2022 was the worst year ever for Bonds so will 2023 be better?

11 January 20232022 was the worst year ever for Bonds so will 2023 be better?

Government bonds, thought as the safest investment had their worst yearly performance ever in 2022 according to analysis conducted by Edward McQuarrie professor at Santa Clara University. When referring to the performance of bonds it is specifically considering the decrease in price of long-term US government and corporate bonds. According to McQuarrie’s research Bond’s had their worst performance in 250 years.

Why the drop?

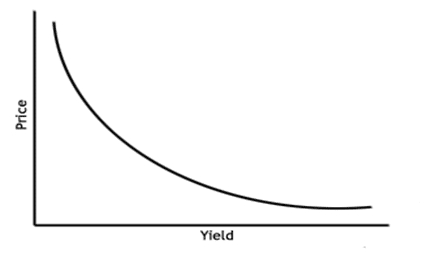

It is important to understand why bonds suffered their biggest losses. This requires an understanding of the relationship between bond prices and interest rates. As interest rates increase, bond prices fall and vice versa. This is because new bonds that get issued will be issued at higher levels of interest forcing the old bonds to have to their prices adjusted to reflect the interest rate shift. Consequently, when inflation is high and central banks need to increase interest rates, the price of bonds suffers as interest on the bonds increase. In 2022 with record high inflation sweeping most established economies, central banks were forced to aggressively raise interest rates to lower inflation levels.

Another complicating factor is that interest rates were already at such a low base to begin with due to the pandemic. After hiking the rates 7 times last year to a current rate of 4.50%. Therefore, the aggressiveness of the hikes sent bond prices plummeting and very quickly. The chart below shows the how aggressive the sell offs in bonds were.

Note that the chart is measured by its yield and there the price drop is just the inverse of the yield. The aggressiveness of the yield jump highlights how weak the bond prices were, especially compared to other years.

The question remains will 2023 be a better or worse year for bonds? Well, this once again depends upon on inflation and the economic data that comes out of the USA. With such aggressive hikes made in 2022 it is unlikely that inflation can keep on going higher and higher at the same rate. Therefore, a shift from the Federal Reserve cannot be faraway. In addition, if a recession threatens to hit the market or occurs it will further pressurise the Fed to lower rates or hikes less aggressively helping the price of bonds.

It is unlikely that Bonds will perform as poorly as they did in 2022 this year. The 0% interest rates that were being bandied around during the early stages of the pandemic are long gone and inflation has for now stabilised. With global volatility still high, bonds can still play an important role in helping build defensive portfolios and trading systems.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Bitcoin showing early signs of another sell off?

Bitcoin had a tumultuous 2022 with the leading cryptocurrency seeing an aggressive sell off. Lead by catalyst such including the collapse of Celsius and exchange FTX, the price of the dropped 65% from 50,000 USD to $17,000. The collapse of the large players within the cryptocurrency sphere sent shockwaves as institutions and retailers pulled their ...

Previous Article

What is going on with Tesla’s share price?

What is going on with Tesla’s share price? Tesla is now one of the world’s most recognisable brands and companies. A leader in technology and pio...