- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Barrick Gold tops estimates and doubles its dividend

- Home

- News & Analysis

- Economic Updates

- Barrick Gold tops estimates and doubles its dividend

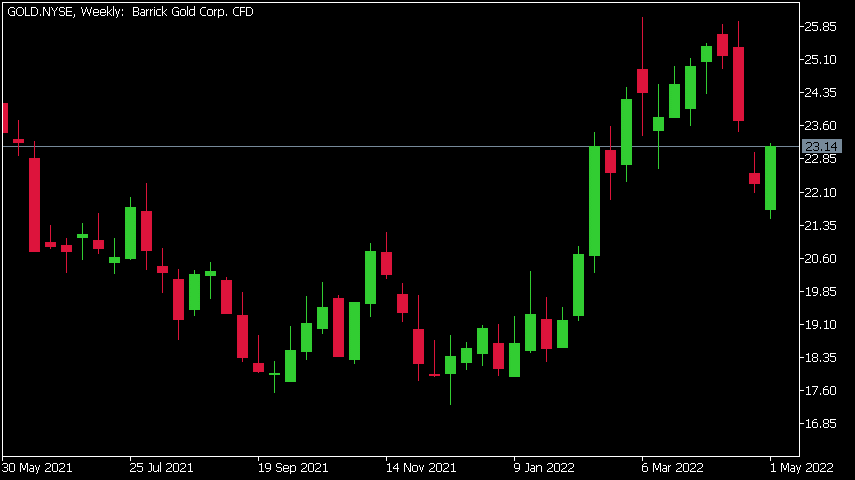

- 1 Month -5.93%

- 3 Month +45%

- Year-to-date +84%

- 1 Year +04%

- Barclays: $28

- Credit Suisse: $22

- Jeffries: $24

- Deutsche Bank: $35

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisBarrick Gold Corp. (GOLD) announced its Q1 2022 financial results before the opening bell over in the US today, surpassing analyst estimates for the quarter.

One of the world’s largest gold producers reported revenue of $2.926 billion in Q1 vs. $2.88 billion expected.

The company reported earnings per share of $0.27 per share vs. $0.24 per share estimate.

”Q1 was a softer quarter, particularly when compared to Q4 of 2021, which included a record-breaking performance from Nevada Gold Mines. With a stronger performance expected in the second half of the year, Barrick remains on track to meet its 2022 production guidance,” said Mark Bristow, President and CEO of Barrick Gold.

”Barrick controls what are unquestionably the mining industry’s best gold assets as well as some substantial copper mines. Reko Diq is one of the largest undeveloped copper-gold porphyry deposits in the world, and if the conditions to closing are satisfied, it will be a very significant addition to this portfolio, even before it goes into production, by boosting reserves and resources as the updated feasibility study unfolds,” Bristow added.

Barrick also announced an enhanced dividend of $0.20 per share after the strong results for the first three months of 2022.

”Our strong operating performance and robust net cash balance has allowed us to provide an enhanced dividend to our shareholders,” Graham Shuttleworth, vice-president and CFO said in a press release.

”We believe this shows the benefit of the Performance Dividend Policy that we announced in February, including the guidance it provides to our shareholders on future dividend streams,” he added.

Barrick Gold Corp. chart

Shares of Barrick Gold were up by over 3% on Wednesday at $23.14 pe share.

Here is how the stock has performed in the past year:

Barrick Gold price targets

Barrick Gold Corp. is the 426th largest company in the world with a market cap of $41.03 billion.

You can trade Barrick Gold Corp. (GOLD) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Barrick Gold Corp., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Uber Q1 results have arrived

Uber Technologies Inc. (UBER) reported its latest financial results on Wall Street on Wednesday. World’s largest ridesharing company reported revenue of $6.854 billion (up 135% from the same period last year) vs. $6.098 billion expected. The company reported a loss per share of -$3.04 for the first three months of 2022 vs. -$0.27 loss per s...

May 5, 2022Read More >Previous Article

Airbnb sets a new record and tops estimates for Q1

Airbnb Inc. announced its first quarter earnings results after the closing bell on Wall Street on Tuesday, exceeding analyst estimates for the first t...

May 4, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading