- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Global equities and risk currencies slide in September

- Home

- News & Analysis

- Economic Updates

- Global equities and risk currencies slide in September

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisSeptember saw a major shift to risk off, with global equity markets having their worst month of 2021. Risk sentiment linked currencies and cryptos also performed poorly as the traditional seasonal weakness of September, increasingly hawkish central banks and other macro issues weighed on investor sentiment.

Global Equities

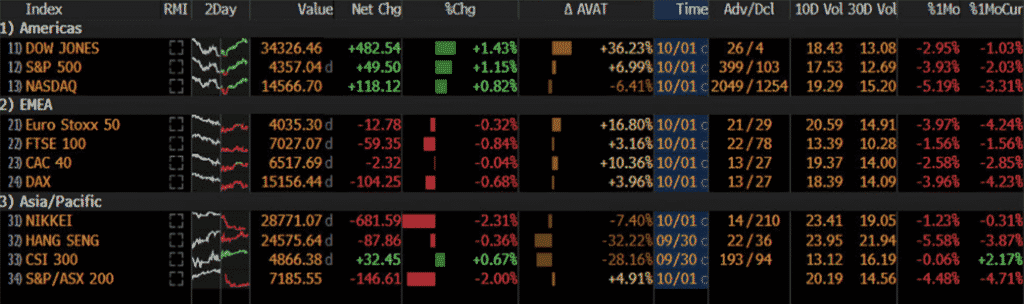

September lived up to its historical seasonal weakness with a steep drop in equities seen across all regions. Third quarter gains were wiped as US benchmark stock indices saw some of the worst monthly performances since March 2020.

Source: Bloomberg

Macro issues and an increasingly hawkish Federal reserve saw global equities take a hit in September. The Evergrande unwinding in China and continuing supply and energy issues gave investors pause to consider whether the global economic recovery had peaked. This, along with a Fed that is all but certain to announce tapering in November, saw stocks and other risk assets drop sharply.

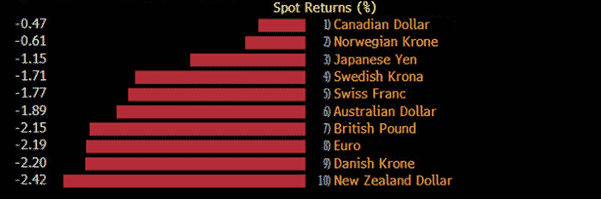

FX Markets

September saw the US dollar surge on the back of a flight to safety, rising US bond yields and an indication from the Federal Reserve that a winding back of its accommodative policies would begin by the end of the year. A big rally in oil prices saw the Norwegian Krone and Canadian dollar somewhat insulated, while the risk sensitive NZD saw its worst month of Q3, dropping over 2% in September.

Source: Bloomberg

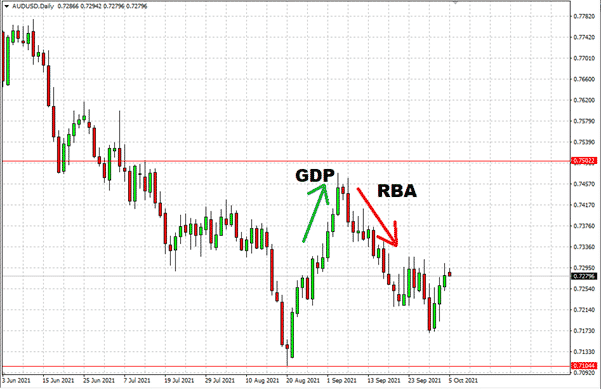

AUDUSD

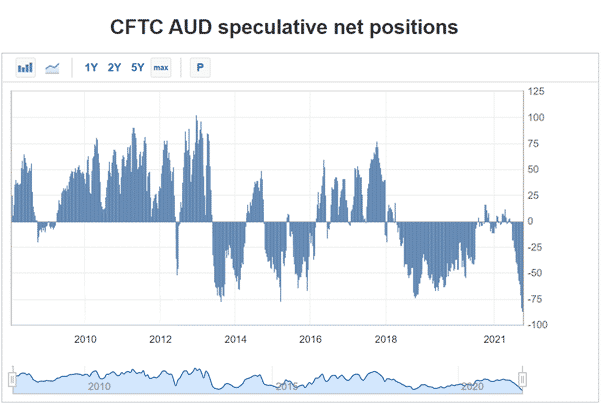

The Aussie dollar saw a rise at the start of September on a better than expected GDP figure, raising hopes that the downturn due to ongoing lockdowns may not be as deep as first feared. A dovish RBA policy statement a week later however saw the AUDUSD decline to head towards testing its 0.71 USD support level and a Commitment of Traders (COT) report showing the biggest speculative net short position in AUD since the futures started trading.

Source : Investing.com

Such an extreme short position could be seen as a bullish contrarian signal. We did see a bounce in AUD in the latter part of September, as plans for reopening the economy solidify and the growing belief of investors we may have seen the “peak” of RBA dovishness as a result.

SOURCE: GO MT4

Commodities

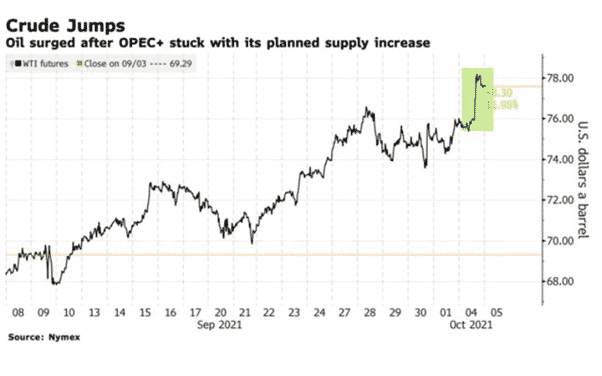

Oil

Brent as US crude strongly rallied during September, breaking through its July highs as OPEC+ confirmed it would stick to its current modest output increase policy, despite demand for petroleum products exceeding expectation.

The oil price has also benefitted from a marked increase in gas prices prompting a switch to fuel oil and other crude products for energy needs.

With three-quarters of global energy demand still being met by fossil fuels, the overall sentiment for oil in the near term looks bullish.

Source: Bloomberg

GOLD

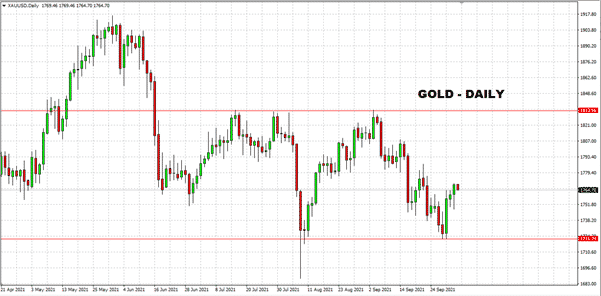

Despite the broader commodity market surging, gold dropped over 3% in September after being rejected early in the month at the 1830 resistance level set back in July.

Gold did find support late in the month at the 1720 support level, as a resurgent US dollar overcame gold’s attractiveness as an inflation hedge and safe haven asset, pointing to possible further weakness.

Source: GO MT4

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Q3 earning season is here – JPMorgan reports

JPMorgan reported their Q3 financial results before the opening bell on Wednesday. Let’s take a closer look at the numbers. The company reported total revenue of $30.44 billion in the third quarter of the year, beating analyst expectation of $29.80 billion. Earnings per share at $3.74 per share – also above analyst forecasts of $3 per share....

October 14, 2021Read More >Previous Article

A

Trading terms glossary A - B - C - D - E - F - G - H - I - J - K - L - M - N - O - P - Q - R - S - T - U - V - W - X - Y - Z - A Acquisition...

September 16, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading