- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Consequences of a Strong USD

News & AnalysisThe USD has been on a tear recently as inflation has engulfed the world economy. The USD, which has traditionally been a strong currency and haven for investors during times of volatility, has performed exceptionally well. The currency is attractive as it provides security for investors as the market trusts the US government to pay its debts and abide by its obligations. The US central reserve has been ultra-aggressive in its attempt to stem the tide of inflation. With little relief to come due to the Federal reserve’s intent to further raise in the near to medium-term future and hawkish sentiment, the dollar does not look like weakening in the short term.

The flow-on effects have not been all positive however, it has affected imports and exports all over the world. Other countries must now pay a higher price for imported goods from the USA. This not only pushes up their inflation rates but also drains those countries of their capital. The impact also disproportionately affects emerging markets and countries. This is because governments that require USD reserves must pay more for their USD. Furthermore, many of these emerging markets are in a weaker economic position to begin with.

The impact of a strengthening USD has also seen a weakening of many US stocks. The impact of inflation has led to higher costs for businesses, lowering profits, and lower consumer spending. Technology stocks and growth stocks have felt the brunt of the increased interest rates and the dollar strength. Stocks like Netflix, Tesla and Block are some examples of companies that have seen a large drop in their share price.

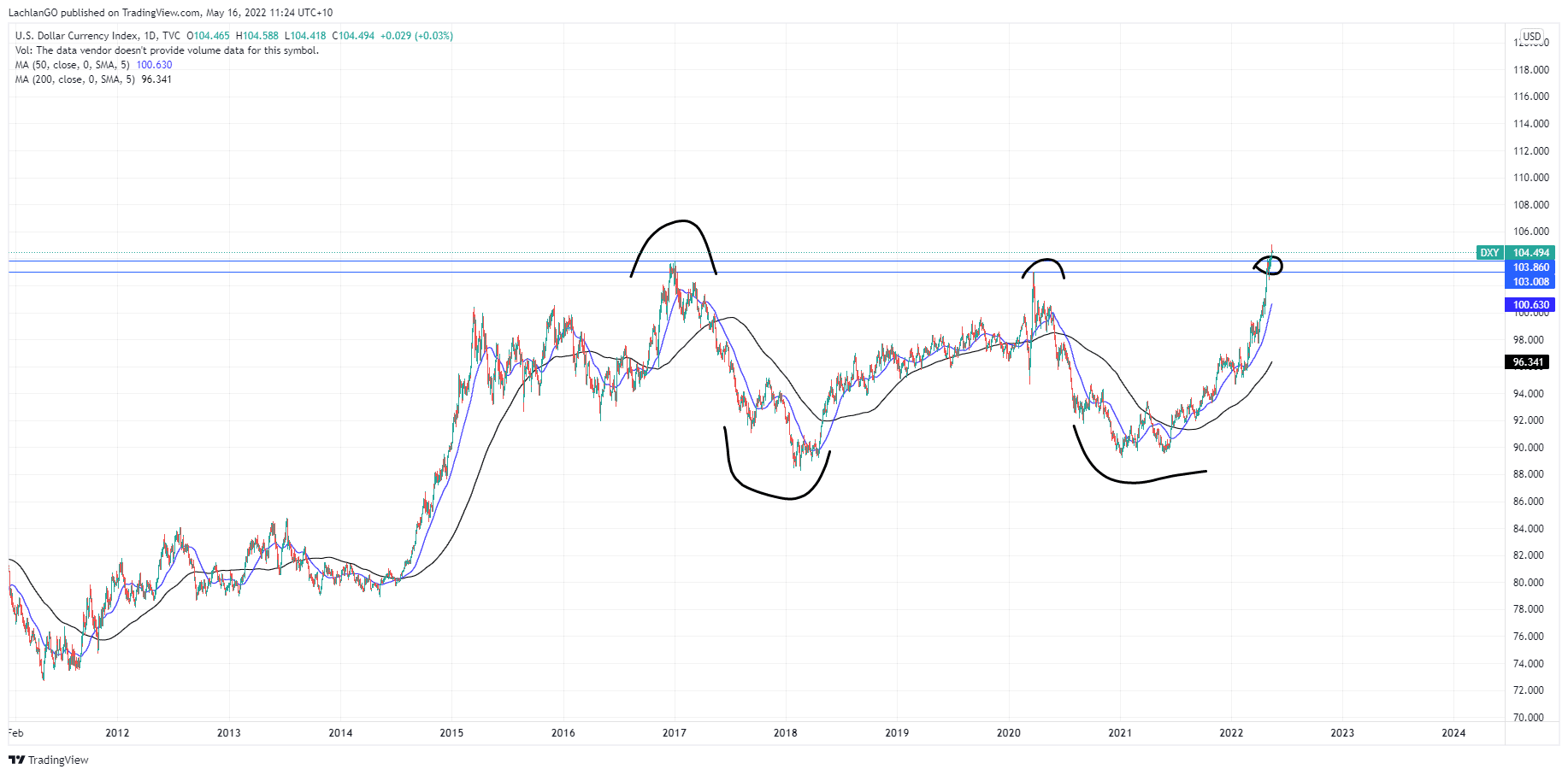

The US dollar index that tracks multiple currencies against the USD is at multi-decade highs, not seen since before the Dot.com burst. There was a thought that the interest rate rises would be priced in, however, the price action on the USD suggests otherwise and the aggressiveness of the rhetoric and actions from the Federal Reserve has surprised much of the market. As it can be seen on the chart below, the USD is breaking out of a long period of consolidation and is at multi-decade highs.

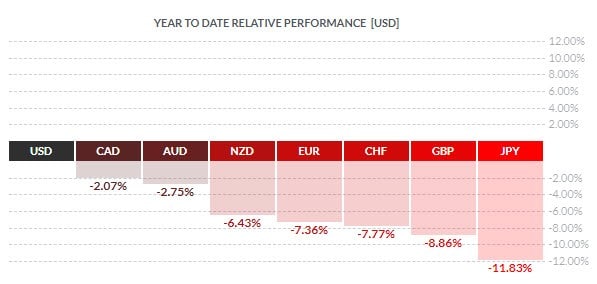

The impact of the recent state of the USD on other currencies can be seen in the chart below. Currencies such as the JPY have suffered from their government’s inaction on inflation, which consequently has given support to the strength of the USD/JPY. Other who have increased their own interest rates have still not done so with the level of hawkishness that Federal reserve has.

Commodity-based currencies such as the CAD and the AUD have fared well as they are both strong mining jurisdictions and this allowed the economy to stay strong during the inflation. Commodities such as Gas, Oil, and Gold are large parts of the Canadian and Australian Economies. In addition, the geographical proximity of the USA to Canada and its trading relationship has protected it from many inflationary pressures. Both countries are also geographically protected from the war in Europe.

Going forward the obvious catalyst for a slowdown may be lowering inflation levels which would likely lead to a less aggressive interest hiking policy from the federal reserve. Alternatively, the market may find a point of resistance whereby it deems the USD too expensive to buy. With no recent supply zone, it is hard to pinpoint the next target. Other potential events that may slow the growth of the USD could be another Covid wave or a slowing down of the economy.

Ultimately, as the USD continues from strength to strength the impact on the world economy will continue to be mixed.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Walmart earnings results are in – the stock is falling

Walmart Inc. (WMT) reported its latest financial results before the opening bell on Wall Street on Tuesday. World’s largest supermarket chain reported revenue of $141.569 billion for the quarter (up 2.4% year-over-year) vs. $138.835 billion estimate. Earnings per share reported at $1.30 per share, falling short of analyst forecast of $1.48 ...

May 18, 2022Read More >Previous Article

Bitcoin (BTC) Cycles.

The Crypto market cap at the time of writing is sitting at $1.46 Trillion, down by just under 5% over the last day, according to CoinMarketCap data. B...

May 16, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading