- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Coca-Cola tops Wall Street expectations in the first quarter

- Home

- News & Analysis

- Economic Updates

- Coca-Cola tops Wall Street expectations in the first quarter

- 1 Month +4.98%

- 3 Month +8.41%

- Year-to-date +9.79%

- 1 Year +21.14%

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Coca-Cola Company reported its latest financial results for the first quarter of the year before the Wall Street opening bell on Monday.

World’s largest beverage producer reported revenue of $10.491 billion in the first quarter, surpassing analyst estimates of $9.832 billion.

Earnings per share reported at $0.64 per share, also above analyst forecast of $0.58 per share.

”We are pleased with our first quarter results as our company continues to execute effectively in a highly dynamic and uncertain operating environment,” James Quincey, Chairman and CEO of Coca-Cola said in press release following the latest results.

”We remain true to our purpose and are staying close to consumers. We are confident in our full-year guidance, and we are well-equipped to win in all types of environments as we fuel strong topline momentum and create value for our stakeholders,” Quincey added.

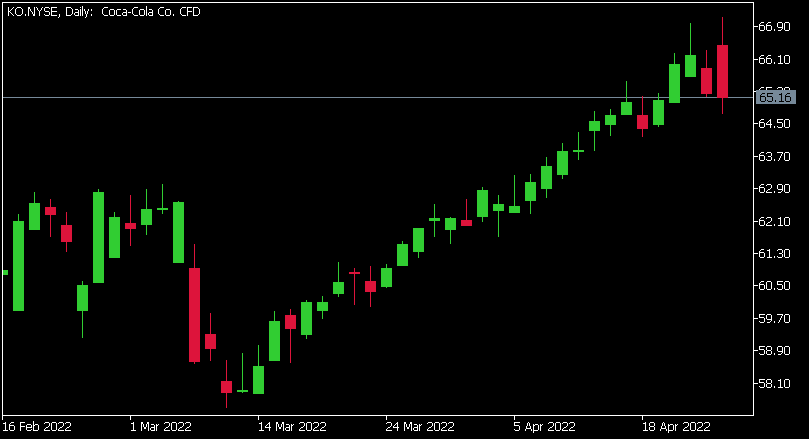

The Coca-Cola Company chart

The latest results did not have an impact on the share price during the trading day on Monday. The stock was down by 0.05% at $65.16 per share.

Here is how the stock has performed in the past year:

Coca-Cola is the 28th largest company in the world, with a total market cap of $283.11 billion.

You can trade The Coca-Cola Company (KO) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: The Coca-Cola Company, TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Musk’s future for Twitter

The future of the large-cap tech giant and social media platform, Twitter, will be one to watch closely after the Board approved tech billionaire and Tesla CEO, Elon Musk's offer to buy the company. The question remains, is this a positive move for the company and its move into the future? Takeover details Musk’s offer, which has already be...

April 27, 2022Read More >Previous Article

Macquarie’s recent $3.5 billion sale to AustralianSuper and Singtel

AustralianSuper and Singtel’s company, Australian Tower Network (ATN), has recently won the auction for Axicom. Early this month, Macquire’s A...

April 21, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading