- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Cryptocurrency

- US markets again hit all time highs and Gold loses its lustre

- Home

- News & Analysis

- Cryptocurrency

- US markets again hit all time highs and Gold loses its lustre

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS markets again hit all time highs and Gold loses its lustre

19 February 2021 By Lachlan MeakinEquity markets

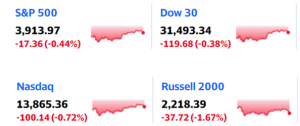

US markets dipped last night with the Dow finishing down for the first time in 4 sessions. This came as the streak of better-than-expected economic data came to an end with initial jobless claims unexpectedly jumping to a one-month high last week.

Retail giant and Dow 30 component Walmart (WMT) also weighed on the index dropping 6.5 per cent after it missed quarterly profit estimates and predicted a low-single digit rise in fiscal 2022 net sales.

Source: Yahoo Finance

Whilst US Markets are flat for the week, UK and Asian equity markets have performed well with signs of China’s economic recovery continuing lifting the Hang Seng and good news on UK vaccination progress sending the FTSE 100 higher.

Source: Bloomberg

The ASX200 again hit post COVID highs this week before pulling back slightly. Optimism in the Australian economic recovery was bolstered this week with another drop in the unemployment rate and vaccine rollouts imminent.

Forex markets

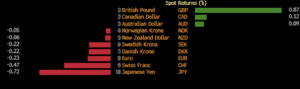

FX markets were mixed this week, the US dollar strengthened modestly against most major currencies, with the exceptions of CAD, AUD and GBP.

Source: Bloomberg

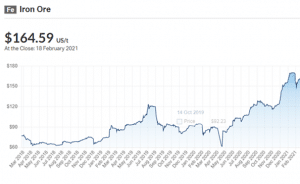

Resource linked currencies AUD and CAD performed well as prices for Copper and Iron ore continued to run hot, with increased demand from China and ongoing COVID related supply issues underpinning the price of these resources.

Source: marketindex.com.au

GBP outperformed this week amid continued optimism over the nation’s vaccine rollout, with the pound touching the highest level versus the euro since March last year.

Source: GO MT4

Commodities

Gold

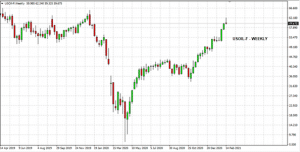

Spot gold (XAUUSD) continued its downtrend setting a new low price for 2021 and within touching distance of the lows set in November. With markets risk on as vaccines rollout and positive signs of an global economic recovery the lustre has been taken off the precious metal for now.

Source: GO MT4

Oil

US crude prices broke above $60 per barrel touching as high as $62 , a level not seen since January 2020.

Severe winter storms and rolling blackouts in the oil producing state of Texas have crippled the oil industry, causing an output drop of more than 4 million barrels a day – almost 40% of the nation’s crude production.

Monday, 22 February 2021

Indicative Index Dividends

Dividends are in PointsASX200 WS30 US500 US2000 NDX100 CAC40 STOXX50 0.821 6.645 0.323 0.011 0 0 0 ESP35 ITA40 FTSE100 DAX30 HK50 JP225 INDIA50 0 0 0 0 0 0 10.131 The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

DOW hits all time highs, Nikkei back to bubble era prices and Bitcoin’s wild ride.

Going into the month’s last day of trading, Global markets have performed well despite a sell off this week. Continued hopes that we’re on a path to economic recovery, with COVID vaccines rolling out and the subsequent drop in cases, have supported markets and drawn in investors. Global Equities Major US Indices all saw record highs, with t...

February 26, 2021Read More >Previous Article

Week Ahead: All time highs for US markets, China drives oil rally and Bitcoin boost.

World equity markets finished modestly positive for a week sparse of economic news. US markets again hit all time highs on the back of strong corpor...

February 15, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading