- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Equities see-saw as Fed spooks then calms the market, US Dollar surges

- Home

- News & Analysis

- Economic Updates

- Equities see-saw as Fed spooks then calms the market, US Dollar surges

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisEquities see-saw as Fed spooks then calms the market, US Dollar surges

30 June 2021 By Lachlan MeakinJune was a rollercoaster ride for world markets with inflation concerns and the major Central banks’ response to these driving big moves in FX, Equities, and commodities.

Global Equities

Major world indices mostly rallied in June with US indices the S&P 500 and NASDAQ finishing the month strongly to set new all-time highs. European and UK markets moved strongly to the upside on continued ECB and BoE dovishness, while Asia/Pacific was more mixed with Australia’s ASX 200 outperforming.

Source: Bloomberg

Equity volatility was low for the first half of the month, as investors waited to see how the US Federal Reserve would react to recent record inflation figures in their closely-watched June meeting. The Fed surprised markets with a hawkish pivot, bringing forward their forecast of when they expect to start normalising rates. This caused a surge in the US dollar and a sharp two-day sell off in equities, with investors contemplating the end to easy money policies.

Central bank chiefs in Europe, the UK and the US calmed the markets in the following week with testimonies and speeches assuring investors that QE and low rates were here to stay a while longer. This caused a reversal of the previous week’s sell-off and saw equities bouncing back with the S&P 500 and NASDAQ setting all-time highs, leaving global stocks poised to close out their fifth quarterly advance.

FX Markets

The Greenback outperformed all major currencies In June. With the hawkish turn from the US Federal Reserve and continued concerns inflation is not as ‘transitory’ as the Fed’s narrative suggests, a resurgent US dollar powered to be within striking distance of its highest monthly gain since July 2020.

Source: Bloomberg

US Dollar

After spending the first half of the month testing its support levels at around 90, the US Dollar index surged after the conclusion of the FOMC meeting, as FX traders positioned themselves for a higher future US interest rate sooner than previously expected. The gains were retraced somewhat after the Fed’s effort to calm the markets saw the drop in equities turn around. Friday’s Non-Farm Payroll figure will be the next big test of where the US dollar will be heading in the short/medium term.

Source: GO MT4

AUDUSD

The Aussie dollar was finally able to break the trading range it’s been stuck in for 2021, with a major break below the lower support of around 0.76 US after the hawkish Fed statement gave the USD a boost.

Old support levels of 0.76 – 0.77 US are likely now to act as resistance putting a cap on any AUDUSD rise, at least until the RBA meets next month. Any unexpected RBA policy statements, whether hawkish or dovish, could be the catalyst for the next big AUDUSD move.

Source: GO MT4

Commodities

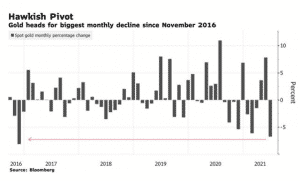

Gold

Gold (XAUUSD) is heading for its biggest monthly drop since 2016 on the Fed’s Hawkish shift. The rise in U.S. stocks to a fresh record and a resurgent US dollar have also weighed on the gold price this month.

Source: Bloomberg

XAUUSD has found some support in the 1775 USD per ounce area where the Fed’s hawkish shift seems to be priced in. Traders are now focusing on the timing of when policy makers may start dialling back stimulus.

Source: GO MT4

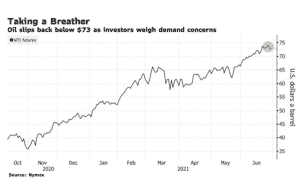

Oil

Early in June at the OPEC-JMMC meeting, the oil cartel announced it was sticking to its existing plans to gradually ease oil output cuts in June and July. With a background of rapidly increasing demand as the world’s economies reopen and supply remains constrained, June saw a very strong month with WTI crude up 10% for the month despite this week’s pullback. There may be some pressure on oil prices next week with another OPEC+ meeting scheduled and increasing concern about the COVID Delta variant spread putting economies in lockdown again.

Source: Bloomberg

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

JPMorgan and Goldman Sachs Q2 numbers are in

JPMorgan and Goldman Sachs reported their Q2 earnings before the opening bell on Tuesday – both beating analyst forecasts. JP Morgan & Co JP Morgan reported total revenue of $31.4 billion in Q2, above analyst forecast of $29.90 billion. Earnings per share were reported at $3.78 vs. $3.21 estimate. ''JPMorgan Chase delivered solid per...

July 14, 2021Read More >Previous Article

Gold and equities rally as Cryptos crash and Dollar dips

After dipping early in the month as inflation fears resurfaced, markets bounced back to broadly rally, with US and Australian equity markets touching ...

May 31, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading