- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Bristol-Myers Squibb exceeds Q1 expectations

- 1 Month +1.96%

- 3 Month +96%

- Year-to-date +72%

- 1 Year +59%

- Morgan Stanley: $64

- Wells Fargo: $65

- Goldman Sachs: $72

- Barclays: $66

News & AnalysisUS pharmaceutical company Bristol-Myers Squibb Co. reported first quarter financial results on Friday, beating analyst expectations.

The company reported revenue of $11.648 billion (up 5% year-over-year) vs. $11.349 billion expected.

Earnings per share reported at $1.96 per share (a 13% increase year-over-year) vs. $1.91 per share estimate.

”We continue to execute against our strategic priorities, deliver solid revenue and earnings growth and advance our product pipeline,” company CEO, Giovanni Caforio said on the results.

”Thanks to our team’s hard work and dedication, we achieved regulatory approvals of Opdualag and Camzyos, our new first-in-class medicines for patients living with metastatic melanoma and symptomatic obstructive hypertrophic cardiomyopathy, respectively. These milestone achievements, combined with our promising product pipeline and strong financial flexibility, provide a solid foundation that will enable us to deliver sustained growth and long-term benefits for our patients,” Caforio concluded.

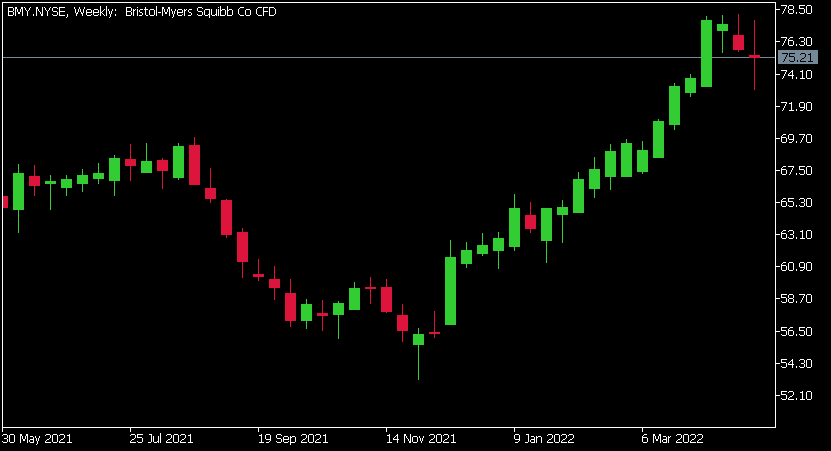

Bristol-Myers Squibb Co. chart

The stock was down by 2.5% on Friday at $75.21 per share.

Here is how the stock has performed in the past year:

Bristol-Myers Squibb price targets

Bristol-Myers Squibb Co. is the 65th largest company in the world with a market cap of $160 billion.

You can trade Bristol-Myers Squibb Co. (BMY) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Bristol-Myers Squibb Co., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Chevron Q1 results are in

Chevron Corporation reported its latest financial results before the market open in the US on Friday. The company reported revenue of $54.373 billion in Q1, coming in above $51.14 billion expected by the analysts on Wall Street. Earnings per share reported at $3.36 per share vs. $3.41 per share expected. Mike Wirth, Chevron’s chairman an...

May 2, 2022Read More >Previous Article

Apple exceeds Wall Street expectations

Apple Inc. reported financial results for its fiscal 2022 second quarter after the closing bell on Wall Street on Thursday. World’s largest company ...

April 29, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading