- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Australian employment figures see a big beat as unemployment hits an historical low

- Home

- News & Analysis

- Economic Updates

- Australian employment figures see a big beat as unemployment hits an historical low

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAustralian employment figures see a big beat as unemployment hits an historical low

14 July 2022 By Lachlan MeakinAustralian employment figures saw 88,000 new jobs created in June, a huge beat of the expected 30k analysts had forecast. The unemployment rate also dropped to a level not seen since 1974 , coming in at 3.5% , well below the forecasted 3.8%.

With the number of unemployed now almost level with job vacancies the figures today showed how tight the labour market is, with the knock on effect of inevitable wage growth putting pressure on the RBA to speed up their tightening cycle to get inflation under control.

With the RBA stating in their last policy meetings statement that “…The size and timing of future interest rate increases will be guided by the incoming data and the Board’s assessment of the outlook for inflation and the labour market”. This latest labour data suggests 25bp hikes are now off the table now, with 50bp and possibly higher now the most likely in the near future.

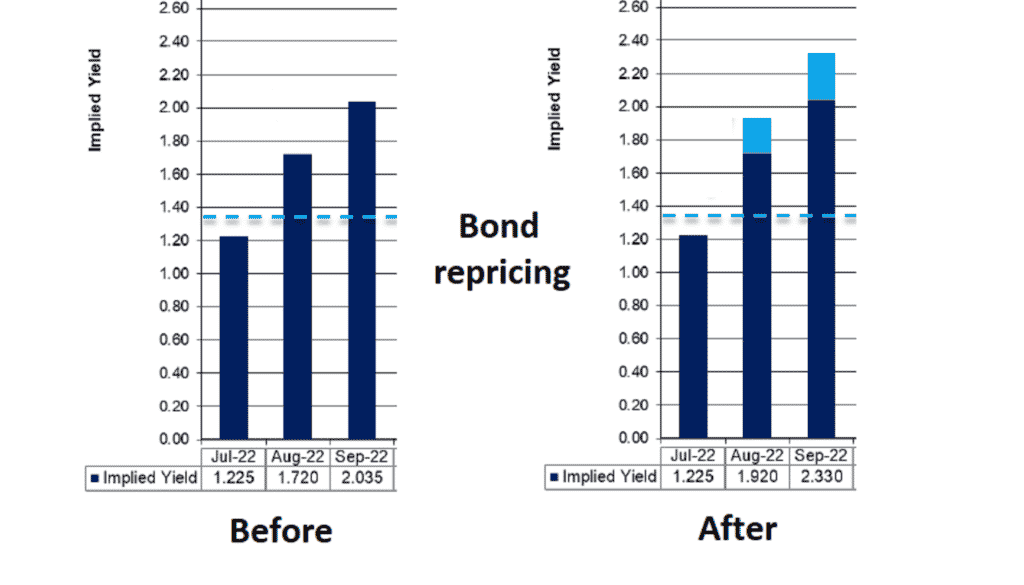

With this in mind, the bond futures market saw a sharp repricing , going into the figures the market was pricing in 79% chance of a 50 bp hike at the next RBA meeting, after a 50bp hike is 100% priced in with now a 20% chance of a 75 bp move on the cards.

Not surprisingly we saw a sharp rally in the AUD on the back of this, though the rally has faded as the afternoon has progressed, with the AUD again tracking equity markets indicating that risk sentiment is still the main driver of AUDUSD price action.

With Q2 inflation data coming out on July 27, the August RBA meeting is certainly going to be one to watch.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

JPMorgan falls short in Q2

JPMorgan Chase & Co. (JPM) reported its latest financial results for Q2 before the opening bell on Wall Street on Thursday. World’s largest bank reported revenue of $30.715 billion, falling short of analyst estimate of $31.806 billion. Earnings per share reported at $2.76 per share vs. $2.89 per share expected. CEO of JPMorgan, Jamie...

July 15, 2022Read More >Previous Article

Oil dips to the bottom of its range as recession fears hit the market.

Oil has seen its first real slip up in price since March. The commodity had been running on the back of high inflation and supply issues stemming from...

July 13, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading