- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Chile’s Boom And Bust

- Capital – Santiago

- Language – Spanish

- Population – 18 Million

- GDP Ranking – 38th

- Government – Democratic (Presidential)

- Main Industries – Copper, Food, Timber

News & AnalysisThese days when you pick up a local newspaper, you’ll generally only find that most information is somewhat limited to what is happening either in your own country or perhaps even the US. The main reason for this is primarily due to the nature of the industry; the media will typically only print which is most likely to sell. That is just good business. However, the downside to this is that there are frequently some fascinating economic stories from around the world which most people may not be aware of for this reason. A prime example of this would be the success and demise story of Chile and in South America.

Chile Summary

The primary income source of Chile is from the mining industry, 80% of government revenue comes from exports of Copper.

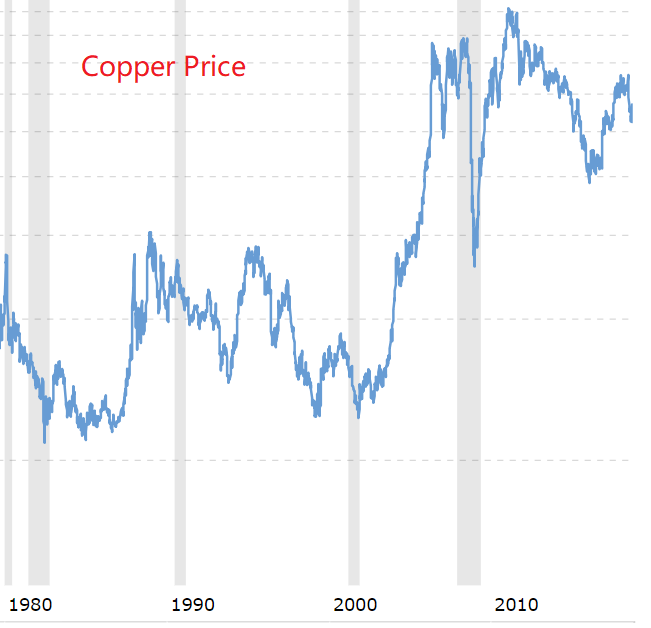

Thus, Chile has experienced two decades of strong economic growth, especially in early 2000’s while the international copper price was at all time high level, which pushed Chile’s economy to the position of “tiger of Latin America.”Since Financial Crisis 2008, the glory days of Chile has gone. Price of copper fell, the new tax law that initially aimed to reduce income disparity has fleed some investment out of the country.

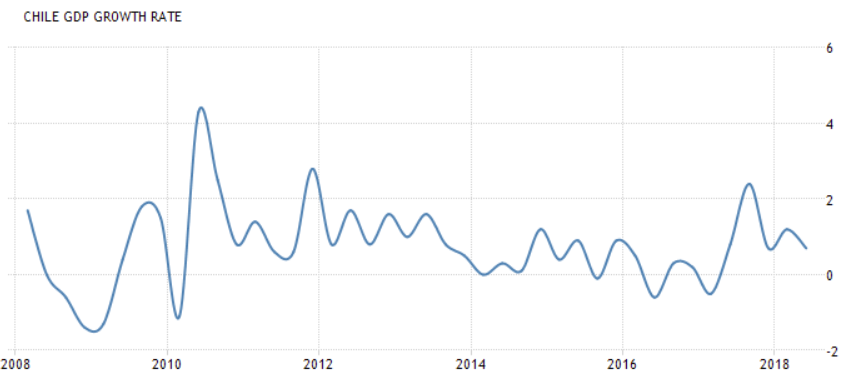

GDP growth was stagnant, and sometimes it was even below zero (see chart below).In the past year, the three major credit rating agencies have downgraded Chile’s sovereign debt since the Debt-to-GDP rate was raising sharping from 4.9% in 2008 to 23.6% in 2017.

People elected Mr. Sebastian Pinera, a billionaire businessman to guide them away from the current economic trap.

Mr. Pinera and his team introduced a Three-step plan to boost investment, productivity, and finally, GDP growth, also they are aiming to reduce the dependency on copper. The first step is planning to spend $15bn to build roads, airports, and railways, etc. You cannot boost productivity with out-dated infrastructure.

Will he successfully bring Chile out of the middle-income trap? We will continually keep an eye on it.

By Lanson Chen – Analyst

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

A Rise in U.S Bond Yields

Is rising bond yields bad news for the equity markets? Bond yields are an important indicator to gauge the direction of equities. They have an inverse relationship which explains why the stocks markets were in a sea of red when the US 10 -Yr Treasury yields soared to multi-year highs on Wednesday. The catalysts behind the surge in yields are mai...

October 5, 2018Read More >Previous Article

USMCA – NAFTA 2.0

The fourth quarter kicked off with some good news on trade with a last-minute agreement between US-Mexico- Canada just before the deadline. "Ameri...

October 3, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading