- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Coca-Cola tops Wall Street estimates for Q4

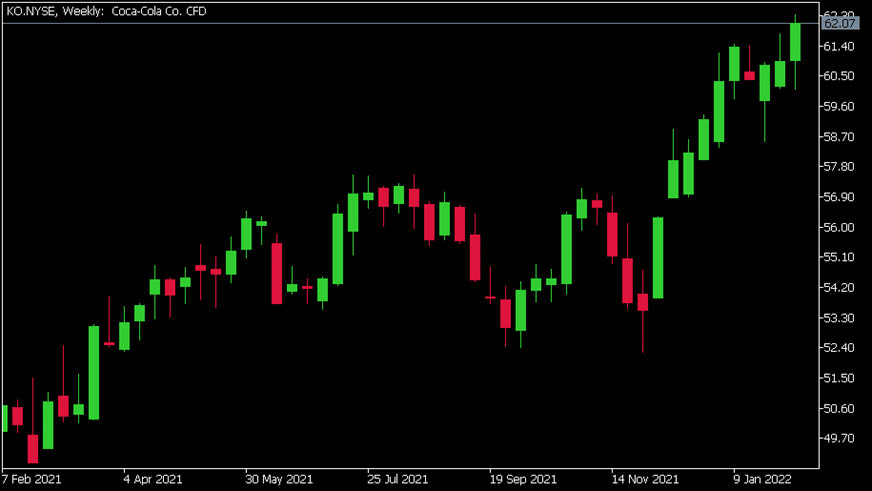

- 1 Month: +0.23%

- 3 Month: +7.58%

- Year-to-date: +3.09%

- 1 Year: +21.35%

News & AnalysisThe Coca-Cola Company (KO) reported its fourth quarter financial results before the opening bell on Wall Street on Thursday. The US beverage company topped analyst forecast, posting solid results for the last quarter of 2021.

Total revenue reported at $9.47 billion vs. $9.005 billion estimate.

Earnings per share reported at $0.45 a share vs. analyst expectation of $0.41 a share.

”In 2021, our system demonstrated resilience and flexibility by successfully navigating through another year of uncertainty,” said James Quincey, Chairman and CEO of The Coca-Cola Company.

”We focused on our key strategies and emerged stronger. We are confident that progress on our strategic transformation has made us a nimbler total beverage company. While the environment remains dynamic, we will build on the momentum from 2021 to drive topline growth and maximize returns,” Quincey added.

The Coca-Cola Company chart (weekly)

Shares of Coca-Cola little changed following the latest financial results, down by 0.10% at $62.07 a share. Here is how the stock has performed in the past year –

Coca-Cola is the 33rd largest company in the world, with a total market cap of $263.65 billion.

You can trade The Coca-Cola Company (KO) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: The Coca-Cola Company, TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Twitter falls short in Q4

Twitter Inc. (TWTR) reported its latest financial numbers before the opening bell on Wall Street on Thursday. Let’s take a look at how the social media company performed in the last quarter of 2021. The company reported total revenue of $1.567 billion in Q4, falling short of analyst forecast of $1.578 billion. Earnings per share reported in...

February 11, 2022Read More >Previous Article

Pfizer Q4 results announced

Pfizer Inc. (PFE) reported its Q4 financial results before the market open on Wall Street on Tuesday. The world’s third largest pharmaceutical co...

February 9, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading