- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- A quick surveillance on the Australian drone sector

- Home

- News & Analysis

- Economic Updates

- A quick surveillance on the Australian drone sector

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisDrones are slowly becoming mainstream in our airspace. Along with unmanned aviation vehicles (UAV), these high flying devices can commonly be reported as a potential UFO.

There has been quite a lot of hype over potential growth of the drone market. The potential value of the global drone industry has been estimated to double within the next five years, putting the value of the industry between $40-60 billion USD. Goldman Sachs is among one of the biggest believers, as they gave the industry an estimated market value of $100 billion USD within the same five years period.

UAVs have a vast array of possible uses. Besides taking jaw-dropping b-roll of landscapes and architecture for social media, they are also currently being used for a wide range of sectors, including construction, mining, agriculture, insurance, defence and law enforcement.

The potential application in the residential and commercial space is only limited to the imagination. As the technology improves, governments from around the world will have to update their regulations.

From the investment perspective, the drone industry has recently suffered from failing to meet expectations and the overall IT sector’s sell off. Eager investors would usually commit early in order to capitalise on any new emerging trend before the fundamentals have emerged. However, after the hype, most of these investors would pull out as these companies release their results.

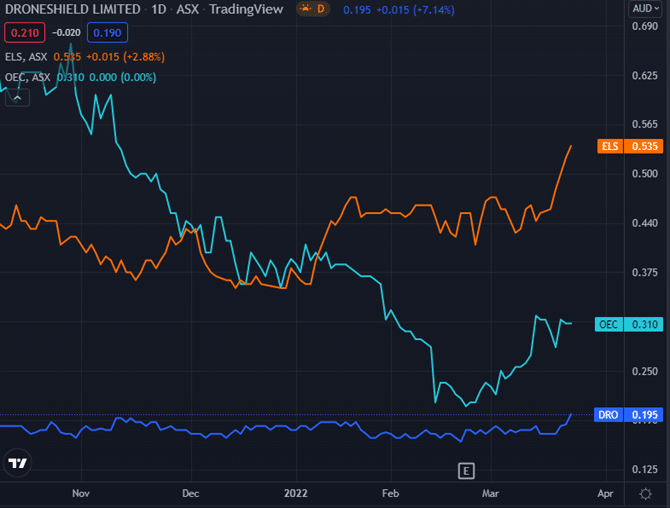

Below is a list of potential drone ASX-listed companies that are closer to delivering on investors’ expectations today, than a few years ago.

DroneShield Limited is a drone detection technology company that is focused on developing and commercializing hardware and software technology for drone detection and security. They offer governments the technology solution to protect their interests against drone intrusions.

They have started 2022 with an impressive winning streak of contracts in the military services, some of which related to the conflict between Russia and Ukraine. This followed the previous financial year where they have experienced rapid revenue growth.

It has recently been admitted to the US General Service Aviation list of preferred suppliers. This pipeline would most likely yield more business. They are prepared for the increase in demand for drone defence over the next coming years.

Elsight has developed a revolutionary innovative high-bandwidth mobile secured-datalink product which enhances the traditional live data transfer methods with a multi-link based technology which is capable of high bandwidth, stable and secured live data transfer.

They have adapted its HALO connectivity technology onto UAVs. They believe their sixth-sense solution is a modern solution for drone connectivity, which can potentially offer unlimited range.

They have recently secured a commercial order of HALO units to DroneUp, a UAV service provider in the US. DroneUp has Walmart as one of their large strategic investors. Their intention is to use drones, connected with HALO technology, to deliver goods to their customers.

Orbital UAV is a world leader in the design and manufacture of integrated engine systems for military drones. Their goal is to provide clean engine technologies and alternative fuel systems with reduced environmental impact from gas emissions and improved fuel economy.

They currently have an impressive network with other companies that are highly regarded in the drone defence space. One of these companies would be Insitu Pacific. These guys are owned by Boeing and have recently won a contract to aid the Australian Army deliver 24 UAVs as part of the LAND 129 phase 3 project.

All in all, the drone industry is slowly emerging and we are fortunate to have some home grown companies to support. Just like any other emerging markets and companies, the potential can be quite high. As an investor, you would need to know how to successfully navigate the hype.

If you would like to take this opportunity to invest in the aforementioned companies and don’t already have a trading account, you can register for a Shares account at GO Markets.

Source: Droneshield, Orbitaluav, Elsight, Wikipedia, Australiandefence, Goldman Sachs Tradingview, AFR

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Oil spikes again on fears of supply shortages

US indices retraced overnight as the market took a step back to assess the recent rally. The Nasdaq finished down 1.32%, the Dow Jones Index was down 1.29% and the S&P 500 was 1.23% in the red. Despite the selling, the session was still a far cry from recent sell-offs. In Europe, the DAX slumped 1.31% after showing some strength early in the...

March 24, 2022Read More >Previous Article

US stocks continued moving up overnight with the technology sector outperforming

The US technology sector rose again last night and worked back the losses from the previous day of trading as the market came to grips with the Federa...

March 23, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading