- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Cryptocurrency

- Week Ahead: All time highs for US markets, China drives oil rally and Bitcoin boost.

- Home

- News & Analysis

- Cryptocurrency

- Week Ahead: All time highs for US markets, China drives oil rally and Bitcoin boost.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWeek Ahead: All time highs for US markets, China drives oil rally and Bitcoin boost.

15 February 2021 By Lachlan MeakinWorld equity markets finished modestly positive for a week sparse of economic news. US markets again hit all time highs on the back of strong corporate earnings, continued optimism in fiscal stimulus and COVID progress as the US infection rate eased to its lowest level since October.

Equity Markets

US

The NASDAQ outperformed with Twitter (TWTR.NAS) continuing the good run of earnings coming from the tech giants in recent weeks.

Disney (DIS.NYSE) surged to all time highs after reporting strong performance in Q1, despite the company’s theme parks in California having been shuttered for the best part of a year.

Source: CQG

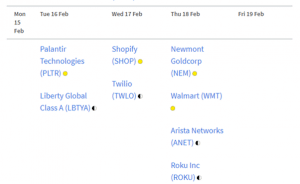

Entering the last week of Q1 corporate reporting we have Walmart (WMT.NYSE) reporting on Thursday, this paired with US retail sales , released on the same day will give a good indication of US consumer demand recovery.

AUSTRALIA

The Australian Market finished slightly down on a week with no major economic announcements. This week we have the employment change and unemployment rate released on Thursday. These figures will be of extra importance with rolling back of JobSeeker payments scheduled for March in what some social advocacy groups are calling a “national crisis”.

Zip Pay (Z1P.ASX) was one shining light, rallying 25% and continuing the surge higher of recent weeks.

FX Markets

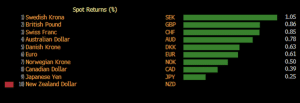

The US dollar index finished down 0.5% weakening against all major currencies with the exception of the NZD.

Source: Bloomberg

AUDUSD

The Aussie continued its impressive rallies after the dip preceding the RBA’s surprise announcement of its bond buying QE programme at the start of the month. A weak US dollar and record iron ore and copper prices are driving it back to the important 78c level.

AUDUSD has experienced strong resistance at these levels this year, the employment report on Thursday will be an important Indicator as to whether the Aussie can break through.

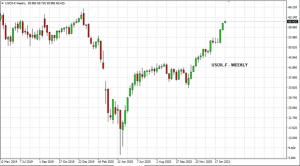

Source: GO MT4

Commodities – Oil

US Crude Oil continued its strong rally breaking the $60 USD a barrel mark, with prices now back in line with pre-pandemic levels.

China’s rapid economic recovery from the pandemic has been cited as the single most bullish factor for oil prices at the moment. China’s January crude oil imports averaged 11.12 million bpd. This was up by more than 18 percent from the December average.

Weekly US Crude inventories will be released Friday with the last 3 weeks having much larger draws than expected. Eyes will be on the figure to see if oil demand is continuing to strengthen.

Source: GO MT4

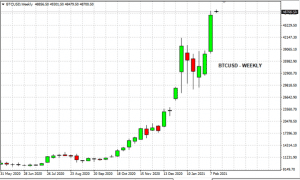

Bitcoin

Bitcoin continued its surge upwards to all time highs as news that an investment arm of Morgan Stanley is considering adding Bitcoin to its list of possible trades.

This comes on the back of a recent Tesla announcement of investment in the cryptocurrency and could indicate a coming broader uptake of Bitcoin in corporate investment circles.

Source: GO MT4

Tuesday, 16 February 2021

Indicative Index Dividends

Dividends are in PointsASX200 WS30 US500 US2000 NDX100 CAC40 STOXX50 11.709 8.488 0.489 0.038 0 0 0 ESP35 ITA40 FTSE100 DAX30 HK50 JP225 INDIA50 0 0 0 0 0 0 0 The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

US markets again hit all time highs and Gold loses its lustre

Equity markets US markets dipped last night with the Dow finishing down for the first time in 4 sessions. This came as the streak of better-than-expected economic data came to an end with initial jobless claims unexpectedly jumping to a one-month high last week. Retail giant and Dow 30 component Walmart (WMT) also weighed on the index dropp...

February 19, 2021Read More >Previous Article

GBPCAD – G10’s Best Performing Currencies Lock Horns

GBPCAD – Hourly Individually, both the British Pound and the Canadian Dollar have surged in recent trading sessions, appearing relatively strong ...

February 11, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading