- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- Commodities’ record high prices wreaking havoc for inflation

- Home

- News & Analysis

- Articles

- Economic Updates

- Commodities’ record high prices wreaking havoc for inflation

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisA sudden rapid increase in commodity prices, propelled by supply concerns stemming from the Russia and Ukraine conflict, has brought about inflationary pressure and moved future inflation expectation. The increase has also pushed indices into a bear market and caused some volatility in global equities.

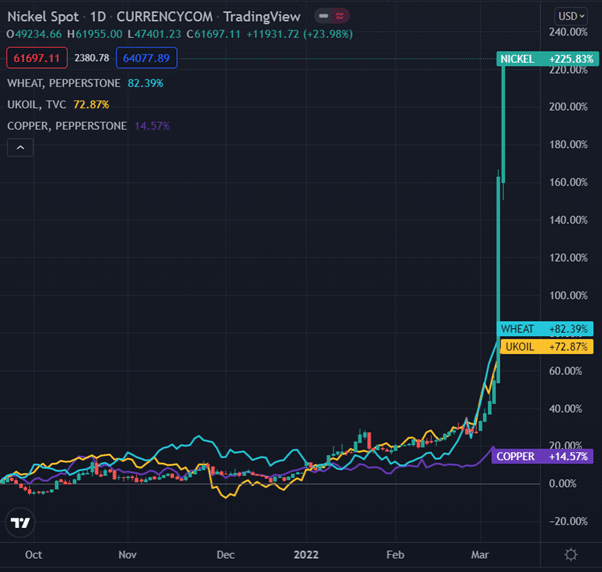

Nickel, European gas and wheat have all hit record highs on Monday. Copper, Brent crude oil, aluminium and thermal coal are currently sitting at their highest levels in years. The commodities rally has stirred up fears that inflationary pressures will persist as the price increase works its way through the supply chain and slows down economic growth.

The Australian 10-year break-even rate is sitting at 2.48%, its highest level since 2014. The US 10-year break-even rate increased to 2.86% on Tuesday, its highest level since 2005. The German 10-year break-even rate hit a record high of 2.62%.

Break-even rates represent the difference between a nominal bond and an inflation-linked bond of the same maturity, implying the average rate of inflation over a given period of time. The spike in these rates suggests that the bond market is expecting inflation to be far more persistent than central banks and strategists have been expecting.

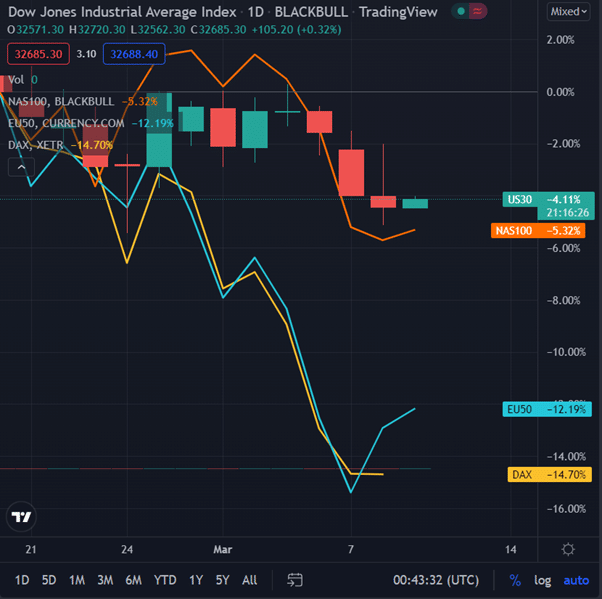

The fear of Russian energy sanctions has led to heavy selling in the global equity markets. The US Dow Jones, Nasdaq, Euro Stoxx 50 and Germany DAX index have slipped into bear markets as shown from the chart above. The EU50 and DAX are currently down 20% since their peaks in mid-January.

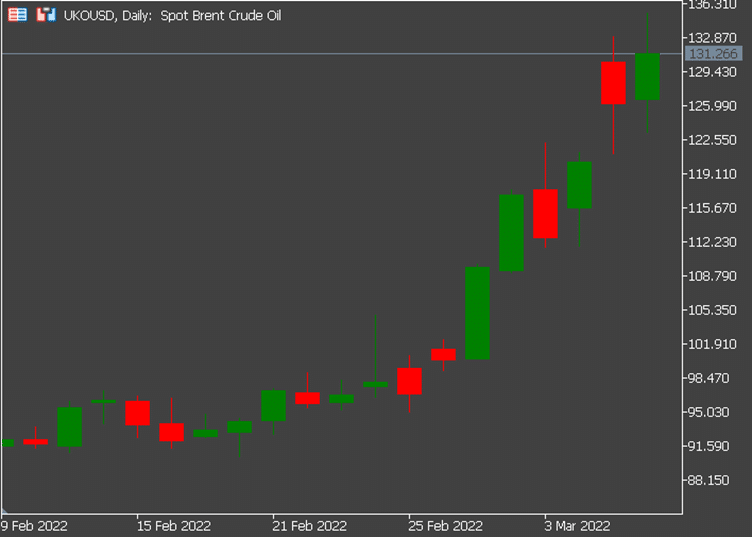

The spike in break-even rates comes after the surge in the price of energy as Brent crude has reached a high of $136 USD a barrel on Monday.

This rapid increase in the cost of energy, namely the Brent Oil, is currently making its way through to our local petrol pumps. As the national average petrol price has climbed to 1.839 per litre.

Other commodity prices are also beginning to break into new territory and are likely to drive up the cost of goods further down the supply chain.

Nickel recently hit a record high of over $60,000 USD a tonne, as supply risks sparked a short squeeze.

About 7 per cent of the world’s nickel is produced in Russia, with the metal being used to produce stainless steel. It is also a major component of lithium-ion batteries, which are used in electric vehicles.

The steady surge in commodity prices and their associated inflation risk has created a dilemma for central banks across the world. Central banks are trying to manage inflation without curbing growth.

All in all, commodity prices are currently on the rise as the conflict between Russia and Ukraine continues. Their prices are now on most investors’ watchlists, as it can affect other markets such as Forex and Indices.

If you would like to take this opportunity to invest and do not yet have a trading account, you can open a GO Markets CFD trading account.

Source: GO Markets MT5, TradingView, Globalpetrolprices, AFR

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Gold pushes through $2000 as demand grows during uncertain times

Gold has seen a resurgence in the past few weeks on the back of inflationary pressure and geopolitical tensions in Ukraine and Russia. Prior to the conflict, the price of Gold was hovering around $1,800 USD per ounce. After pushing through $2000 USD per ounce the price is now moving closer to its all-time high at $2070. The rise in other commodi...

March 9, 2022Read More >Previous Article

The USA and the UK ban Russian oil imports as Gold price approaches all-time high

The USA and the UK announced measures to ban Russian oil imports in order to isolate Russia from the global economy. This follows on from sanctions im...

March 9, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading