- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- European Round-Up: 5th November

- GBP Markit/CIPS UK Services PMI (October) lower at 52.2 vs. 53.3 forecast

- GBP Markit/CIPS UK Composite PMI (October) lower at 52.1 vs. 53.4 forecast

- USD ISM Non-Manufacturing/Services Composite (October) higher at 60.3 vs. 59.1 forecast

News & Analysis

Key Economic News Releases Today:To keep up to date with the upcoming economic events click here for our Economic Calendar.

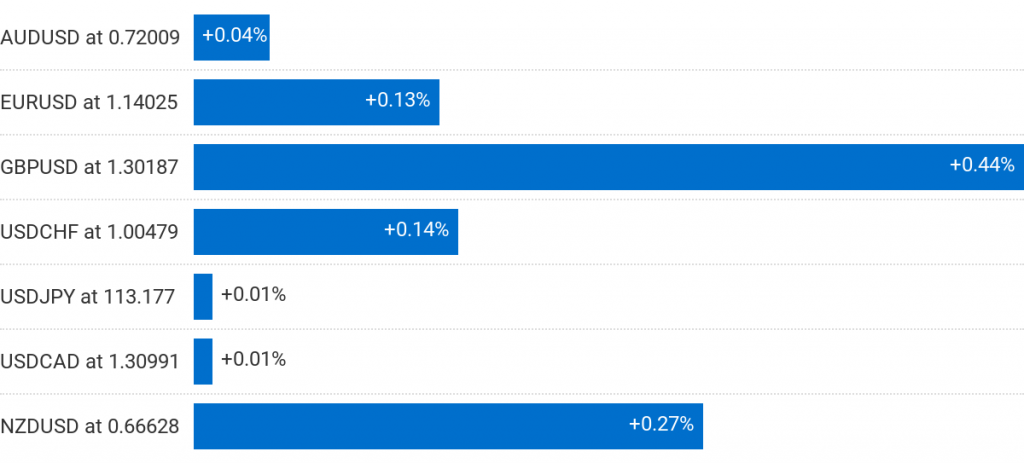

Forex

Latest news on Brexit had a slight impact on the Pound when news broke out that Brussels and Dublin rejected the Irish border plan by the Brexit Secretary Dominic Raab. The Pound weakened to the session low against US dollar; however, it later recovered.

GBPUSD – Hourly

Commodities

The US announced that they would re-impose sanctions on Iran today. However, they granted temporary waivers from oil sanctions to eight countries, including China, India, Japan, South Korea, Taiwan, Italy, Greece, and Turkey, so they are allowed to import Iranian oil.

Oil trading slightly higher today after reaching the lowest level since August at the end of last week.

USOUSD – Hourly

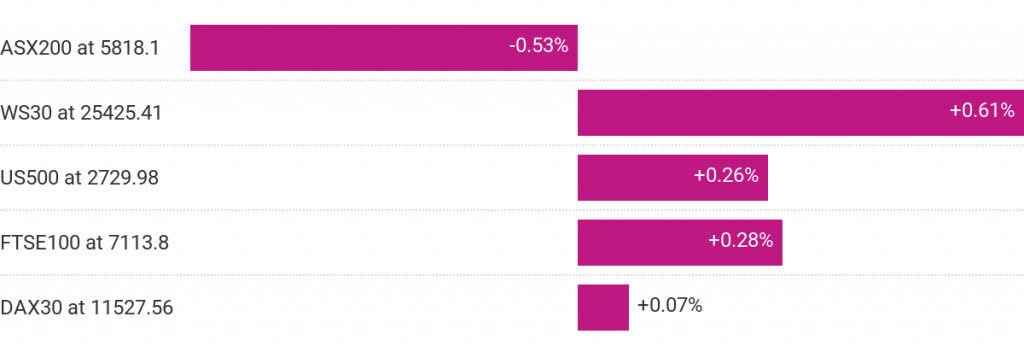

Indices

The S&P 500 and the Dow Jones Industrial Average rose today after strong results from Berkshire Hathaway. A drop in Apple shares dragged down the Nasdaq, the share price for the tech giant fell by around 3%.

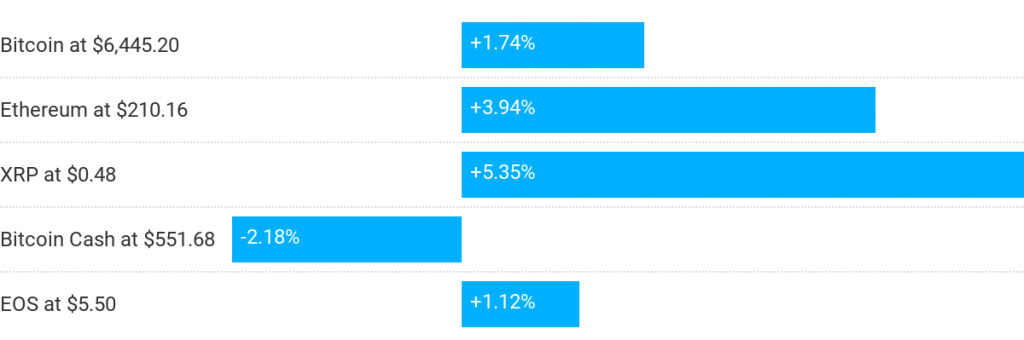

Cryptocurrencies

Relatively good day for the top 5 cryptocurrencies today with XRP making the most significant gains, up by 5.35%.

Chart Of The Day By Adam Taylor

NZDJPY – Price action converging on two significant price points, the previous highs around 75.60 and also the 200 Day Moving Average. Above here we may see a rally targeting 77.00 or a corrective move could see the pair head down towards the weekly pivot of 74.55.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Go Markets MT4, Google, Datawrapper

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

A Pivotal Moment For Sterling

GBPUSD - Has Cable run out of steam? Looking at GBPUSD, we can see the month of November has kicked off with some impulsive moves higher off the back of potential Brexit deals concluding behind closed doors. In the short-term, we might be witnessing the tail end of the recent rally as price action is showing signs of exhaustion, particula...

November 6, 2018Read More >Previous Article

What to expect from the RBA this Tuesday?

Australian’s weak inflation report this week has set the tone for the RBA’s Rate Statement next Tuesday. The underlying inflation readin...

November 4, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading