- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Chevron Q1 results are in

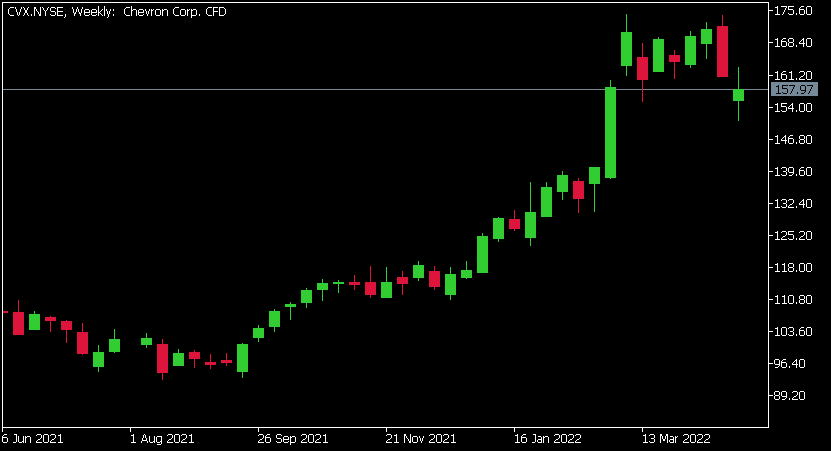

- 1 Month -3.96%

- 3 Month +75%

- Year-to-date +39%

- 1 Year +01%

- Morgan Stanley: $188

- Wells Fargo: $184

- Citigroup: $145

- Barclays: $148

- JP Morgan: $169

- UBS: $192

News & AnalysisChevron Corporation reported its latest financial results before the market open in the US on Friday.

The company reported revenue of $54.373 billion in Q1, coming in above $51.14 billion expected by the analysts on Wall Street.

Earnings per share reported at $3.36 per share vs. $3.41 per share expected.

Mike Wirth, Chevron’s chairman and CEO on the latest results: ”First quarter financial performance saw return on capital employed increase to 14.7 percent and our balance sheet strengthen further.”

”Chevron is doing its part to grow domestic supply with U.S. oil and gas production up 10 percent over first quarter last year.”

”Consistent with our plans, we’re investing to grow both traditional and new energy business lines.”

”While we continue to respond to the energy-related challenges of today, we are deeply saddened by the tragic events in Ukraine and hope for a peaceful resolution soon,” Wirth added.

Chevron Corporation chart

Here is how the stock has performed in the past year:

Chevron price targets

Chevron Corporation is the 26th largest company in the world with a market cap of $309.56 billion.

You can trade Chevron Corporation (XOM) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Chevron Corporation, TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

AbbVie posts mixed results for Q1

AbbVie Inc. reported its financial results for the first quarter before the market open on Friday in the US. The biotechnology and pharmaceutical company reported revenue just shy of expectations at $13.538 billion (a 4.1% increase year-over-year) in Q1 vs. $13.662 billion expected. Earnings per share reported at $3.16 per share (a 9.3% incre...

May 2, 2022Read More >Previous Article

Bristol-Myers Squibb exceeds Q1 expectations

US pharmaceutical company Bristol-Myers Squibb Co. reported first quarter financial results on Friday, beating analyst expectations. The company re...

May 2, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading