- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Tied In A Gridlock, Eyes Are Now On The FOMC Meeting!

- Home

- News & Analysis

- Economic Updates

- Tied In A Gridlock, Eyes Are Now On The FOMC Meeting!

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

The results of the US Mid-term election have been released and the Democrats took control of the House of Representatives, securing Washington in a legislative deadlock as widely expected. The talks of “impeachment” of the President will likely be making headlines as the Democrats are now empowered by investigative and procedural powers.

In the meantime, the markets will be shifting their attention to the economic releases and the FOMC meeting. The markets are not expecting any material changes but will look for more insights on the outlook of interest rates for 2019 and 2020 as the Fed approaches their target level. Being in gridlock, the US economy might struggle to continue rising and be poised to decelerating. Recently, we have seen that employment and household spending have been supportive of the economy while the housing market and a dip in business investment shows signs of cooling off.

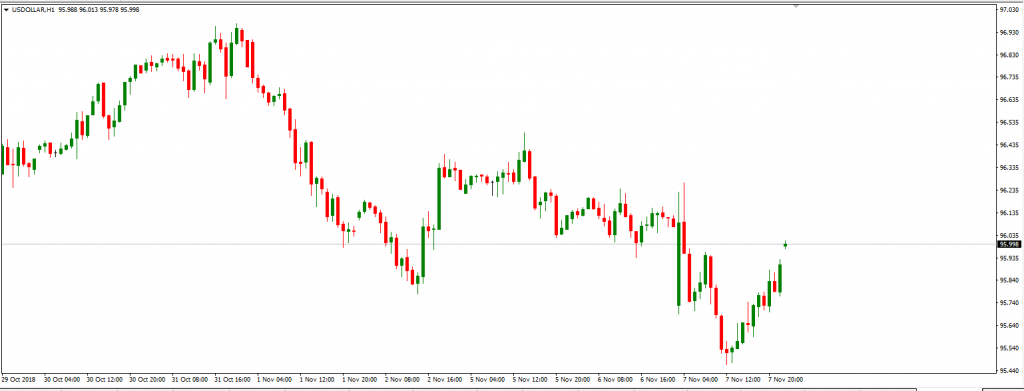

There were concerns of a more aggressive Fed last month following Powell’s comments on the costs of borrowing being far from neutral level. The markets are not expecting any significant changes but will be more concerned with the tone and clues on the interest rate move in December. As of writing, the US Dollar Index already making a comeback post the election results.

US Dollar Index (Hourly Chart)

Source: GO MT4The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

US Mid-Election & The Fed sticks to the Game Plan

The propaganda around the US mid-election dominated the markets this week. With the Democrats now in control of the House of Representatives, the Congress will be tied up in a legislative gridlock leaving the market participants to evaluate the effects of the election results on the policy making in the US. As widely expected, the Democrats a...

November 9, 2018Read More >Previous Article

A Pivotal Moment For Sterling

GBPUSD - Has Cable run out of steam? Looking at GBPUSD, we can see the month of November has kicked off with some impulsive moves higher off th...

November 6, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading