- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Better than expected – BlackRock tops Wall Street estimates for Q1

- Home

- News & Analysis

- Economic Updates

- Better than expected – BlackRock tops Wall Street estimates for Q1

- 1 Month -2.24%

- 3 Month -19.25%

- Year-to-date -21.93%

- 1 Year -10.78%

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisBetter than expected – BlackRock tops Wall Street estimates for Q1

14 April 2022 By Klavs ValtersBlackRock Inc. reported its first quarter financial results before the opening bell in the US on Wednesday.

World’s largest asset manager reported revenue of $4.699 billion, beating analyst forecast of $4.672 billion.

Earnings per share also topped analyst forecast at $9.52 per share vs. $8.70 per share expected.

”BlackRock generated $114 billion of long-term net inflows in the first quarter, with positive flows across all product types, investment styles and regions, demonstrating the breadth of our asset management platform. Our ETFs delivered $56 billion of net inflows, as clients increasingly use them to efficiently allocate capital, access liquidity and manage risk,” Chairman and CEO, Laurence D. Fink said after the latest results.

”BlackRock is increasingly the partner of choice globally as clients look to build deeper and more comprehensive relationships. We announced another significant client mandate during the quarter that exemplifies our One BlackRock approach – bringing together investment expertise, operational excellence and world-class technology. I am incredibly excited by the opportunities ahead of us and believe BlackRock is well-positioned to continue generating durable, differentiated organic growth and delivering value for all of our stakeholders,” he added.

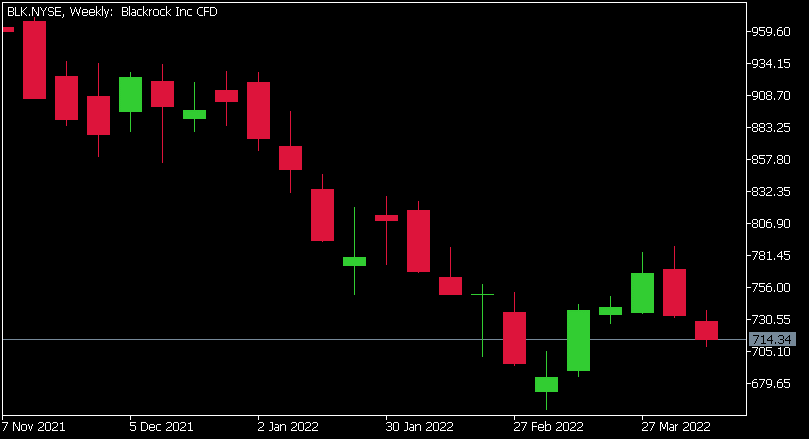

BlackRock Inc. chart

BlackRock shares trading lower despite beating Wall Street expectation for Q1, down 0.3% at $714.34 per share.

Here is how the stock has performed in the past year:

BlackRock Inc. is the 127th largest company in the world with a market cap of $108.68 billion.

You can trade BlackRock Inc. (BLK) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: BlackRock Inc., TradingView, CompaniesMarketCap, MetaTrader 5

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

JPMorgan Q1 results announced

JPMorgan Chase & Co. reported its latest financial results for Q1 before the opening bell on Wall Street on Wednesday. World’s largest bank reported revenue of $30.717 billion in the quarter, narrowly beating analyst estimate of $30.59 billion. Earnings per share fell short of Wall Street expectations at $2.63 per share vs. $2.72 per sh...

April 14, 2022Read More >Previous Article

Lynas Rare Earths releases impressive Quarterly growth figures

Lynas Rare Earths (LYC) has continued its recent momentum by releasing impressive quarterly figures. LYC is a premier Rare Earth mining and production...

April 12, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading