- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Earnings Season Explained & 2022 Performance thus far

- Home

- News & Analysis

- Economic Updates

- Earnings Season Explained & 2022 Performance thus far

- CommSec estimates that over $36 billion in dividends have been paid or will be paid in coming weeks. That is down from the last reporting season in August 2021, when over $41 billion was paid out. But payouts in this interim reporting season are higher than equivalent reporting season in February 2021 ($25.8 billion) and higher than the $27.5 billion paid out in the interim reporting season in February 2020.

- CommSec released its final assessment of the Company Reporting Season on February 28.

- Overall reporting season was encouraging. While expenses or costs were up as expected, so were revenues. As a result, aggregate profits and cash levels continued to rise. And encouragingly, almost 88 per cent of the 138 S&P/ASX200 half-year reporting companies reported a statutory profit – the most in two years and in line with the long-term average. Further, around 67 per cent of companies lifted profits. And similarly, cash levels lifted to record highs, giving companies plenty of options.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisASX-listed companies must report their financial results to shareholders at least twice a year, within two months of the end of their balance sheet date.

As most companies have balance sheet dates of 30 June, the main reporting season takes place in August when many companies release their full-year results. Half-year results generally are released in February and paid in March/April.

Not all companies report during these periods as not all have balance sheet. A company’s website will often have information about when it is scheduled to release earnings reports.

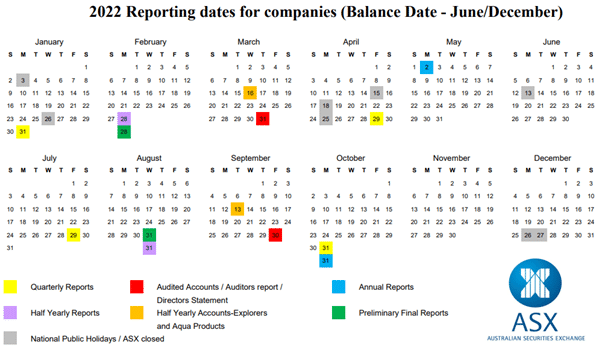

Below is a calendar providing the reporting dates for all companies in the ASX with a balance sheet.

What information is released?

Most companies release several documents to help shareholders and analysts in their assessment of information.

The main document is the statutory result, often called the ‘preliminary final report’. Some companies release their annual report at the same time.

Companies can also distribute a results presentation, and management might give real-time presentations either face-to-face or by conference calls to analysts and media.

What are the risks?

It is important for investors to understand that past performance is no guarantee of future performance. The value of your share holdings and your portfolio overall can go up and down over time.

As a shareholder, or would-be shareholder, it’s important to know as much as you can about a company’s financial health to inform your views about its potential to perform in line with your investment strategy.

Dividend report: Over $36 billion to be paid

Since late January, listed companies have been paying out dividends to shareholders. In fact, around $4.3 billion has been paid out so far. But the distributions ramped up, reached a peak in the week beginning of March 28th.

GO Markets provides access to a range of Securities in the ASX:200. By having access to the platform, you can either build a diverse portfolio of ASX Shares, or alternatively you can open a CFD trading account and trade the ASX, HK, NYSE and NASDAQ as a CFD. Please visit us here for more information www.gomarkets.com/au or call us on 03 8566 7680 to speak to one of our Account Managers.

Sources: Commsec, ASX.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Constellation beats Wall Street expectations

Constellation Brands Inc. reported its fiscal fourth quarter 2022 financial results on Thursday. The US beer, wine and spirits producer and marketer beat both revenue and earnings per share estimates, sending the stock higher during the trading day. Revenue reported at $2.103 billion in the quarter vs. $2.017 billion expected. Earnings per...

April 8, 2022Read More >Previous Article

The Agriculture Industry is running hot

The Agriculture sectors and companies that operate within it have seen a nice surge in recent months and have been booming in the wake of supply chain...

April 6, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading