- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Equity and FX markets whipsaw between risk on and risk off

- Home

- News & Analysis

- Economic Updates

- Equity and FX markets whipsaw between risk on and risk off

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisIn August equities and risk currencies dipped as fears of slowing global growth, rising Delta strain cases and tapering of loose monetary policy from central banks saw the markets switch to risk off mode. With some milder inflation figures from the US and central banks seemingly backing off imminent taper talk for now, we did see risk on return in the second half of the month with considerable bounces in both equities and risk sensitive currencies such as the AUD.

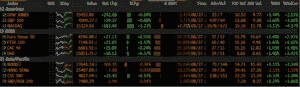

Global Equities

After a dip earlier in the month Global Equities rebounded strongly into the end of the month. Help came from mild US inflation figures, which bolstered the Fed’s ‘transitory’ narrative and a dovish end to the Jackson Hole symposium where Fed President Jerome Powell calmed investor fears over any imminent tapering of stimulatory bond purchases.

Source: Bloomberg

All 3 major US indices finished the month strongly with the NASDAQ, S&P 500 and Dow all closing at all time highs. Despite lockdowns and a steep drop in the price of iron ore, the Australian ASX 200 also hit all time highs on the back of a dovish RBA, positive risk sentiment and a decent reporting season. We also saw strong performances from UK and European markets, with the German Dax also hitting all time highs on strong economic figures out of the Eurozone.

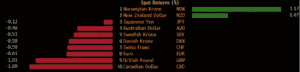

FX markets

The US Dollar mostly outperformed major currencies during August, with a strong rally earlier in the month on expectations of a more hawkish Fed and a wobble in equity markets giving it a boost as a safe haven currency. Gains were pared back in the second half of the month as equities recovered and investor risk appetite returned.

The two advanced economies that looked to raise rates first, Norway and New Zealand, both saw their currencies outperform the US dollar. In NZ’s case, this despite the RBNZ surprising the market by holding rates during the month in response to a flare up of COVID cases and resulting lockdowns.

Source: Bloomberg

AUDUSD

The Aussie dollar started the month with a steep drop breaking the bottom of its recent range and support level around the 0.73 USD mark. The sell off was kick started by dovish RBA minutes, and compounded by a resurgent US Dollar on the back of an equity sell off. The second half of the month has seen a bounce back to the 0.73 level on improved risk sentiment and a dovish US Federal Reserve causing headwinds for the US dollar. If the AUDUSD is rejected at this level we could see a further down-leg to the major psychological and technical support area of 0.70. If it can retake the range and 0.73 acts as support again we could see a trend change from the last 2 months of selling.

SOURCE: GO MT4

Commodities

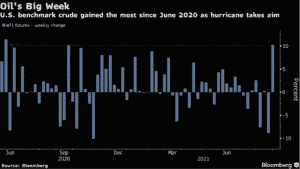

Oil

US crude had a volatile month as risk off and fears of slowing demand on weak Chinese figures released during the month weighed on the price. There was a sharp rally late in the month, with oil last week posting its biggest gain in over a year as energy firms began closing U.S. production in the Gulf of Mexico ahead of a major hurricane expected to hit early next week. Depending on the length of the shut down and severity of Hurricane Ida, more gains could be ahead.

Source: Bloomberg

Crypto Currencies

August saw the return of the Bitcoin and Ether bull market with both tokens racking up impressive gains for the month. Crypto bulls have put Chinese regulatory crackdowns and fears of similar US provisions behind them as risk on returned to the market and optimism in further mainstream adoption fuelled the steep rise, with Bitcoin now testing the psychologically important 50k USD level, up 25% from where it started the month.

SOURCE: GO MT4

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Zoom beats Q2 expectations

Zoom reported its second quarter financial numbers after the market close on Monday. The video-calling software company reported total revenue of $1.02 billion in Q2 (up by 54% year-over-year) vs $991 million expected. It was the first time the total revenue exceeded $1 billion in a single quarter. Earnings per share also came in above estima...

August 31, 2021Read More >Previous Article

XPeng tops earnings expectations for Q2

XPeng reported its Q2 financial results before the opening bell on Thursday, beating analyst expectations. Let’s take a closer look at the numbers. ...

August 27, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading