Energy crunch a weak GBP and a Recession, what is going on?

6 September 2022The World and the European region are amid an energy crisis. With, the remnants of Ukraine and Russian crisis still lingering countries such as Germany and England are suffering as they struggle to keep up with the prices. The price of Natural Gas is nearly 5 times the price of what it was a year ago and Coal Prices soaring to all-time highs.

What has been happening?

The economies of countries such as Germany and England have been under the pump even prior to the very recent surge in energy prices. During the pandemic when many western countries engaged in extremely low/zero interest rates to keep the economy functioning. This was done to stimulate borrowing and spending. In addition, many governments engaged in social welfare programs to support citizens who could not work during this time. However, this left a problem with too much free money being circulated through the economy.

Due to the low interest rates, the was already a concern for Central Banks because at some stage they were going to have to increase interest rates, especially as inflation began to rear its ugly head. However, when the war is Ukraine broke out, energy prices skyrocketed as supply chains for most commodities became disrupted. Specifically Natural Gas and Coal began to rocket in price. Whilst most commodity prices settled, Coal and Gas have continued to rise alongside increasing inflationary pressures from European countries and the UK. Similarly with the rise in strength of the USD pushing commodity prices higher, this meant that for countries with already high inflation figures were at the mercy of the producers.

Specifically in the UK, growth expectations are already in retreat with the potential that the economy is already in technical recession. GDP dropped by 0.1% in the second quarter and consumer confidence has fallen and predictions are that the inflation figure in the UK could rise to 20% if the energy crisis does not subside. The other concern is that due to the insane inflation figures, the ECB and the Bank of England still need to be aggressive in hiking interest rates, with the prospect of having to choose between a recession and hyperinflation an almost lose-lose scenario.

The sky-high energy prices and recession is not just limited to England, with Germany being a primary gas importer from Russia. With the Nord Stream 1 Gas pipeline already being turned off and Winter approaching, the potential for further shut offs could prove catastrophic in accelerating inflation in a country that has already recorded its highest inflation figures in 50 years.

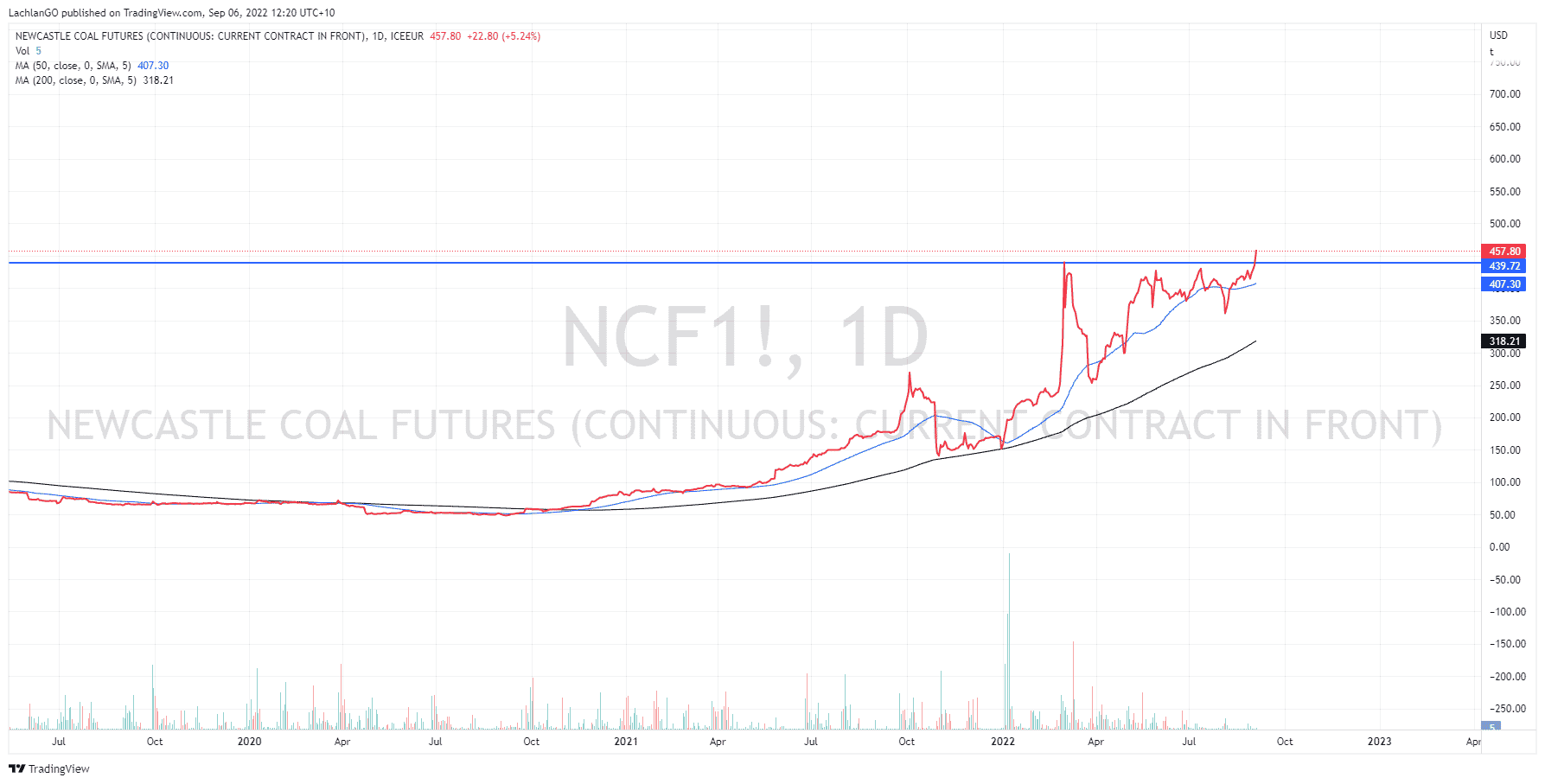

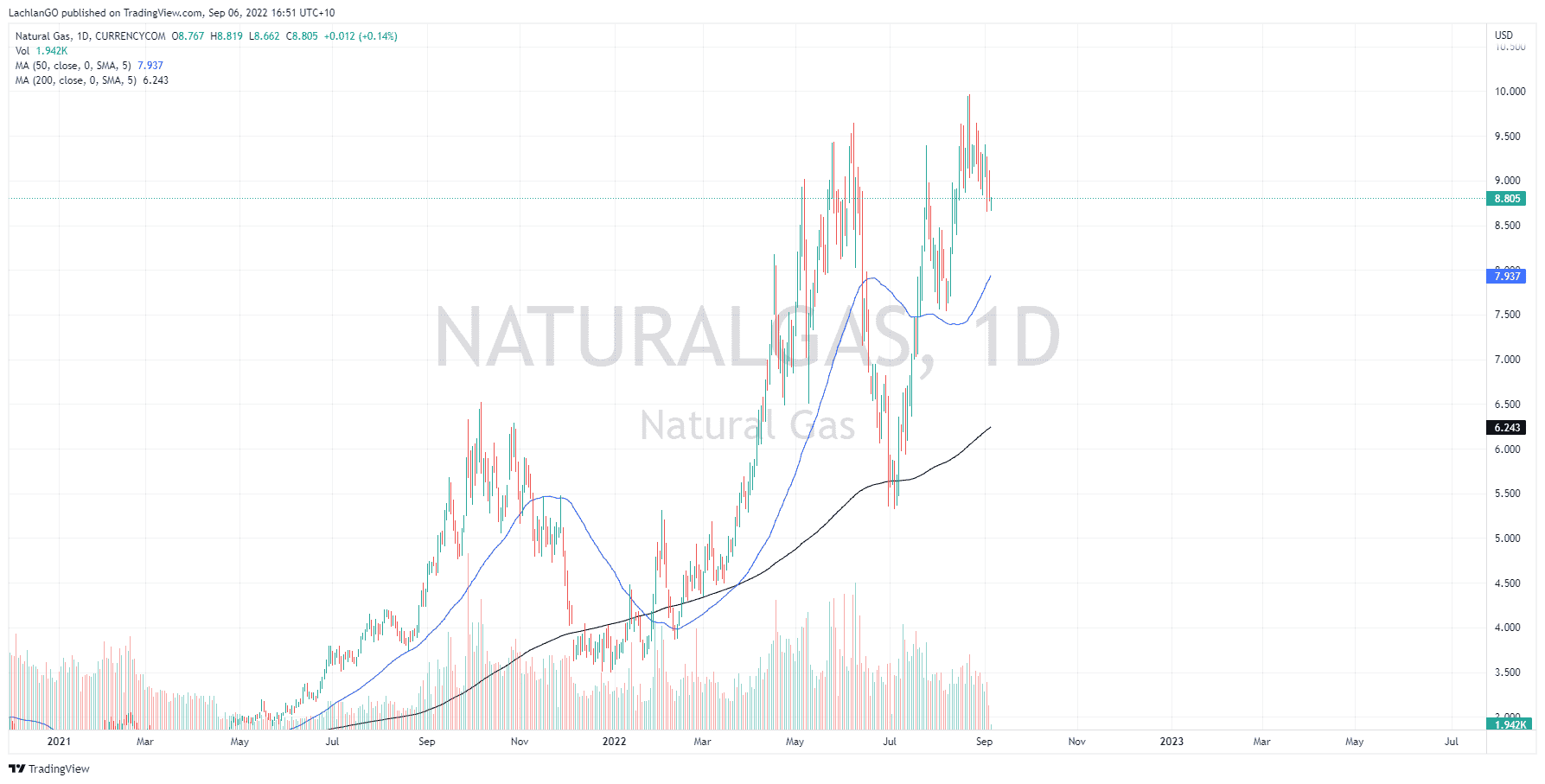

Below the price of Natural gas and coal show how the prices have lifted to record highs. Coal futures have soared to record highs and natural gas is consolidating near its recent highs testing multi decade levels.

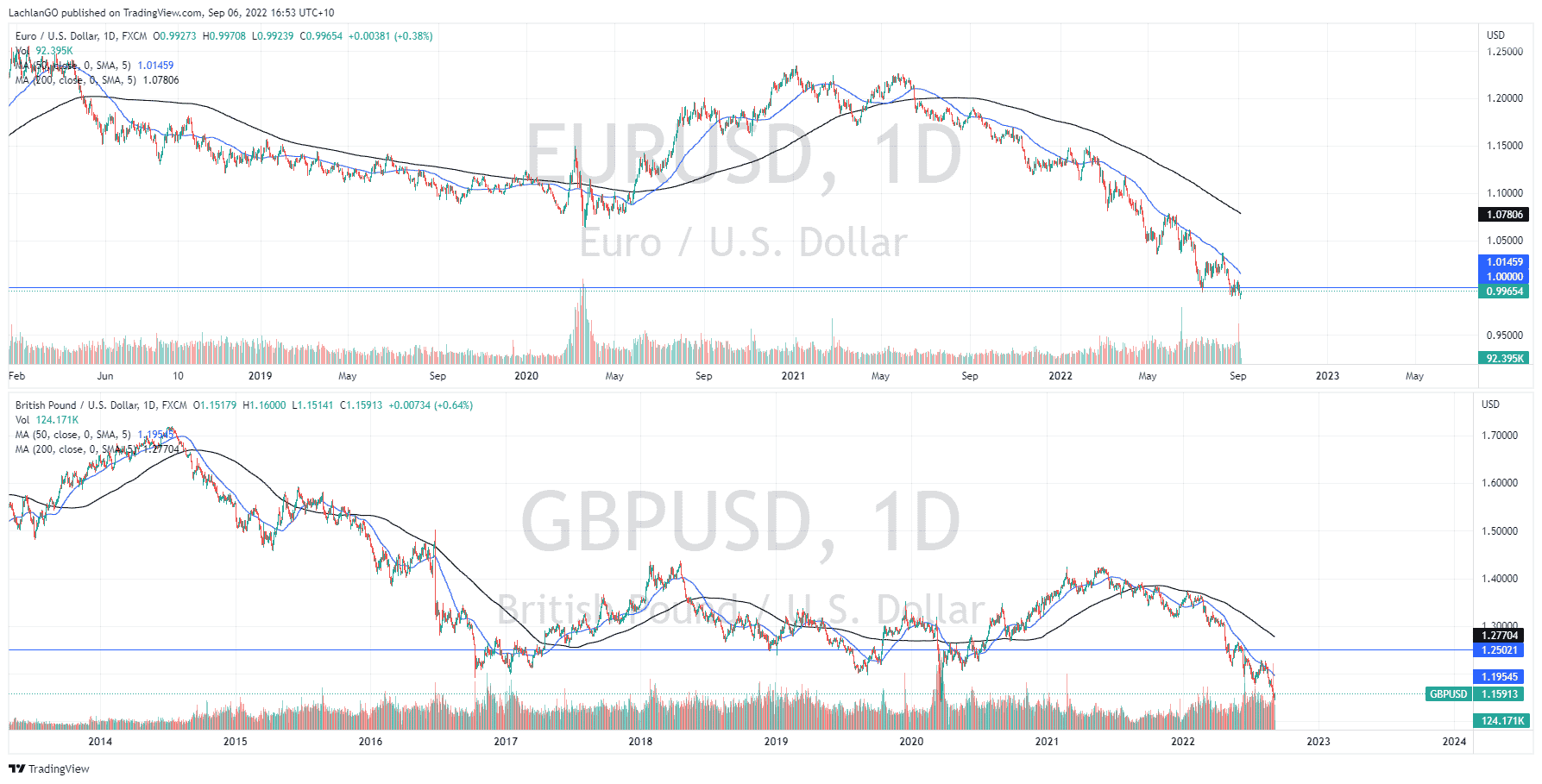

Furthermore, the EUR the GBP have been smashed from pillar to post with the fear of recession looming large. Even though the Bank of England has hiked rates 5 times already this year, there is a a significant concern over the growth outlook in the country. The UK is a net importer which means that when the currency is weaker overseas goods being bought by citizens and companies become weaker.

The GBP has not been alone, however with the EUR also falling heavily. The price of the EUR has become heavily correlated to that of Natural Gas prices. The EUR has fallen below parity with the USD to levels not seen since the early 2000s. If a recession is to get closer and closer, it is possible that the GBP and EUR will continue to fall.

Ultimately, the energy crisis and the selloffs in the GBP and the EUR have shown to be disastrous and until the soaring inflation can be bought back under control, the road ahead looks extremely volatile.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Market Recap – A look at the markets after the Labor Day Weekend U.S.

You may already be aware that our financial markets here in Australia and around the world are so closely intertwined that any event, decision or political movement in the U.S. may affect us directly or indirectly in the way we see the markets, our investments and opportunities on our day-to-day basis. Therefore, it is very important that as an...

Previous Article

The week ahead – ECB, RBA, BoC and Fed headline a data heavy calendar

Global equities saw a steep sell-off last week as economic concerns, the European energy crunch and increasingly hawkish Central banks weighed on mark...