- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- China’s dominance of Rare Earths and the West’s opportunity

- Home

- News & Analysis

- Economic Updates

- China’s dominance of Rare Earths and the West’s opportunity

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWhat are Rare Earths?

Neodymium and praseodymium (NdPr) are two resources that you have probably never heard of, but you use every day. They are not like Gold, Iron ore or even Lithium. They are the two most important light Rare Earths, and they have outstanding magnetic and conductive properties. The name ‘Rare Earths’ is a bit of a misnomer as Rare Earths are not actually that rare. In fact, they are quite abundant. However, a complex separation procedure is needed to extract the valuable material and being able to do so in a commercially viable way has made rare earths projects quite rare.

Rare Earths play an important role in most technologies as they are vital components for more than 200 products including, smartphones, earphones, computer hard drives and most importantly Electric Vehicles. They are also equally important for military defence systems and hardware. As the world moves towards net zero, rare earths will play an essential role in supporting the transition.

Geopolitical Pressures

As discussed above the need for these strategic metals is paramount. These issues are further compounded because China produces the majority of the world’s rare earths, including 80% of the global supply in 2020. The Chinese government has taken actions to restrict the ability for local Chinese Rare Earth companies to act independently and with discretion. This includes approving the merger of China’s largest, Rare Earth companies in order to consolidate the industry. China had been enacting a policy increasing its control over what it deems ‘strategic industries’. The fear for the west is that the Chinese government will either restrict the exports of rare earths or gouge the price. This becomes even more significant when regarding the importance that these resources play in the development of military hardware.

In response, both the USA and Australia have pledged financial support to rare earths companies to reduce their reliance on China. If the Russian – Ukraine crisis has taught the market anything, it is the importance of secure supply chains. This is even more important for strategic resources.

Future demand

The future demand for rare earths is predicted to increase to astronomical levels over the next decade. Global consumption of the materials reached 167,000 tonnes in 2020. The demand is expected to grow to 280,000 tonnes by 2030. This is specifically true accounting for how important rare earths are for military hardware and equipment. The price of critical Nd, the most sought after Rare Earth, has risen by 250% since the start of 2020 indicating the massive surge in demand.

The VanEck Rare Earth/Strategic Metals ETF (REMX) is a collection of the world’s major Rare Earth companies. The chart shows that the prices of rare earth companies’ have surged since mid-2020 as interest in Electric Vehicles picked up. The price broke through the neckline in mid-2021. It has then seen a period of consolidation between 100-130 USD and rested the support at around 100 USD.

The story of Lynas Rare Earths

Within the REMX ETF sits Lynas Rare Earths (LYC) which is the ETF’s largest holding outside of China. LYC is also in the ASX200 and stands stands head and shoulders as the largest Rare Earths mining stock and company outside of China. Whilst almost all others Rare Earth companies are in the exploration/early production phase, Lynas has been operating for almost 15 years. In 2021, LYC agreed to extend their operation and build a commercial light Rare Earths separation plant in the U.S.A. in Texas, with the US government to provide $30,000,000 worth of funding to complement its existing processing plant in Malaysia. In their recent half yearly report, CEO Ms Lacaze specifically outline that their record revenue could be attributed to the NdPr market price which exceeded US$100/kg for the first time since 2011.

Technical Analysis

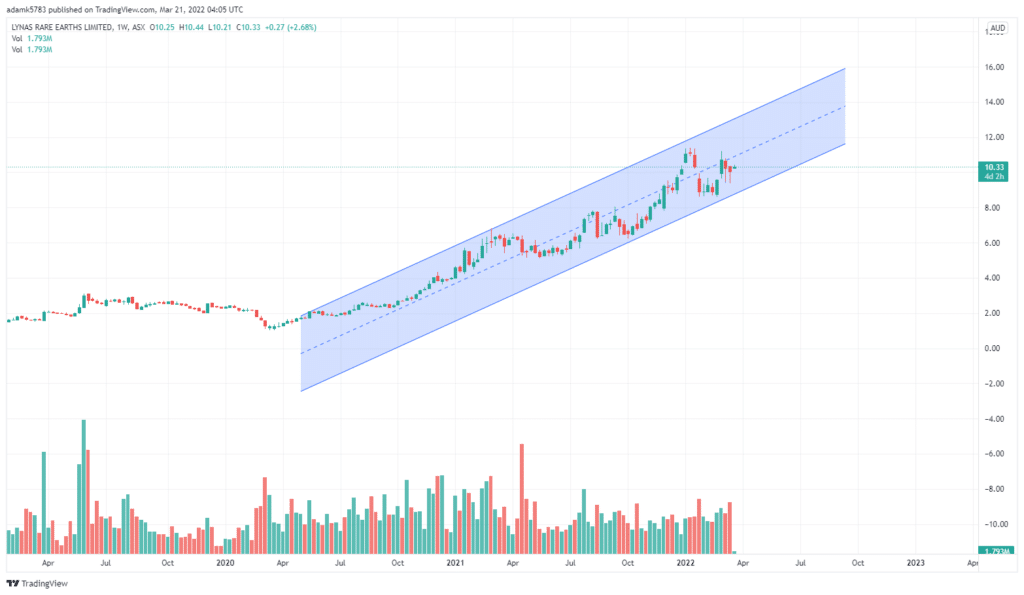

On the weekly chart the price of LYC has seen a meteoric rise since early 2020, rising over almost 700%. LYC has seen this rise in a nice channel of price action, very much correlating with the price of NdPr.

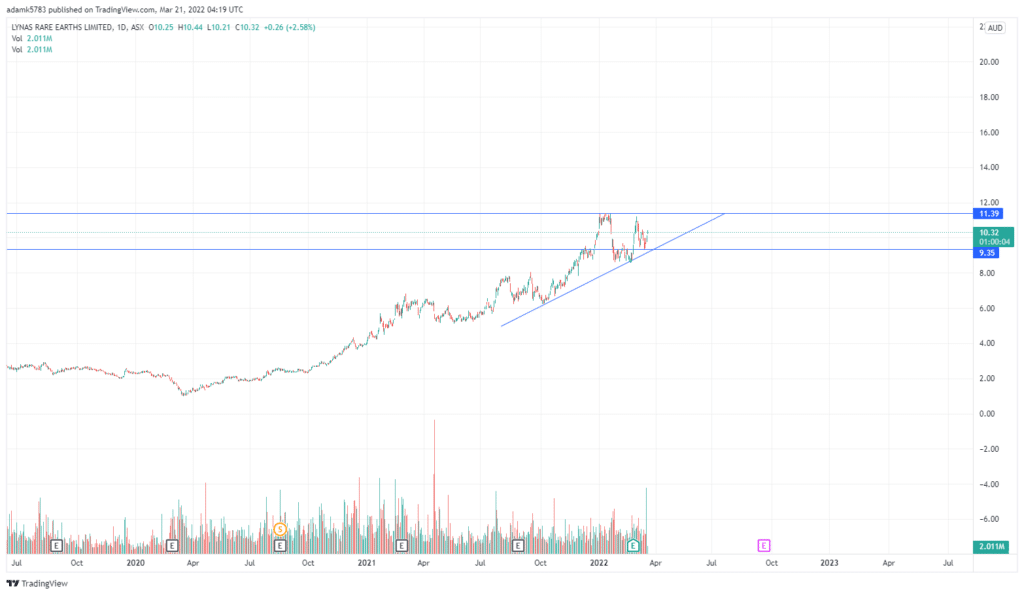

On the shorter daily time frame the price of LYC looks to be contracting as it approaches its resistance level at $11.39. The recent surge in volume indicates that there is potentially new interest coming into the company and that it may be getting ready for another move up. If the price can break out past this resistance point, there is a lot of clear room for the price to grow.

As the demand for renewable energy, electric vehicles and Rare Earths will continue to dominate our lives ins some way and opportunity abounds for companies such as LYC who can produce them at a commercially viable level.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Pfizer’s Performance and the 4th Booster Plan

Pfizer Inc. is an American multinational pharmaceutical and biotechnology corporation headquartered on 42nd Street in Manhattan, New York City. The company was established in 1849 in New York by two German immigrants, Charles Pfizer and his cousin Charles F. Erhart. They have been uniquely positioned to be a leading company in the fight against ...

March 23, 2022Read More >Previous Article

Just Do It – Nike latest results announced

Nike Inc. (NKE) reported fiscal 2022 financial results for its third quarter ended February 28, 2022. The US sporting goods giant reported revenue ...

March 22, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading