- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Amazon records its first loss since 2015

News & AnalysisAmazon has followed some of the other tech sector players in providing weaker than expected quarterly results. The global giant saw its share price drop dramatically after hours in response to the release of the report.

Key Report Figures

Revenue at Amazon increased by just 7% which marks its lowest figure since the .com bust in 2001. The revenue figure was also 44% lower than the same period a year ago. Whilst the lower revenue was somewhat expected, the forecast of slower growth in the quarters to come is what most scared investors and dragged the price down. The company is forecasting revenue of between $116 billion and $121 billion for the period ending June 30. This was compared to analyst projections of $125 billion.

The big drain on its figures for the quarter was its loss on its investment in electric vehicle company, Rivian. Their losses on the investment totalled $7.6 billion. Shares in Rivian lost more than half their value during the last quarter.

Changing Macro Factors

Amazon was one of the biggest winners from the pandemic seeing accelerated growth due to stay at home orders around the world. However, as policies have changes shopping behaviours are changing. Shoppers are increasing their presence at physical shops at the expense of online shopping. Amazon has also laid blame at its poor performance due to factors such as the geopolitical situation in the Ukraine which has caused disruptions to the supply chains. High inflation levels have also contributed to poor profit margins and rising costs.

Amazon CEO Andy Jassy stated that “The pandemic and subsequent war in Ukraine have brought unusual growth and challenges”. Like Microsoft, Amazon did see a 36% increase in sales for its cloud-based business AWS. The system generated 57% of growth with a total of 6.5 Billion of revenue.

The general market sentiment, especially for large tech stocks, has been extremely bearish and with the Nasdaq in a bear market many stocks have suffered and fallen in line with this. The road ahead for Amazon may still see further challenges as the company looks to wade its way through Inflationary and other pressures.

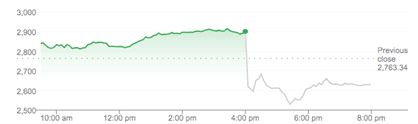

The share price for Amazon closed at $2,891.93 before dropping dramatically after hours as seen below.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

QANTAS confirms its plan for Project Sunrise

The major Australian airline announced its commitment to direct flights from Sydney and Melbourne to mainland Europe and the East Coast of America by 2026. The commitment was announced on the back of encouraging quarterly figures due to a strong recovery in the travel sector and the easing of many Covid restrictions. Trading results QANTAS an...

May 2, 2022Read More >Previous Article

NIO’s April delivery numbers are in

NIO Inc. reported its latest delivery numbers for April on Sunday. The Chinese electric vehicle company delivered 5,074 cars last month – a decre...

May 2, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading