- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- Bank bailouts see markets bounce, ECB surprises with big hike

- Home

- News & Analysis

- Articles

- Economic Updates

- Bank bailouts see markets bounce, ECB surprises with big hike

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThursdays US session was risk on led by global banking support after SNB gave a lifeline to Credit Suisse while 11 large US banks stepped up to help First Republic (FRC).

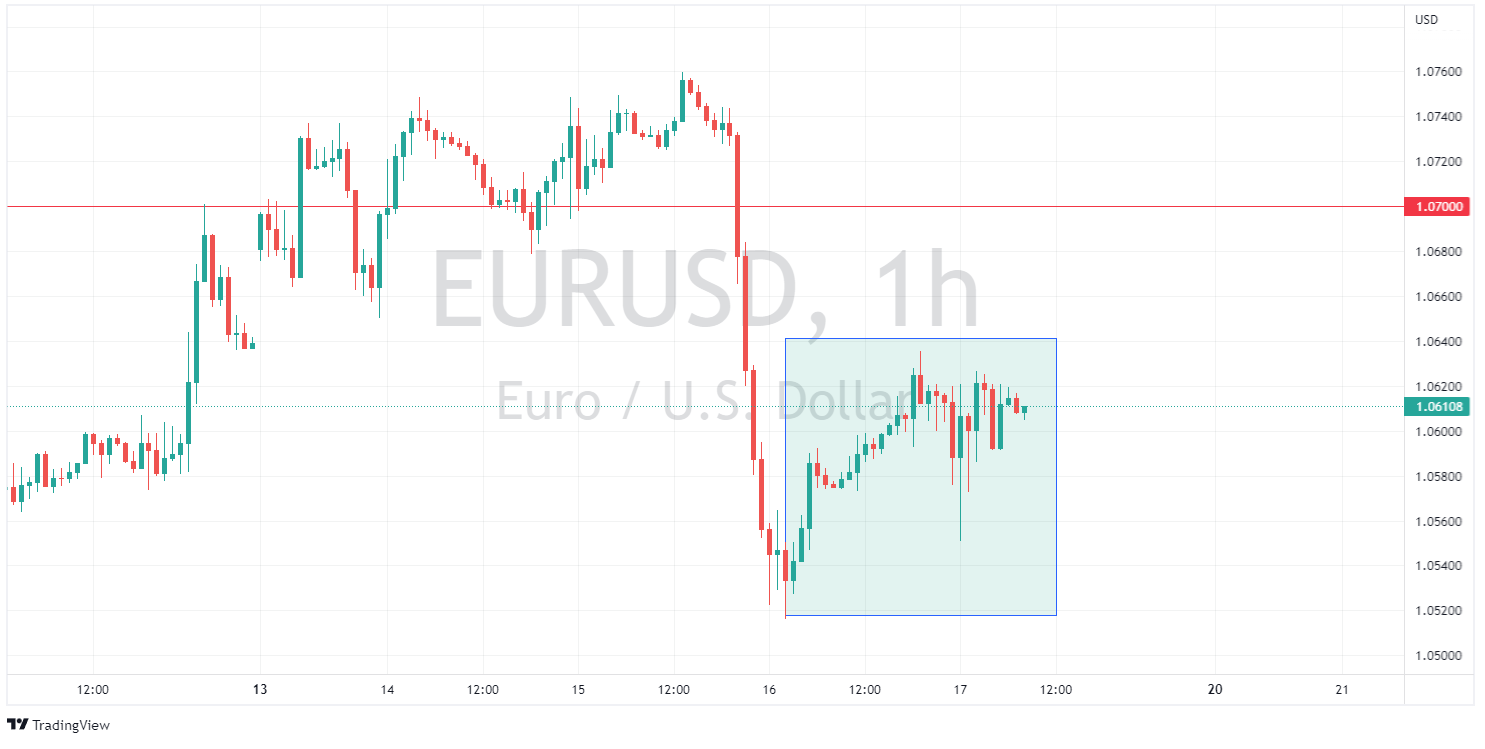

In spite of the backdrop of recent bank turmoil the ECB hiked 50bp surprising the market that had priced in a 25bp hike. Even though the size was larger than expected (though only 1 week ago 50bp was a done deal) this was seen as a “dovish” hike as the ECB gave no forward guidance on future hikes, instead stating they would by taking in meeting by meeting depending on data. This saw the Euro rally modestly, back above the 1.06 level against the USD.

Safe haven flows mostly unwound, with gold holding steady, while bonds, the JPY and USD declined on improved sentiment.

BTCUSD again tested the 25k a t token level where it has encountered major resistance, and again was unable to hold above despite strong rally in the tech sector.

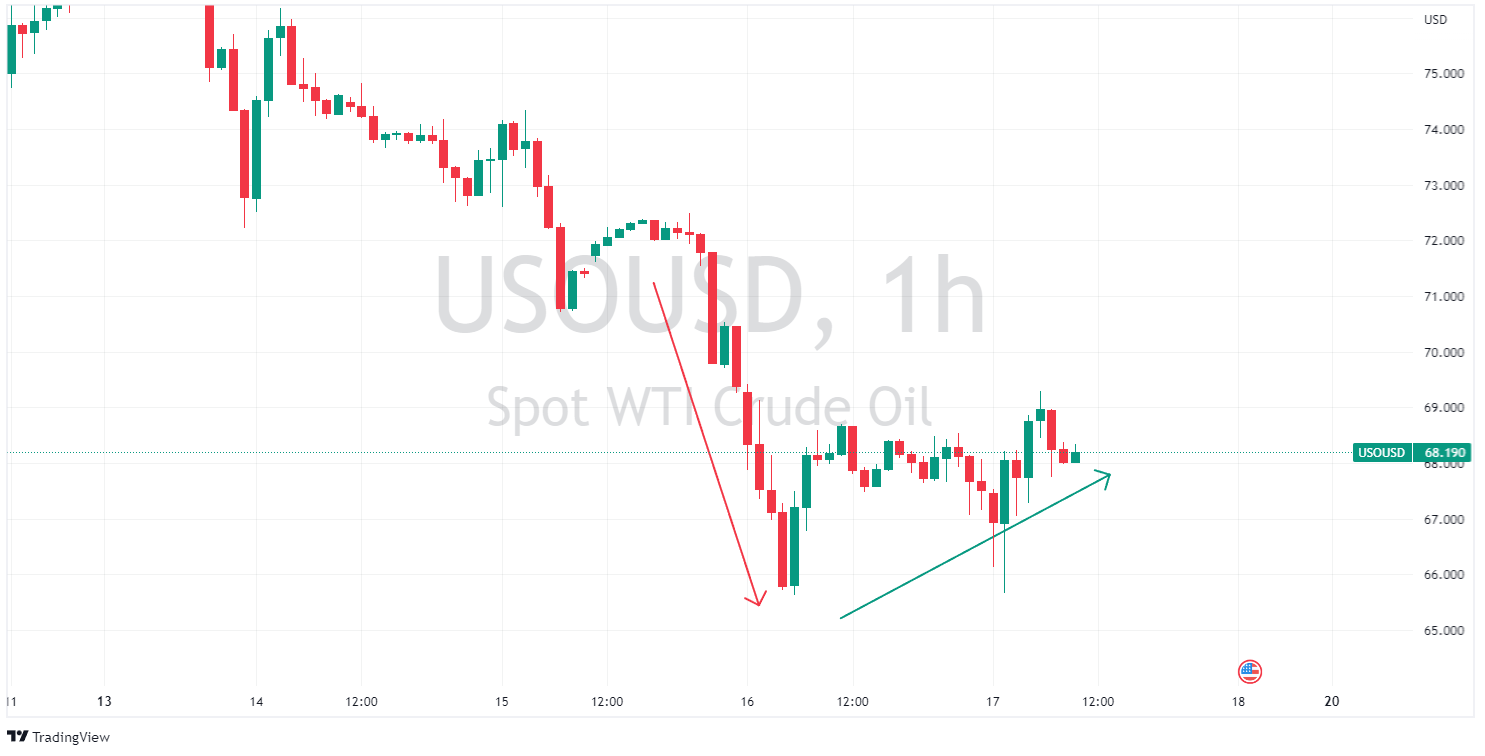

WTI Oil also turned around sharply during the session, dropping to a 65 handle early on only to rebound significantly from oversold levels to settle above $68 a barrel on improved risk sentiment.

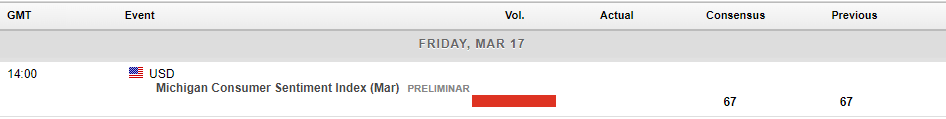

In economic news, a pretty quiet day ahead with really only US consumer sentiment worth watching.

Video Recap:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

The week ahead – SNB, Federal Reserve and BoE rate decisions

US and European markets dropped steeply on Friday as investors remained shaken by the fallout of bank collapses in the US and the issues at Credit Suisse ahead of a pivotal week in Central Bank policy meetings. Over weekend a SNB brokered deal a deal was announced that UBS will buy rival Credit Suisse for 3 billion Francs and agreed to assum...

March 20, 2023Read More >Previous Article

Will the ECB continue with a 50bps hike as planned?

In the lead-up to the European Central Bank (ECB) interest rate decision this week, the market has seen significant turmoil. Firstly from the Silicon ...

March 16, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading