- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

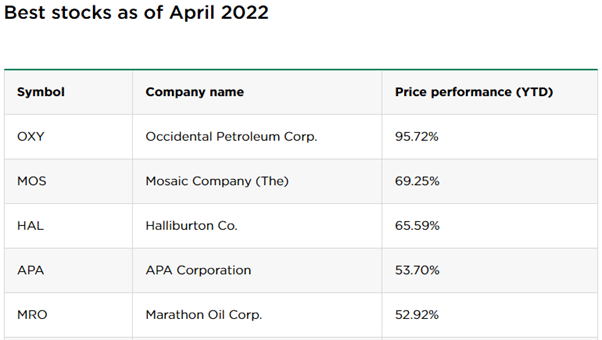

- Best-Performing Stocks: April 2022

News & AnalysisIt’s been a volatile stretch for the stock market. From pandemic-induced sell-offs, record highs in 2021 and a bumpy start to 2022, the market has certainly tested investors’ mettle. But when looking for the best stocks, investors should consider long-term performance, not short-term volatility. To help with that, we’ve compiled the best 5 stocks in the S&P 500, measured by year-to-date performance.

Occidental Petroleum Corp. OXY

Occidental Petroleum Corporation is an American company engaged in hydrocarbon exploration in the United States, the Middle East, and Colombia as well as petrochemical manufacturing in the United States, Canada, and Chile. It is organized in Delaware and headquartered in Houston.

Oil stocks — Energy stocks rose on Tuesday as oil prices, which have seesawed in recent weeks, jumped back above $100 a barrel. Occidental Petroleum jumped about 4.2%, 3.7% and 2.1%, respectively.

Mosaic Company. MOS

The Mosaic Company is a Fortune 500 company based in Tampa, Florida which mines phosphate, potash, and collects urea for fertilizer, through various international distribution networks, and Mosaic Fertilizantes. It is the largest U.S. producer of potash and phosphate fertilizer.

For MOS, shares are up 12.11% over the past week while the Zacks Fertilizers industry is up 2.17% over the same time period. Shares are looking quite well from a longer time frame too, as the monthly price change of 29.18% compares favourably with the industry’s 15.77% performance as well.

Considering longer term price metrics, like performance over the last three months or year, can be advantageous as well. Over the past quarter, shares of Mosaic have risen 73.08%, and are up 134.05% in the last year. On the other hand, the S&P 500 has only moved -6.67% and 7.94%, respectively.

Halliburton Co. HAL

Halliburton Company is an American multinational corporation responsible for most of the world’s hydraulic fracturing operations. In 2009, it was the world’s second largest oil field service company. It has operations in more than 70 countries.

In the last-reported quarter, this Houston, TX-based provider of technical products and services to drillers of oil and gas wells beat the consensus mark on stronger-than-expected profit from its Drilling and Evaluation division. Halliburton had reported net income per share of 36 cents, ahead of the Zacks Consensus Estimate by 2 cents. Revenues of $4.3 billion generated by the firm also came in above the Zacks Consensus Estimate of $4.1 billion.

APA Corporation. APA

APA Corporation is the holding company for Apache Corporation, an American company engaged in hydrocarbon exploration. It is organized in Delaware and headquartered in Houston. The company is ranked 595th on the Fortune 500.

The Energy sector it’s been one of the best performing sectors, higher by 1.4%. Among large Energy stocks, APA Corp (Symbol: APA) are the most notable, showing a gain of 4.0%. APA Corp, meanwhile, is up 63.69% year-to-date.

Marathon Oil Corp. MRO

Marathon Oil Corporation is an American company engaged in hydrocarbon exploration incorporated in Ohio and headquartered in the Marathon Oil Tower in Houston, Texas. The company is ranked 534th on the Fortune 500 and 1900th on the Forbes Global 2000.

Marathon Oil will be looking to display strength as it nears its next earnings release, which is expected to be May 4, 2022. On that day, Marathon Oil is projected to report earnings of $0.90 per share, which would represent year-over-year growth of 328.57%.

GO Markets allows you access to the Nasdaq and New York Stock Exchange by offering the ability to trade these stocks using a CFD Derivative. If you would like to know more about the products and account types available to you, kindly visit us on https://www.int.gomarkets.com/metatrader-5/

Sources: cnbc.com, Wikipedia, nerdwallet.com, finance.yahoo.com, Zacks Equity Search,

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Coal prices soar as Australian Coal miners reach 52-week highs

Coal prices have spiked in recent times due to the energy crunch that has developed in Europe relating to pressures from Russia and Ukraine. Australian Coal companies have been the big beneficiaries of the rise in prices. White Haven Coal (WHC) and New Hope Corporation (NHC) have seen bullish price moves and are currently trading near their 52-week...

April 19, 2022Read More >Previous Article

Where to next for Magellan Financial?

Magellan Financial Group (MFG) has seen a tumultuous 12 months in which the share price has seen a large fall from grace. The large Australian managed...

April 14, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading