- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- An update on Jerome Powell’s (Federal Reserve) latest speech

- Home

- News & Analysis

- Economic Updates

- An update on Jerome Powell’s (Federal Reserve) latest speech

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe US Federal Reserve (Fed) has recently doubled down on their hawkish views, after Jerome Powell’s latest speech. There are preparations to substantially increase the interest rate in May. The speech has subsequently put pressure on the Australian Reserve Bank (RBA) to raise the interest rate at a faster pace.

Mr Powell said “the US central bank could raise rates in 50 basis point increments at upcoming meetings and leave rates higher in the longer term than would have traditionally been expected.”

Earlier last week, the Fed had increased its benchmark rate by 25 basis points to 50%, this is the first time it had been increased in three years. This was intended to help curb the 40 year high in inflation. This decision shows the Fed’s willingness to increase the rates as needed.

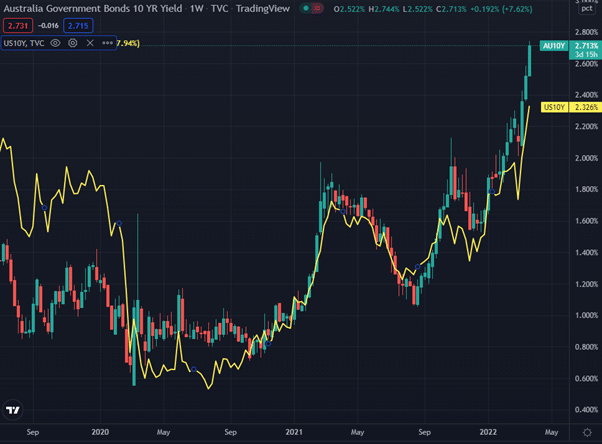

The Australian three-year government bond rate has recently cracked the 2% mark, it hasn’t been above this level since 2018. Bond traders have taken interest and increased their bets on the RBA policy tightening. They also expect the overnight cash rate to be at 1.57% by the end of the year, which indicates the rate to be increased up to seven times. It was previously expected to increase five times.

The bond rate is sensitive to short-term interest rate expectations. The US three-year bond yield has also increased, sitting at 2.367%. This indicates that the Fed will increase its benchmark rate more than the RBA.

The big four banks have different forecasts when it comes to the RBA’s decision to increase the rates. Westpac and NAB believe the rate hikes will occur in August. CBA expects it to be earlier in June. ANZ has not announced their intentions as they are waiting for the September RBA meeting to make an informed decision.

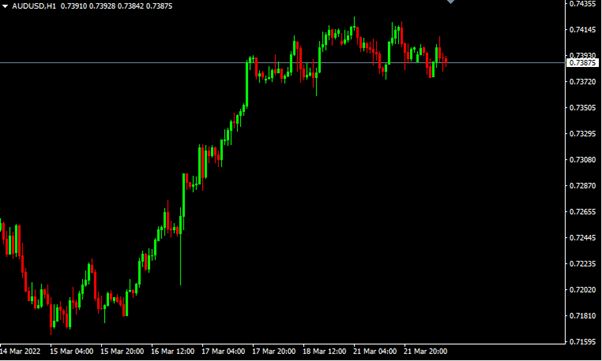

The Australian/US dollar exchange rate is currently floating around the 74 cents mark. This currency can be a liquid proxy for global growth or risk appetite in general. It has remained relatively stable since the conflict in Russia and Ukraine.

Australian 10-year bond yield is currently higher compared with US’ yield. This has also provided support for the Australian dollar.

The rising oil prices will also provide further support for the Australian dollar as Australia is a net exporter of energy.

All in all, the recent speech from Mr. Powell has provided tremendous insight into where the Federal Reserve is heading. The RBA can potentially follow their lead and this would result in knock on effects, which would in turn affect the AUD/USD. Many investors are keeping a keen eye on the current interest rate hike timeline.

If you would like to take this opportunity to invest in the AUD/USD and don’t already have a trading account, you can register for a Forex CFD account at GO Markets.

Source: GO Markets, Tradingview, Bloomberg, AFR

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Adobe’s latest numbers are in

Adobe Inc. reported its financial results for fiscal first quarter 2022 after the closing bell on Wall Street on Tuesday. The American software company reported revenue of $4.262 billion in the quarter (9% increase year-over-year), slightly beating analyst forecast of $4.241 billion. Earnings per share reported at $3.37 per share in the Q1 vs...

March 23, 2022Read More >Previous Article

Pfizer’s Performance and the 4th Booster Plan

Pfizer Inc. is an American multinational pharmaceutical and biotechnology corporation headquartered on 42nd Street in Manhattan, New York City. The co...

March 23, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading