- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Cyclical assets stumble on hawkish Fedspeak and BoE recession forecast

- Home

- News & Analysis

- Economic Updates

- Cyclical assets stumble on hawkish Fedspeak and BoE recession forecast

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisCyclical assets stumble on hawkish Fedspeak and BoE recession forecast

5 August 2022 By Lachlan MeakinUS stock Indices were mixed and ultimately little changed overnight with growth concerns taking centre stage after the Bank of England’s sustained recession forecast and Fed governor Mester again reiterating the central banks resolve in bring down inflation. Mester stated that she sees it as not unreasonable to see a 75bps hike in September and expecting rates to continue rising through HI 2023.

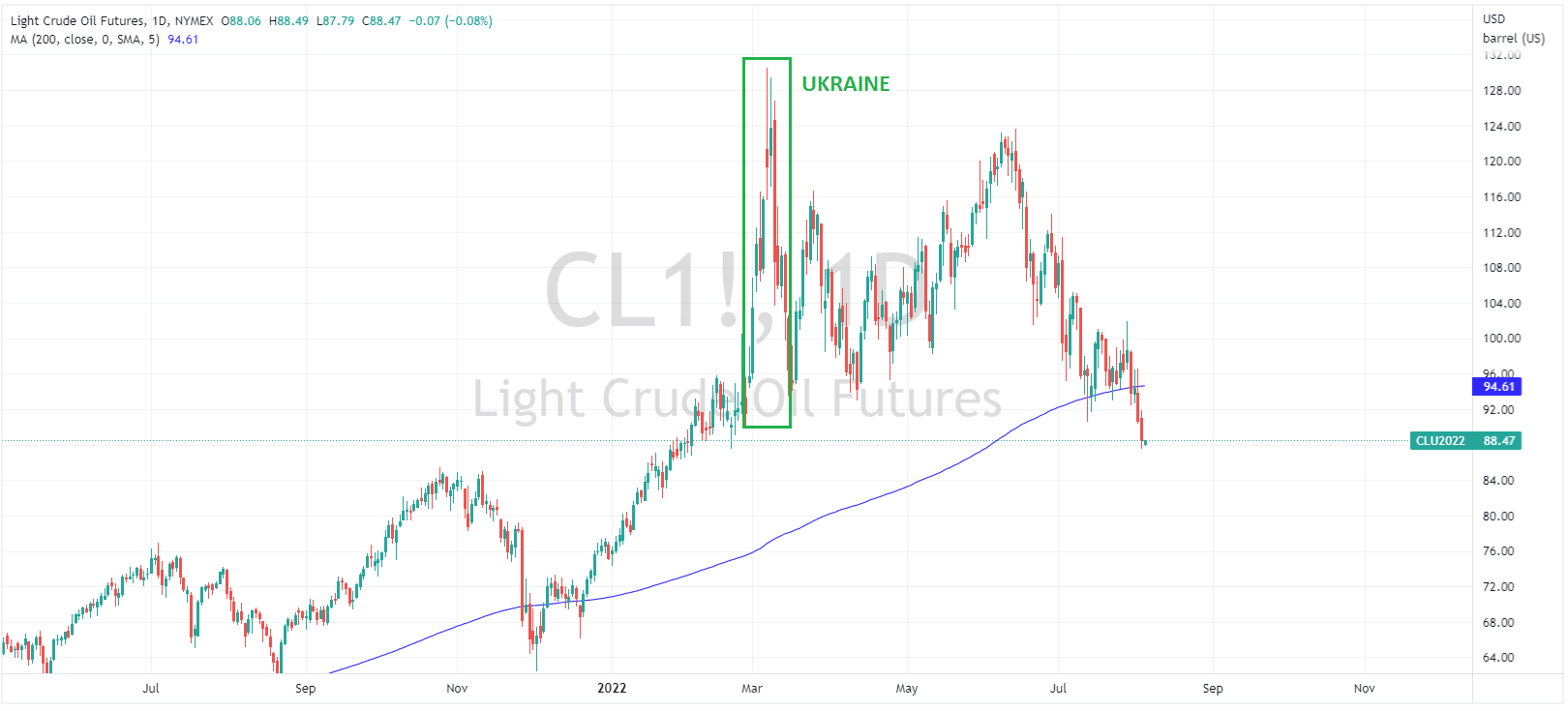

Crude Oil tumbled on recession fears spurred by the BoE comments, dropping below it’s 200 day SMA and giving up all the Ukraine invasion gains.

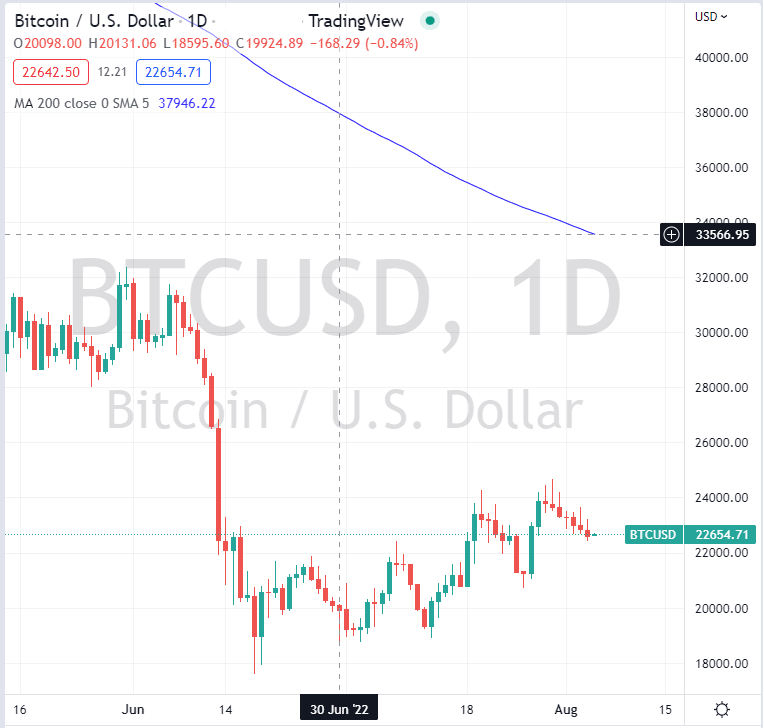

Bitcoin extended the weeks loss, down for a 7th straight session

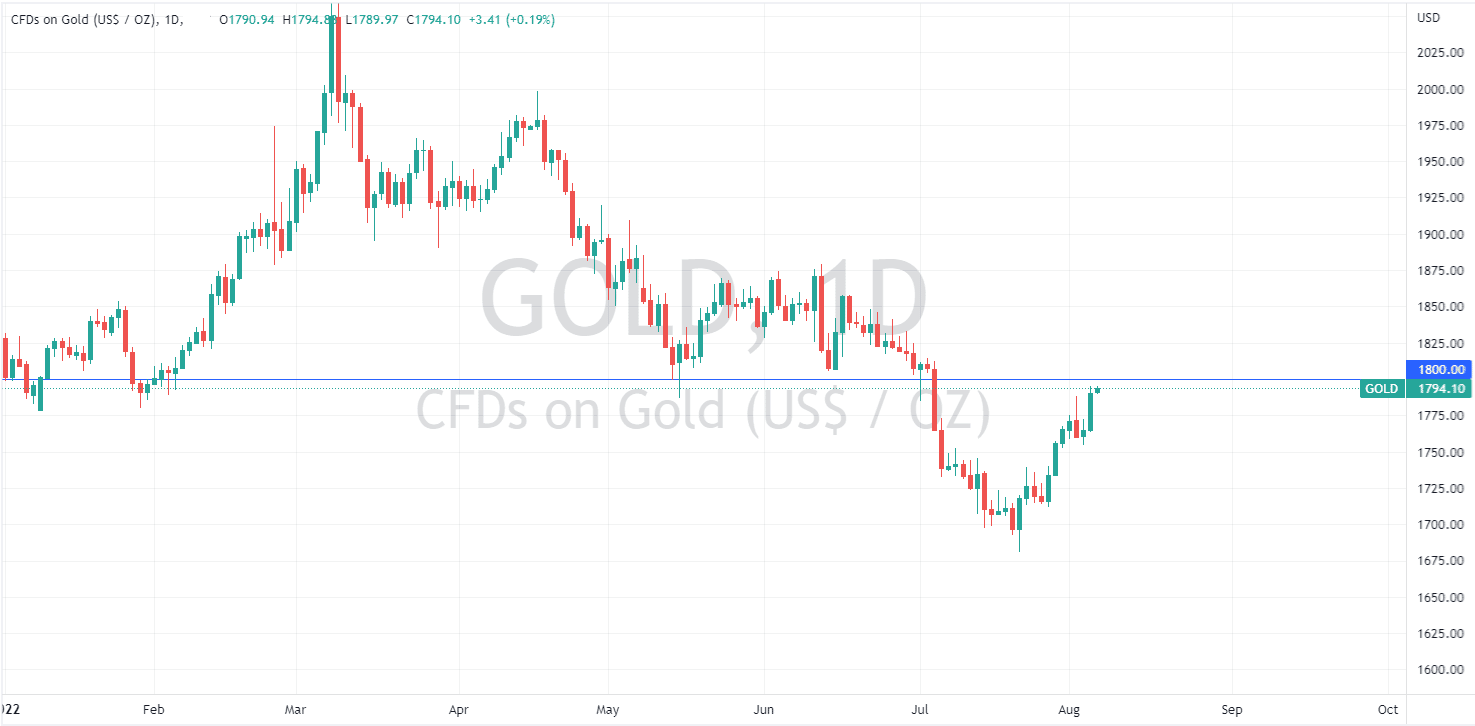

A weak US dollar (with Chinese military exercises new Taiwan being a headwind) bond yields dropping and a flight to safety saw Gold outperform, the spot price pushing towards the psychological $1800 USD an Oz level which has provided strong support and resistance in the recent past.

Looking ahead, we have the closely watch Non Farm Payroll employment result from the US today where 250k jobs are expected to be added in July. With the Fed being in a data-dependent, meeting-by-meeting mode traders will use the data to shape expectations of how the Fed will set policy at its September meeting, expect some big moves in the FX market at the release of these figures released at 12:30 PM GMT (10:30 pm AEST)

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Four Australian Stocks to Watch

Today, we are going to be looking at some Australian stocks to watch, there has been positive activity in the Australian market over the last couple of weeks, after a fresh round of bank earnings and stronger than expected retail data helped major U.S. indices pare recent losses. So, there’s plenty of activity to discuss, however, we are going to...

August 8, 2022Read More >Previous Article

Alibaba posts better-than-expected results

Alibaba Group Holdings Limited (BABA) reported its latest financial results before the market open on Thursday. The Chinese e-commerce gi...

August 5, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading