- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Constellation beats Wall Street expectations

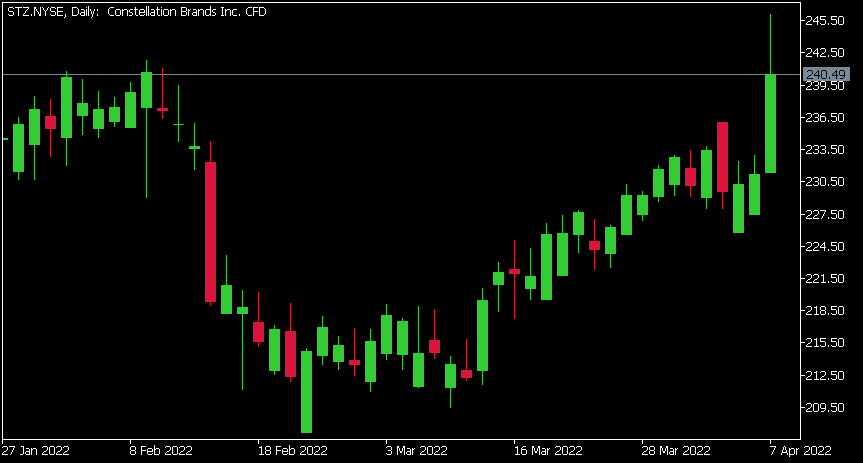

- 1 Month +12.81%

- 3 Month -1.54%

- Year-to-date -3.97%

- 1 Year +7.50%

News & AnalysisConstellation Brands Inc. reported its fiscal fourth quarter 2022 financial results on Thursday.

The US beer, wine and spirits producer and marketer beat both revenue and earnings per share estimates, sending the stock higher during the trading day.

Revenue reported at $2.103 billion in the quarter vs. $2.017 billion expected.

Earnings per share at $2.39 a share vs. $2.09 a share estimate.

”Driven by a relentless focus on building brands consumers love, our business continues to gain momentum. Despite various headwinds, we extended our leadership position in the high-end of the U.S. beer market, our high-end wine and spirits brands continue to outpace the industry complimented by successful innovation, we continue to invest aggressively in our core business, and we’ve set a strong foundation for future growth,” Company President and CEO, Bill Newlands, said following the latest results.

Garth Hankinson, CFO of Constellation also made comments after the results, highlighting future plans for the company and its shareholders: ”Our capital allocation strategy remains unchanged and includes a focus on maintaining an investment-grade rating, returning capital to shareholders through dividends and share repurchases, and investing in the growth of the business. In fiscal 22 alone, our strong operating results and powerful cash generation capability enabled us to return almost $2 billion in capital to shareholders as part of our $5 billion commitment by the end of fiscal 23.”

Constellation Brands Inc. chart

Shares of Constellation were up by around 4% on Thursday, trading at $240.49 per share.

Here is how the stock has performed in the past year:

Constellation Brands Inc. is the 381st largest company in the world with a market cap of $46.33 billion.

You can trade Constellation Brands Inc. (STZ) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Constellation Brands Inc., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Commonwealth Bank’s plans to expand crypto services to 6.5M delayed by red tape

One of Australia’s biggest banks is still wading through a sea of red tape spun by local financial regulators before launching its crypto products to all its retail users. Financial regulators are standing in the way of expanded crypto services on Commonwealth Bank of Australia’s (CBA) mobile app. In an Australian first, the bank aims to...

April 8, 2022Read More >Previous Article

Earnings Season Explained & 2022 Performance thus far

ASX-listed companies must report their financial results to shareholders at least twice a year, within two months of the end of their balance sheet ...

April 7, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading