- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Amazon falls short in Q1

- 1 Month -11.29%

- 3 Month 3.55% -13.27%

- Year-to-date -13.27%

- 1 Year -16.69%

- Citigroup: $4400

- UBS: $4500

- Deutsche Bank: $4100

- Credit Suisse: $4100

- Goldman Sachs: $4200

- JP Morgan: $4500

News & AnalysisAmazon.com Inc. announced its first quarter results after the market close in the US on Thursday, falling short of Wall Street analyst expectations.

The US online retailer reported revenue of $116.444 billion in the quarter vs. $116.45 billion estimate.

Analysts were expecting earnings per share of $8.35 a share in Q1, however, the company reported a loss per share of $7.56 a share.

”The pandemic and subsequent war in Ukraine have brought unusual growth and challenges,” company CEO, Andy Jassy said in a press release after the latest numbers were announced.

”With AWS* growing 34% annually over the last two years, and 37% year-over-year in the first quarter, AWS has been integral in helping companies weather the pandemic and move more of their workloads into the cloud. Our Consumer business has grown 23% annually over the past two years, with extraordinary growth in 2020 of 39% year-over-year that necessitated doubling the size of our fulfillment network that we’d built over Amazon’s first 25 years—and doing so in just 24 months. Today, as we’re no longer chasing physical or staffing capacity, our teams are squarely focused on improving productivity and cost efficiencies throughout our fulfillment network. We know how to do this and have done it before. This may take some time, particularly as we work through ongoing inflationary and supply chain pressures, but we see encouraging progress on a number of customer experience dimensions, including delivery speed performance as we’re now approaching levels not seen since the months immediately preceding the pandemic in early 2020,” Jassy concluded.

*Amazon Web Services

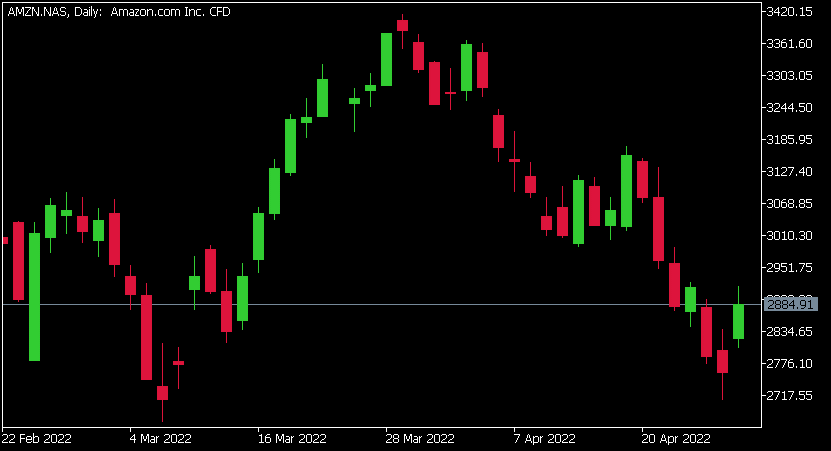

Amazon.com Inc. chart

Amazon ended the trading day on Thursday up by 4.65% at $2884.91, but the stock fell in the after-market trading by over 11% after disappointing Q1 results.

Here is how the stock has performed in the past year:

Amazon’s price targets

Amazon.com Inc. is the 5th largest company in the world with a market cap of $1.470 trillion.

You can trade Amazon.com Inc. (AMZN) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Amazon.com Inc., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Apple exceeds Wall Street expectations

Apple Inc. reported financial results for its fiscal 2022 second quarter after the closing bell on Wall Street on Thursday. World’s largest company beat both revenue and earnings per share estimates. Total revenue reported at $97.278 billion in the quarter (a 9% percent year-over-year) vs. $94.034 billion expected. Earnings per share at $1....

April 29, 2022Read More >Previous Article

McDonald’s delivers in Q1

McDonald's Corp. reported its Q1 financial results before the opening bell over in the US on Thursday. World’s biggest fast food company reported...

April 29, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading