- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Domain prepares $180 million for acquisition of Realbase

- Home

- News & Analysis

- Economic Updates

- Domain prepares $180 million for acquisition of Realbase

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisDomain Group encompasses a portfolio of brands that support it to be a leading property marketplace in Australia for consumers, agents and organisations with an interest in the Australian property market. Home buyers often use Domain as an alternative to RealEstate.

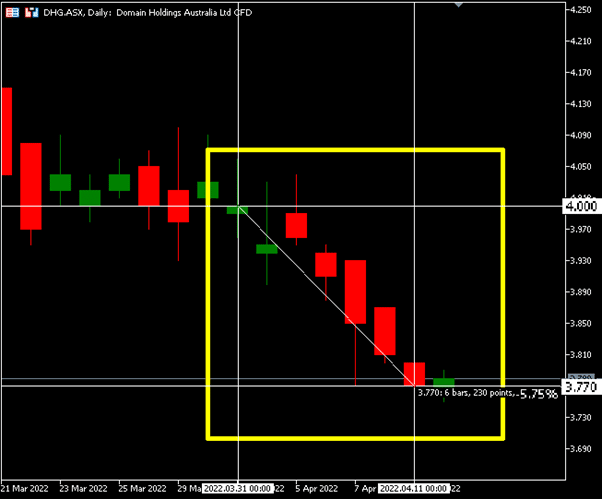

Domain Holdings, owned by Nine Entertainment, is currently raising $180 million in capital to fund purchase of a real estate campaign management platform, Realbase. This funding effort placed a trading halt on Friday, the 1st of April. Domain shares price closed at $4 prior to the trading halt. It has dropped 5.75% as the price closed at $3.77 yesterday.

The capital raise was structured as an accelerated non-renounceable entitlement offer. It was priced at $3.80 a share, which is very close to yesterday’s closing price. However, at the time of the raise, it was roughly a 5% discount. Majority shareholder, Nine Entertainment, underwrote the offer whilst Macquire and UBS were the joint lead managers and book runners.

The $180 million purchase of Realbase will include some contingent consideration of up to $50 million, provided that Realbase meets their targets. The target is to increase their Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) five times by the end of financial year 2026.

Who is Realbase?

Realbase is a leading campaign management technology platform used within the Australian and New Zealand region, with 40% market share. Real estate agents would use the platform to construct, price, order and track their marketing products’ campaigns, this would be for both on and off market property sales. Their two key brands are Realhub and Campaigntrack.

This highly strategic acquisition will provide complementary marketplace offerings for Domain’s strategy. They will be able to provide solutions to help both the agents and house hunters to track every stage of the property journey.

For the financial year ending 2022, Realbase is expecting to generate $22 million in revenue with an EBITDA of $9 million.

Nine will take up all its entitlement in the equity raising, or about 59 per cent, and will sub-underwrite up to 18.9 million shares in the institutional and retail tranches of the offer. If Nine is required to pick up a shortfall, its total shareholding in Domain after the equity offer would rise to 62.03 per cent from 59.03 per cent.

All in all, with this potential acquisition, Domain will be able to provide more services to their consumers. This can result in new opportunities for new business and investors.

If you would like to take this opportunity to invest in Domain and don’t already have a trading account, you can register for a Shares or Shares CFD account at GO Markets.

Sources: GO Markets MT5, ASX, Wikipedia, Domain, Fool, AFR

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Dividends with potential to keep an eye on

Choosing the right Dividend has always been a mixture or in-depth analysis, market opportunity and a bit of luck the company reaches their financial goals. Below is a breakdown of two stocks that have a sound platform for potential growth. Below there’s a breakdown of the two stocks with analysis brought by Goldman Sachs and Morgans. Harve...

April 12, 2022Read More >Previous Article

Commonwealth Bank’s plans to expand crypto services to 6.5M delayed by red tape

One of Australia’s biggest banks is still wading through a sea of red tape spun by local financial regulators before launching its crypto produc...

April 8, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading