- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Apple exceeds Wall Street expectations

- 1 Month -6.28%

- 3 Month +2.78%

- Year-to-date -7.84%

- 1 Year +22.60%

- Barclays: $170

- Credit Suisse: $168

- Deutsche Bank: $210

- Morgan Stanley: $210

- UBS: $185

- Wells Fargo: $205

News & AnalysisApple Inc. reported financial results for its fiscal 2022 second quarter after the closing bell on Wall Street on Thursday. World’s largest company beat both revenue and earnings per share estimates.

Total revenue reported at $97.278 billion in the quarter (a 9% percent year-over-year) vs. $94.034 billion expected.

Earnings per share at $1.52 per share vs. $1.42 per share expected.

”This quarter’s record results are a testament to Apple’s relentless focus on innovation and our ability to create the best products and services in the world,” Apple’s CEO, Tim Cook commented on the latest results.

”We are delighted to see the strong customer response to our new products, as well as the progress we’re making to become carbon neutral across our supply chain and our products by 2030. We are committed, as ever, to being a force for good in the world — both in what we create and what we leave behind,” Cook added.

The company also announced cash dividend of $0.23 per share.

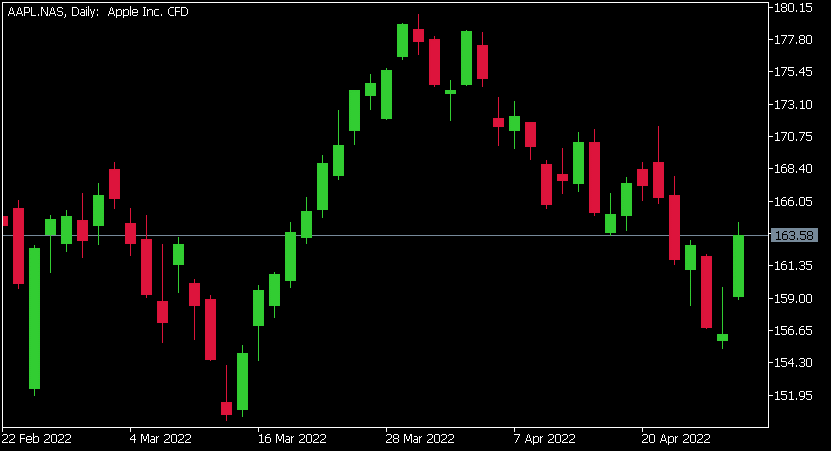

Apple Inc. chart

Shares of Apple were up by 4.52% at the end of the trading day on Thursday at $163.58 a share. The stock fell by around 3% in the after-hours trading following the latest financial results.

Here is how the stock has performed in the past year:

Apple’s price targets

Apple Inc. has a total market cap of $2.670 trillion.

You can trade Apple Inc. (AAPL) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Apple Inc., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Bristol-Myers Squibb exceeds Q1 expectations

US pharmaceutical company Bristol-Myers Squibb Co. reported first quarter financial results on Friday, beating analyst expectations. The company reported revenue of $11.648 billion (up 5% year-over-year) vs. $11.349 billion expected. Earnings per share reported at $1.96 per share (a 13% increase year-over-year) vs. $1.91 per share estimate. ...

May 2, 2022Read More >Previous Article

Amazon falls short in Q1

Amazon.com Inc. announced its first quarter results after the market close in the US on Thursday, falling short of Wall Street analyst expectations. ...

April 29, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading