- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- BlackRock, BLK.NYSE.

- BlackRock is one of the world’s largest investment management companies by AUM.

- The company operates as a single business segment.

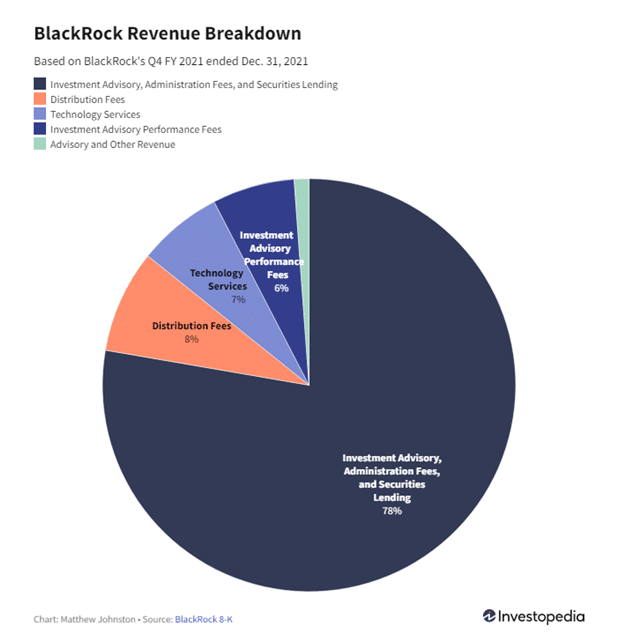

- The firm derives most of its revenue from investment advisory and administration fees.

- BlackRock said that it has halted purchases of Russian securities amid Russia’s invasion of Ukraine.

News & AnalysisBlackrock has been slowly, consistently and quietly gathering assets across the globe. They are a multinational company whose main aim is to invest in industries and make as much money as possible. BlackRock, Inc. is an American multinational investment management corporation based in New York City. Founded in 1988, initially as a risk management and fixed income institutional asset manager, BlackRock is the world’s largest asset manager, with US$10 trillion in assets under management as of January 2022.

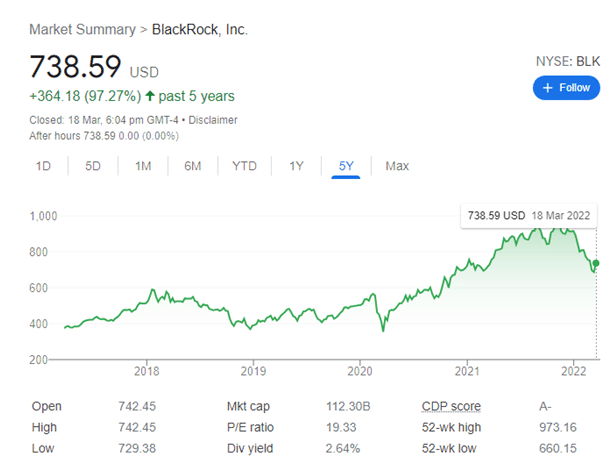

BlackRock’s share price has been rising for several years see chart below, as it has consolidated itself as one of the big three institutional investment agencies (Vanguard and State Farm) and has benefited from the rise of index-based investing and the strong financial market performance over the last several years. Indeed, BlackRock just reported its latest quarterly results highlighted by assets under management crossing a milestone of $10 trillion, driving overall solid operating and financial momentum. Overall, there’s a lot to like about BLK as a high-quality leader with a positive long-term outlook. That said, some headwinds into 2022 between rising market volatility and a changing interest rate environment warrant some caution. A plan to expand headcount while wages are rising is already pressuring margins and may limit the near-term upside in the stock.

Key Takeaways

Is BlackRock an investment to consider?

Despite near-term market headwinds, BlackRock maintains a positive long-term outlook as a leading investment manager well-positioned to grow and consolidate its market share advises BOOX Research.Motley Fool adds: A stellar long-term investment

BlackRock continues to lead the pack when it comes to portfolio solutions. The firm has done a splendid job of building out its iShares ETF offerings. It has also established itself as a leader in sustainable investment solutions to both institutional and retail clients, leveraging its technology platform in the process to drive continued growth. The stock has outperformed the S&P 500 for a decade now, returning investors a total of roughly 500% versus the index’s 300%, and there’s no reason it can’t continue to do so for the next decade. The company’s strong growth history allows it to pay out an attractive dividend yield of 1.9% at Friday’s prices, making it a solid option for income investors. Finally, BlackRock’s ability to innovate and get ahead of clients’ needs makes it a stellar long-term investment for any portfolio.

Sources: Wikipedia, SeekingAlpha, Investopedia, Motley Fool.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Powell indicates higher interest rates to come as Oil jumps again

US indices were down today as Jerome Powell indicated that the Federal Reserve is going to increase interest rates at a higher and faster rate than currently in place. US equities dropped after Powell’s speech. Ultimately the major indices ended relatively flat by the close of trading. The Nasdaq closed down 0.40% after taking a breather from its...

March 22, 2022Read More >Previous Article

Is the US Dollar at risk?

The US Dollar is as synonymous to us in life as the morning and night is. It has dominated as a reserve currency for decades. It’s paved the way...

March 21, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading