- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Are we at risk of ‘Stagflation’?

- Slowing economic growth

- Increased unemployment

- Increased cost of goods

News & AnalysisThe world economy is grappling with inflation that is surging out of control. Inflation rates have surged to decade highs across multiple countries. Central banks across the globe have been doing their best to reduce growth by raising interest rates. “The World economy is in danger,” World Bank president David Malpass wrote in a report. High inflation and slow growth are occurring at the same time. This is a massive cause for concern as the threat of ‘Stagflation’ becomes apparent. Stagflation as its name suggests a set of circumstances in which the economy is both inflating but stagnating at the same time

The elements that cause stagflation.

Causes

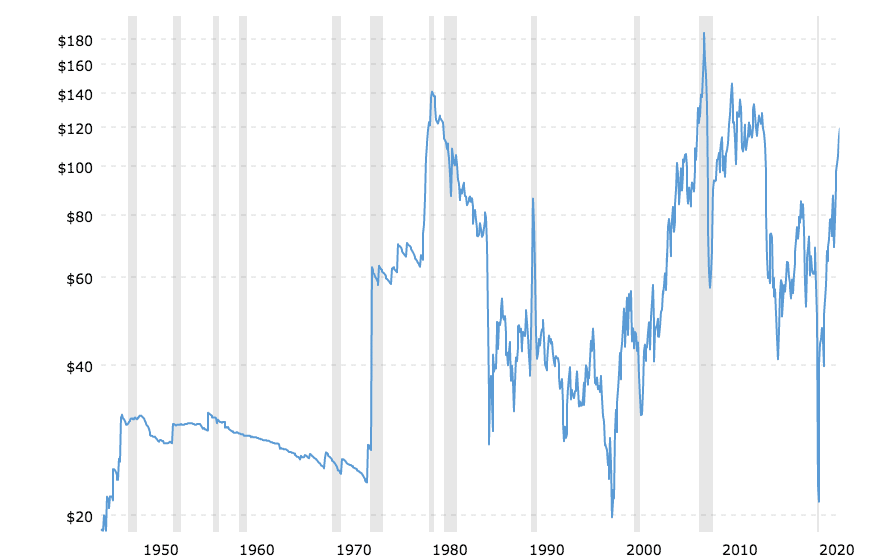

The most notable case of stagflation was in 1973, when stagflation ripped across the USA a massive spike in oil prices caused by the Arab oil embargo caused stagflation. Other commodities shot up in price. Currently commodities are also experiencing price shocks. The chart below highlights the oil price shock. It is arguable that this situation of inflation is being temporary and cyclical rather than structural like it was in the 70s. In addition, Central Banks are much more weary of this type of situation then in the 70s.

Post – Covid 19, the global economy saw massive growth as the markets rebounded and saw high prosperity. Share markets were at all-time highs and investment was ripe. However, the Russia and Ukraine war and rising inflation caused the perfect storm. Essentially, there was too much money due to policies during Covid 19. As the crisis evolved, the supply of commodities began to reduce and global supply chains became effected. Prices for gold, gas and oil among other commodities skyrocketed. This increase in commodity prices coupled with the increased price of other goods and services has led to a highly problematic situation.

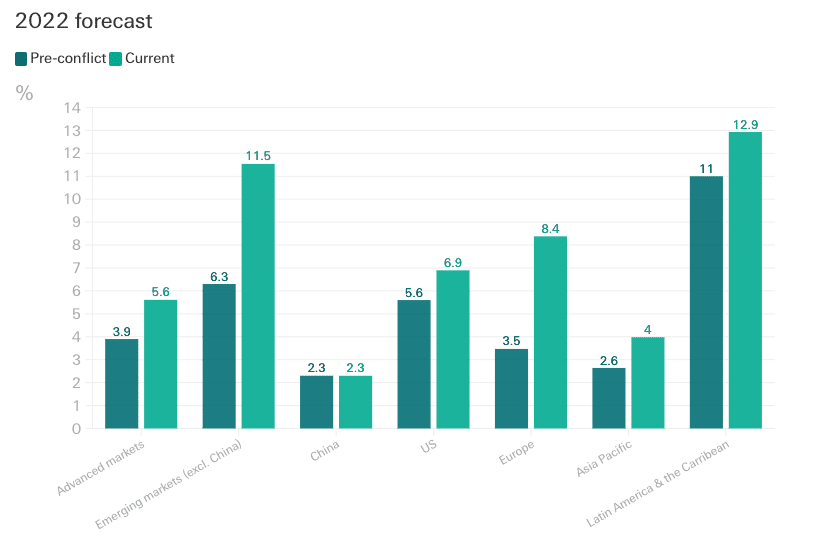

Global inflation rates before and after the Russian invasion of Ukraine.

Central banks have sought to increase interest rates slowing growth and increasing unemployment. Growth rates have been slowing with estimates of global growth cut to 2.9% a hit of 1.2% from the January Projection of 4.1%.

The consequences of stagflation has the potential to cause disastrous. Countries will need to find ways to increase the supply of goods to reduce supply pressures or reduce demand. Stagflation is a global issues. Inflations rates around the world are close to 8%.

What does stagflation mean for the Stock and Foreign Exchange market

The current situation will likely disproportionately effect emerging markets or growing economies. Therefore currencies in those markets may weaken. Investment in stronger economies and whilst also flowing towards safer currencies. The situation is not ideal for equities either, especially growth companies. As spending decreases and the cost of supplies increases, there is a real risk that unemployment will increase and businesses will fail

What’s Next?

The current economic situation is far from ideal, however what does this mean for the world going forward? Stagflation does not have a neat solution such as a recession in which governments can lower interests. Alternatively, as inflation has skyrocketing the central banks have had to reduce interest rates. The combination of both issues occurring at the same time requires more a more delicate solution. There is also no perfect solution. Governments need to improve productivity which allows for more supply without inflating prices to much. Economist, Robert A Mundell highlighted that the method to combat stagflation is “…based on fiscal ease to get more production out of the economy, in combination with monetary restraint to stop inflation.”

The resolution of the Russia and Ukraine crisis will go a long way to reducing supply pressure and bringing prices of commodities such as natural gas and oil down. However, it may take a while still for the economy to stablise.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

NIO Q1 results announced

NIO Inc. (NIO) reported its first quarter financial results before the market open in the US on Thursday. The Chinese electric vehicle maker reported revenue of $1.563 billion in the first quarter (up by 24.2% year-over-year), topping analyst estimate of $1.561 billion. Loss per share reported at -$0.12 per share, lower than the -$0.15 loss p...

June 10, 2022Read More >Previous Article

AUD/USD’s reaction to the yesterday’s RBA interest decision

The AUDUSD pair has reached an intraday peak of 0.72469 following the RBA decision. The buying action was spurred on by Aussie bullish investors a...

June 8, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading