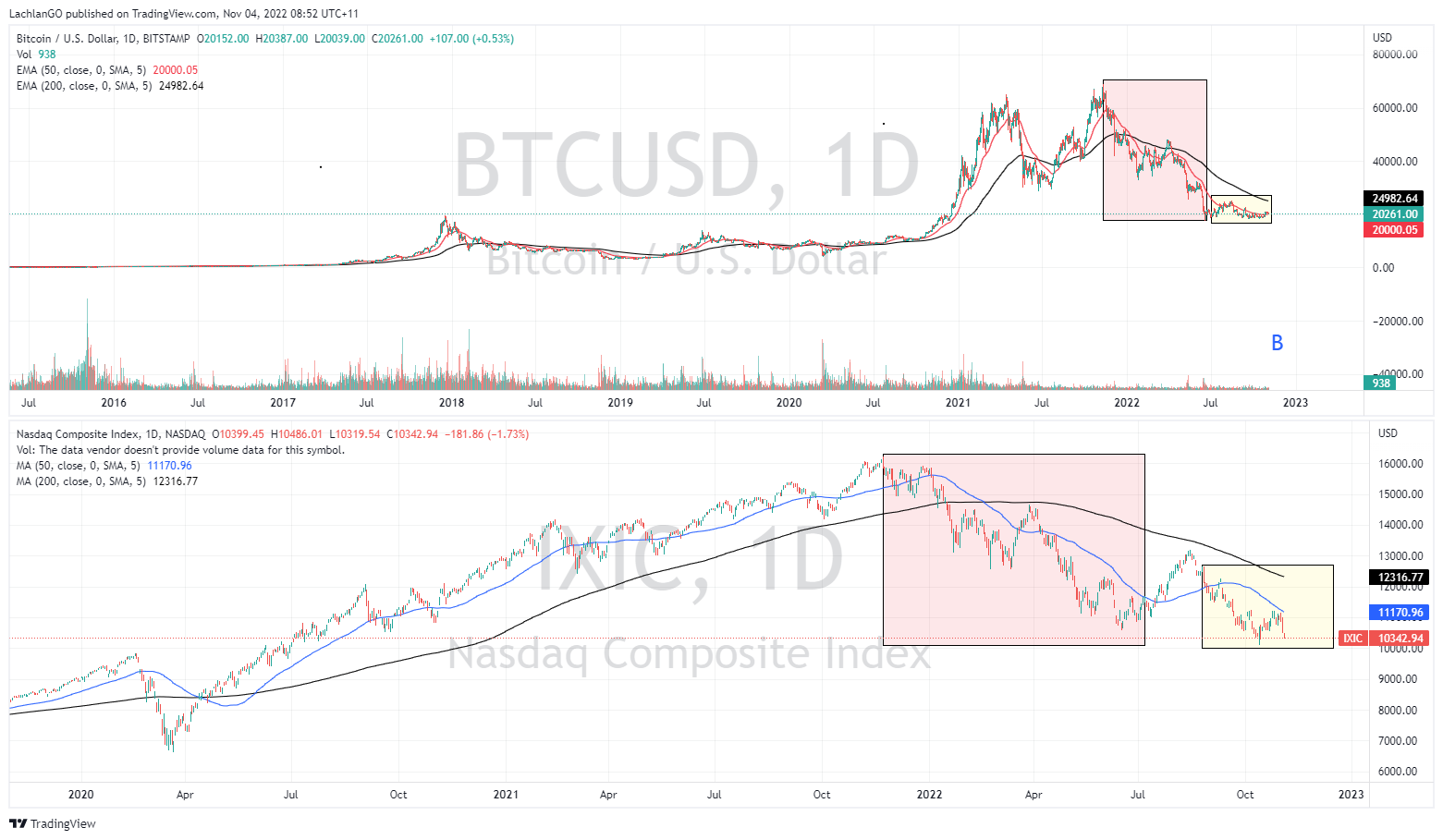

Early on, there was a thought that Bitcoin would become a hedge against inflation, or an alternative to Gold or Oil. With the recent wave of record high inflation that has swept up much of the world the leading cryptocurrency failed this test, and this proved to be wishful thinking. In fact, Bitcoin showed itself to be quite the oppositive of a hedge and was rather much more aligned with growth assets such as the Nasdaq and the technology sector. Prior to May 2022, the Nasdaq and Bitcoin has a correlation of 0.82 out of 1. In addition, with still so much unknown about how governments and Central Banks will come to treat the cryptocurrency and what regulations may be implemented there is a lot of uncertainty about how market regulation will affect the supply and demand. The chart indicates just how correlated the Nasdaq and Bitcoin were, sharing similar peaks in mid-November 2021 and following very similar price action until July 2022. However, after July there has been a shift in the correlation.

Today, Bitcoin is neither correlated strongly with either Gold or the NASDAQ and has carved out a niche for itself. Whilst the Nasdaq has continued to fall, Bitcoin has seemingly found its bottom. The price of Bitcoin has reclaimed its 50-day moving average which is its short-term support, and the price looks like it may continue to move up. The range of Bitcoin has also become much tighter indicates, that the overall volatility has reduced and that the price has reached some level of equilibrium showing that neither the buy nor sell side has been able to gain any ascendancy. Due to how vicious the selling has been this may very well indicate the last of the selling. Importantly, even with the increased liquidity that has flowed into the asset from institutions and ETF’s, the price has still been able to find support and not fall int a liquidity vacuum.

Where it fits in?

The recent price action brings up a more existential question which is where does Bitcoin fit in on the spectrum of safe to risky assets? Based on the information presented above there is no way that Bitcoin should at this stage be considered as a haven asset. The price is still too volatile to be considered a safe asset. In addition, there is still so much unknown with how the price might react in the future, specifically regarding future regulations. On the other hand, Bitcoin has exhibited some characteristics of a safer asset, mainly, in recent times, its increasing resistance to high volatility and wild price fluctuations. This may indicate that it is maturing as an asset.

Therefore, at this stage of its life it may be best to classify Bitcoin in its own quasi- growth basket. When analysing Bitcoin for potential trading or investing opportunities it is important keep in mind that it does not act like a traditional asset.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

US mid terms loom as a potential catalyst for equities.

The US midterm elections are coming up next week on 8 November and have the potential to have a big say on the direction and volatility of the US and global markets. All the 435 seats in the House of representatives will be decided upon. Currently, the makeup of the house includes 220 Democrats, 212 republicans and 3 vacant seats. The ...

Previous Article

Bank of England announces biggest single rate hike in 33 years

Another day, another hike. On Wednesday, the US Federal Reserve announced its latest policy decision to raise its interest rates from 3.25% to 4%, to ...