- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Citigroup beats estimates for Q2 – the stock price jumps

- Home

- News & Analysis

- Economic Updates

- Citigroup beats estimates for Q2 – the stock price jumps

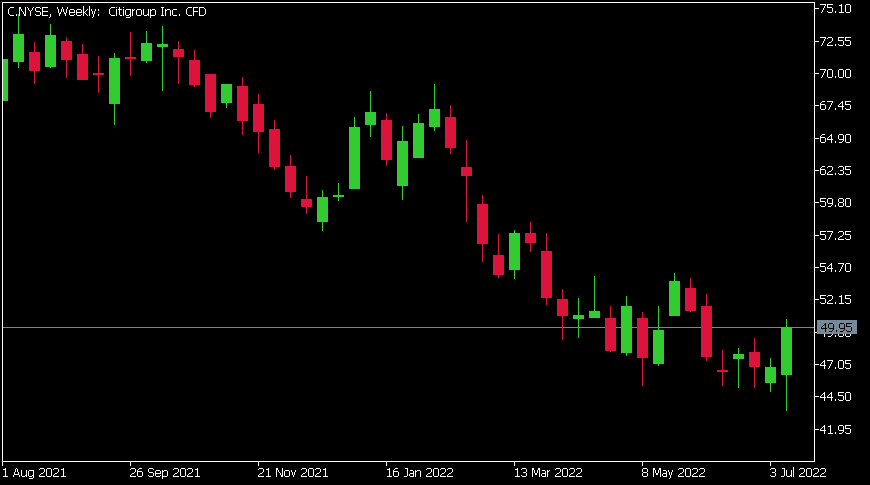

- 1 Month +7.44%

- 3 Month -1.87%

- Year-to-date -17.24%

- 1 Year -25.29%

- Morgan Stanley $46

- Well Fargo $60

- Piper Sandler $62

- RBC Capital $60

- Morgan Stanley $57

- Credit Suisse $58

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisCitigroup Inc. (C) reported its latest financial results before the market open in the US on Friday, surpassing analyst expectations.

The US investment banking company reported revenue of $19.638 billion for the second quarter vs. $18.352 billion estimate.

Earnings per share reported at $2.19 per share for the quarter vs. $1.68 per share expected.

Jane Fraser, CEO of Citigroup commented on the latest results: ”While the world has changed since our Investor Day in March, our strategy has not and we are executing it with discipline and urgency. Treasury and Trade Solutions fired on all cylinders as clients took advantage of our global network, leading to the best quarter this business has had in a decade. Trading volatility continued to create strong corporate client activity for us, driving revenue growth of 25% in Markets. While economic sentiment clearly impacted Investment Banking and Wealth Management, we continue to invest in these businesses and we like where they are headed. In U.S. Personal Banking, the positive drivers we saw in our two credit cards businesses over the last few quarters converted into solid revenue growth this quarter, most notably a 10% growth in Branded Cards.”

”In a challenging macro and geopolitical environment, our team delivered solid results and we are in a strong position to weather uncertain times, given our liquidity, credit quality and reserve levels. I am particularly pleased with our capital strength. We ended the quarter with a Common Equity Tier 1 ratio of 11.9%, having built capital due to a higher regulatory requirement. We intend to generate significant capital for our investors, given our earnings power and the upcoming divestitures,” Fraser added.

Citigroup Inc. (C) chart

Share price of Citigroup jumped by 13.23% on Friday after better than expected financial results, trading at $49.95 per share.

Here is how the stock has performed in the past year:

Citigroup price targets

Citigroup Inc. is the 122nd largest company in the world with a market cap of $97.05 billion.

You can trade Citigroup Inc. (C) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Citigroup Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

ANZ set to acquire Suncorp in mega acquisition

Big 4 bank ANZ is set to takeover Suncorp in a massive buyout. The agreement stipulates that the buyout is only for the banking side of the business with the insurance arm not being apart of the deal. Details of the deal ANZ is set to pay Suncorp 4.9 Billion dollars 1.3 time the current Net Tangible Asset value of Suncorp. The compl...

July 18, 2022Read More >Previous Article

Morgan Stanley results announced

Morgan Stanley (MS) reported its latest financial results for the second quarter before the market open in the US on Thursday. The US financial ser...

July 15, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading