- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- ExxonMobil exceeds analyst estimates for Q2 – the stock gains

- Home

- News & Analysis

- Economic Updates

- ExxonMobil exceeds analyst estimates for Q2 – the stock gains

- 1 Month +10.20%

- 3 Month +17%

- Year-to-date +67%

- 1 Year +59%

- HSBC $97.50

- Morgan Stanley $106

- B of A Securities $120

- Truist Securities $83

- Piper Sandler $109

- Credit Suisse $125

- Goldman Sachs $125

- Evercore ISI Group $120

- Barclays $111

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisExxonMobil Corporation (XOM) reported its second quarter financial results before the opening bell on Wall Street on Friday.

The oil and gas giant topped Wall Street expectations for the second quarter of 2022.

The company reported revenue of $115.681 billion vs. $111.302 billion expected.

Earnings per share reported at $4.14 per share vs. $3.84 per share expected.

”Earnings and cash flow benefited from increased production, higher realizations, and tight cost control,” Darren Woods, chairman and CEO of Exxon Mobil said in a press release following the latest report.

”Strong second-quarter results reflect our focus on the fundamentals and the investments we put in motion several years ago and sustained through the depths of the pandemic.”

”Key to our success is continued investment in our advantaged portfolio, including Guyana, the Permian, global LNG, and in our high-value performance products, along with efforts to reduce structural costs and improve efficiency. We’re also helping meet increased demand by expanding our refining capacity by about 250,000 barrels per day in the first quarter of 2023 – representing the industry’s largest single capacity addition in the U.S. since 2012. At the same time, we’re supporting the transition to a lower-emission future, growing our portfolio of opportunities in carbon capture and storage, biofuels, and hydrogen,” Woods concluded.

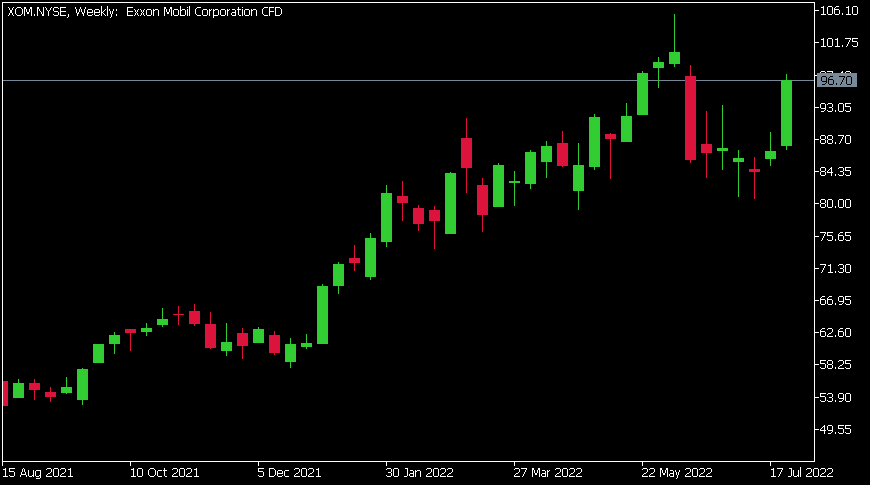

ExxonMobil Corporation (XOM) chart

The stock gained by around 4% after beating estimates for Q2, trading at $96.70 per share.

Here is how the stock has performed in the past year:

ExxonMobil price targets

ExxonMobil Corporation is the 14th largest company in the world with a market cap of $406.36 billion.

You can trade ExxonMobil Corporation (XOM) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: ExxonMobil Corporation, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

The week ahead – Central banks, NFP star in a busy calendar, will bad news be good news?

Market sentiment continued to improve in the past week with equity markets rallying as traders pared back on bets on the extent of the Federal Reserves rate hike path. Corporate earnings also buoyed the markets with the likes of Amazon and Apple having bumper gains on Friday after their results were released. Looking ahead, a very busy calendar ...

August 1, 2022Read More >Previous Article

US dollar drops as the economy shrinks by 0.9% for the last quarter.

US economic data revealed last night shows that the country’s GDP has shrunk by 0.9%, although some are remaining positive that a recession may stil...

July 29, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading