- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Did China Retaliate with a Currency War?

News & AnalysisA Currency War

Did China retaliate with a Currency War?

Monday kicked-off with a bang with plenty of big moves in the financial markets. A risk-off sentiment prevails in the markets as dark clouds of trade tariffs resurfaced and are overshadowing the markets. Investors are awaiting for China to retaliate.

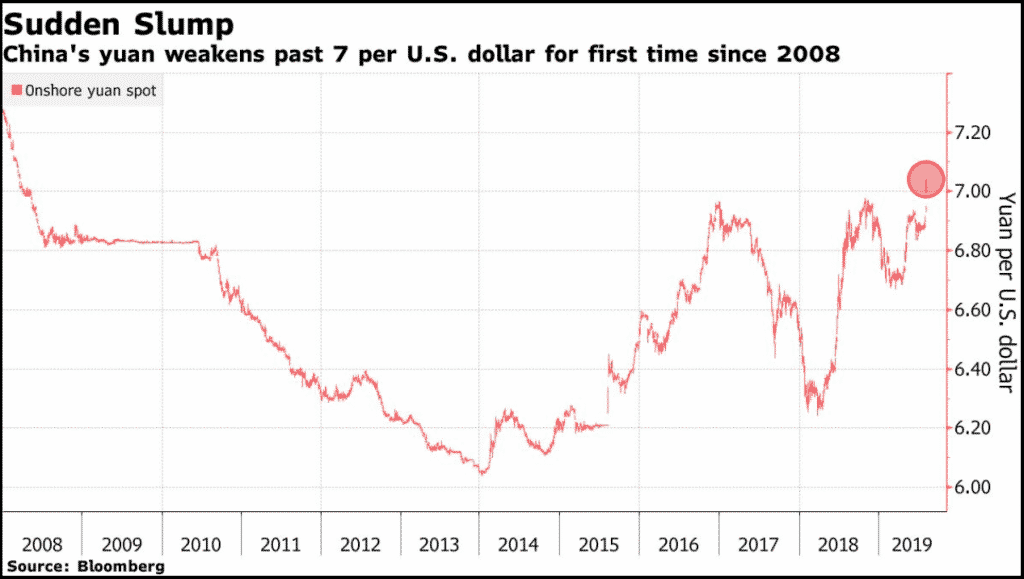

However, the significant fall in the Chinese Yuan might already be “the” signal that Beijing has used its currency for retaliation.

The Chinese Yuan fell below a symbolic level of 7 to the US dollar for the first time in more than a decade after The People’s Bank of China sets Yuan reference rate at 6.9225 – the lowest level in 2019. The central bank blames the tumble in the Yuan on the escalating trade tensions but tried to downplay the 7.00 psychological level.

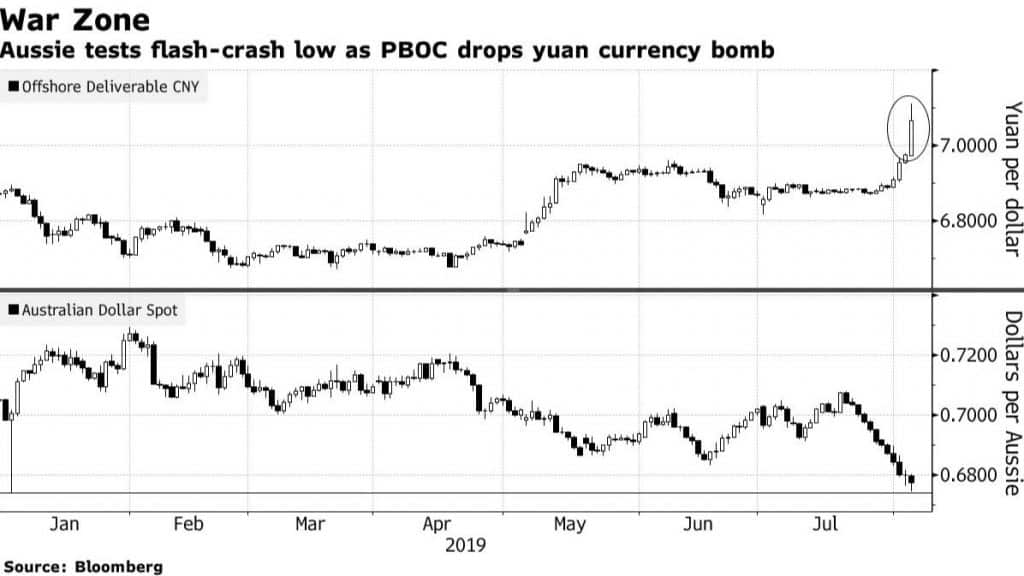

The weaker Yuan created havoc in the markets as investors turned risk-off on fears that a currency war has ramped up. The move has pulled other Asian currencies down to the exception of the Japanese Yen, which is bolstering higher on haven flows.

Source: Bloomberg Terminal

The Aussie dollar was also weaker against the US dollar and dropped to 7-months low at 67.48 US cents during the Asian trading hours.

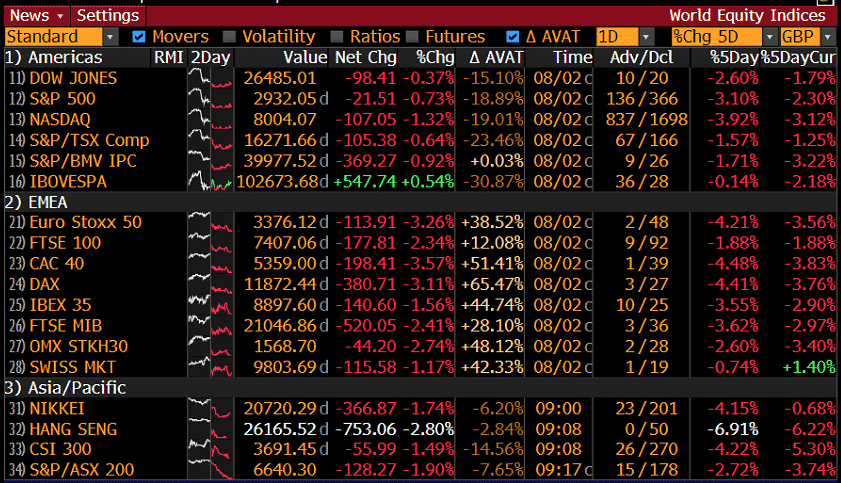

In the stock market, Asian shares were in a sea of red. The sell-off was exacerbated when Bloomberg reported that China had asked state purchasers to halt imports of American agricultural products.

Source: Bloomberg Terminal

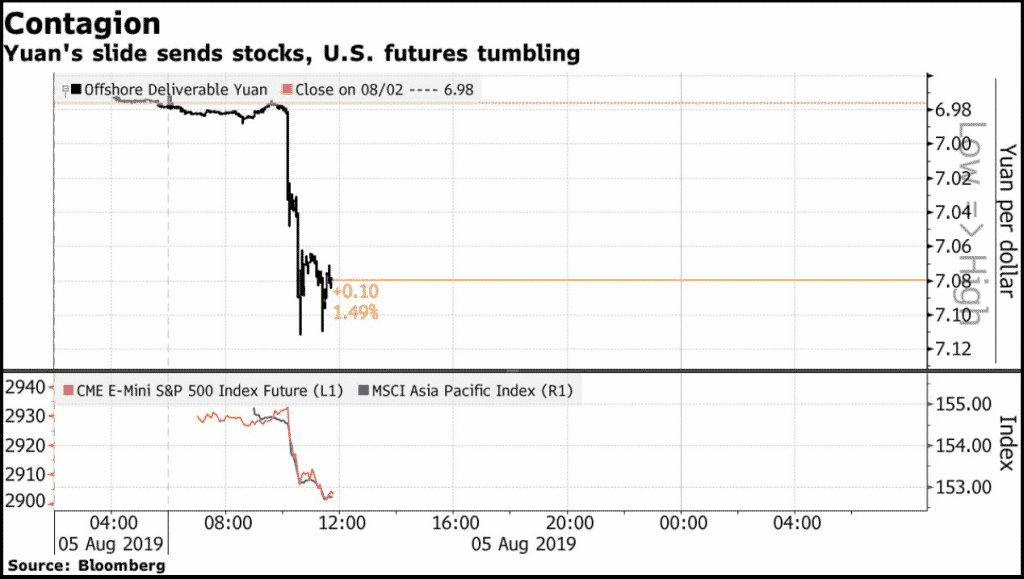

Attention is now on President Trump’s reaction to the Yuan’s slide. European and US futures tumbled, and the markets are poised to a negative open.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

RBA August Statement

The Main Headlines of the RBA August Statement By Philip Lowe, Governor: Monetary Policy Decision The Board decided to leave the cash rate unchanged at 1.00 per cent. The outlook for the global economy remains reasonable. The persistent downside risks to the global economy combined with subdued inflation have led a number of central ban...

August 6, 2019Read More >Previous Article

When good economic news is bad news?

Market response to any specific economic data release is far from standard even if actual numbers differ greatly from consensus expectations...

August 2, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading