- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Bitcoin (BTC) Cycles.

- Bitcoin halving is when the reward for mining bitcoins is cut in half.

- At the current rate that bitcoins are being produced, halvings happen about every four years.

- Bitcoin halving is part of a system designed to cap the total number of bitcoins at 21 million.

News & AnalysisThe Crypto market cap at the time of writing is sitting at $1.46 Trillion, down by just under 5% over the last day, according to CoinMarketCap data. Bitcoin (BTC) has been trading between $34,562 on Monday to a low of $26,258 USD today. That is a drop of 24.68% and it could potentially fall further, in what many are advising it is resembling a continuation of Bitcoin’s Cycles, where the asset could lose up to 85% of its value according to Richard Heart (Founder of HEX, PulseChain, PulseX and early Bitcoin adopter).

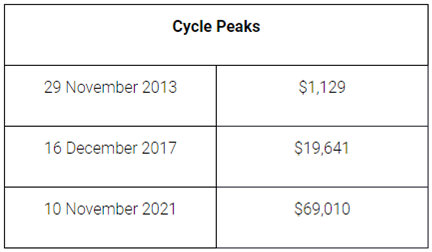

The cycles peaks as you can see below, are huge in terms of price action. One thing that usually comes after an all-time high run as it has recently, is the depreciation of the asset otherwise known as a correction. A correction is a decline of 10% or greater in the price of a security, asset, or a financial market. Corrections can last anywhere from days to months, or even longer. While damaging in the short term, a correction can be positive, adjusting overvalued asset prices and providing buying opportunities.

One of the most powerful of narratives to Bitcoin’s cycles is that of the halvings. Roughly every four years Bitcoin’s issuance rate is programmatically halved. A Bitcoin halving limits the supply of new coins. Mining is the process of verifying transactions and adding new blocks to the Bitcoin network. Experts are predicting that the remaining Bitcoins will be mined by 2140.

The halvings happen without any regard to ongoing demand, meaning that if the ongoing demand remains the same after a halving event, whatever demand was being met by new supply will be restricted, necessitating an upwards adjustment of price.

The halving-driven cyclicality thesis claims that these price increases cause Bitcoin to garner further attention, capturing additional investment as the population becomes increasingly informed about bitcoin, its properties and potential. So, from the halving price increases, new demand is brought forward and the foundations of a new bull market is laid down.

In short, Bitcoin’s a young asset, it has built momentum over the years and within each cycle, it tends to recruit more investors as these investors are buoyed by the upward projection and adoption from institutions. While it remains anyone’s best guess whether bitcoin will keep following the exact same patterns and trends established by previous price cycles, unlocking new levels of demand as it goes, investors can at least feel reasonably assured that human psychology will remain unchanged, and that Bitcoin will continue cutting its issuance rate in half every four years until it reaches its 21 million supply limit.

As a GO Market trader, you will have access to BTCUSD pair, along with other major cryptocurrencies on our MetaTrader systems. To register for an account please visit us here https://www.int.gomarkets.com/. If you would like to discuss differences in MT4 and MT5 systems along with the different account types we offer please email me [email protected] or call our Melbourne office on 03 8566 7680.

Sources: Flowbank.com, CoinMarketCap, www.businessinsider.com, CoinMetrics by Clark Moody.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Consequences of a Strong USD

The USD has been on a tear recently as inflation has engulfed the world economy. The USD, which has traditionally been a strong currency and haven for investors during times of volatility, has performed exceptionally well. The currency is attractive as it provides security for investors as the market trusts the US government to pay its debts and ab...

May 17, 2022Read More >Previous Article

Terra Luna and its collapse

If you follow my articles, you will see that from time to time, I delved into areas that are not directly link to trading CFDs, this is because I have...

May 16, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading