- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Coal Price Effect on Newcastle Coal Futures NCF1

- Home

- News & Analysis

- Economic Updates

- Coal Price Effect on Newcastle Coal Futures NCF1

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

As a trader the penny should now have dropped regarding the importance of energy stocks. Geopolitical issues around the world, especially surrounding Ukraine and Russia, has pushed energy stock prices to all time heights. This is due to supply chains being affected by the ongoing conflict.

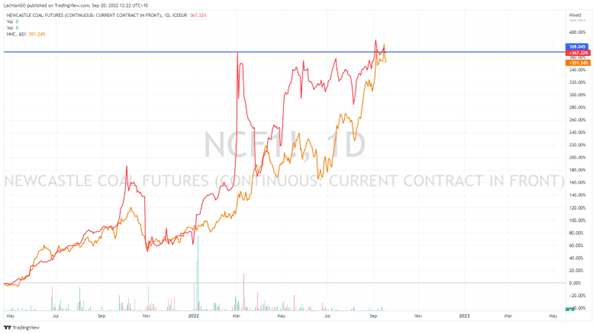

Newcastle Coal Futures, (NCF1) illustrate the increase in coal price pe the price of coal started skyrocketing, figure 1 shows the correlation between the price of the underlying commodity and the price of coal companies.

The price as of 20 September 2022 is $439.20, an increased of 155% since the 1st of January and it is at the same price it was at the height of the Russian invasion of Ukraine. It is possible that the price of coal could continue to increase with an increased demand then was expected. The main causes of high coal prices are a rapid diversification of European energy demand away from Russian gas and coal, with a resulting increase in demand for gas and coal from other suppliers.

Figure 1.

Ultimately when either investing in equites or trading equites or commodities it is important to have some understanding of the current state of regarding coal and energy stocks as they have been some of the biggest drivers in market.

Sources: Tradingview.com, https://www.australianresourcesandinvestment.com.au/, https://www.theice.com/

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Technical Analysis – Oil taps a major trend line

The price of oil has been in a strong upward trend since May 2020, when it reached its bottom during the early stages of covid 19 pandemic, and the price of oil reached close to $0. The price of oil has respected the trend over the long term and has now retested the trend for the third time. As seen above, oil has failed to break below the t...

September 21, 2022Read More >Previous Article

USDJPY showing signs of another breakout

The USDJPY has been one of the strongest performing currency pairs since the beginning of the year. With geopolitical volatility and record high infla...

September 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading