- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Deere & Co. tops estimates

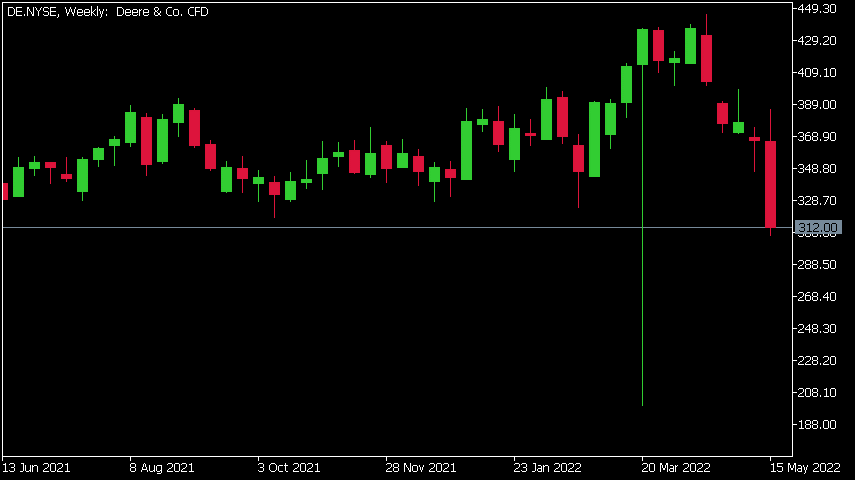

- 1 Month -22.37%

- 3 Month -15.12%

- Year-to-date -8.63%

- 1 Year -12.91%

- JP Morgan: $440

- Wells Fargo: $455

- Deutsche Bank: $417

- Barclays: $415

- Credit Suisse: $463

News & AnalysisDeere & Co. (DE) reported its financial results on Friday for the second quarter ended May 1, 2022.

The American manufacturer of farm machinery and industrial equipment reported revenue of $13.37 billion in the quarter (up by 11% year-over-year), topping analyst estimate of $13.231 billion.

Earnings per share also coming in above expectations at $6.81 per share vs. $6.69 per share estimate.

”Deere’s second-quarter performance reflected a continuation of strong demand even as we face supply-chain pressures affecting production levels and delivery schedules,” said John C. May, CEO of Deere & Co.

”Deere employees, suppliers, and dealers are working hard to address these challenges. We are proud of their extraordinary efforts to get products to our customers as soon as possible under the challenging circumstances,” May concluded.

Deere & Co. chart

Shares of Deere & Co. fell by 14.07% on Friday, despite topping Wall Street expectations. The stock was trading at around $312 per share.

Here is how the stock has performed in the past year:

Deere & Co. price targets

Deere & Co. is the 132nd largest company in the world with a market cap of $96.11 billion.

You can trade Deere & Co. (DE) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Deere & Co., TradingView, MarketWatch, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Xpeng tops first quarter expectations – the stock falls on future outlook

Xpeng tops first quarter expectations – the stock falls on future outlook Xpeng Inc. (XPEV) reported its first quarter financial results before the opening bell on Wall Street on Monday. The Chinese electric vehicle company reported revenue of $1.175 billion in the quarter (up by 152.6% year-over-year) vs. $1.165 billion expected. The co...

May 24, 2022Read More >Previous Article

Why are US retail giants bleeding?

Retail and consumer staples Walmart and Target have seen dramatic drops in their share prices in the last week as the cost of inflation begins to take...

May 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading